What Benefits Does A 100 Disabled Veteran Get In Florida

If you're searching for video and picture information related to the key word you have come to pay a visit to the right site. Our website provides you with suggestions for seeing the maximum quality video and image content, hunt and locate more enlightening video content and graphics that match your interests.

comprises one of tens of thousands of movie collections from various sources, particularly Youtube, so we recommend this video that you see. You can also bring about supporting this site by sharing videos and images that you like on this blog on your social networking accounts like Facebook and Instagram or tell your closest friends share your experiences concerning the ease of access to downloads and the information you get on this site. This site is for them to visit this site.

Any honorably discharged veteran who has been determined by the US Department of Veterans Affairs to have a 100 total and permanent service-connected disability rating or has been determined to have a service-connected disability rating for compensation of 100 and is in receipt of disability retirement pay from any branch of the US Armed Forces and is qualified to obtain a drivers license is exempt from certain driver license fees.

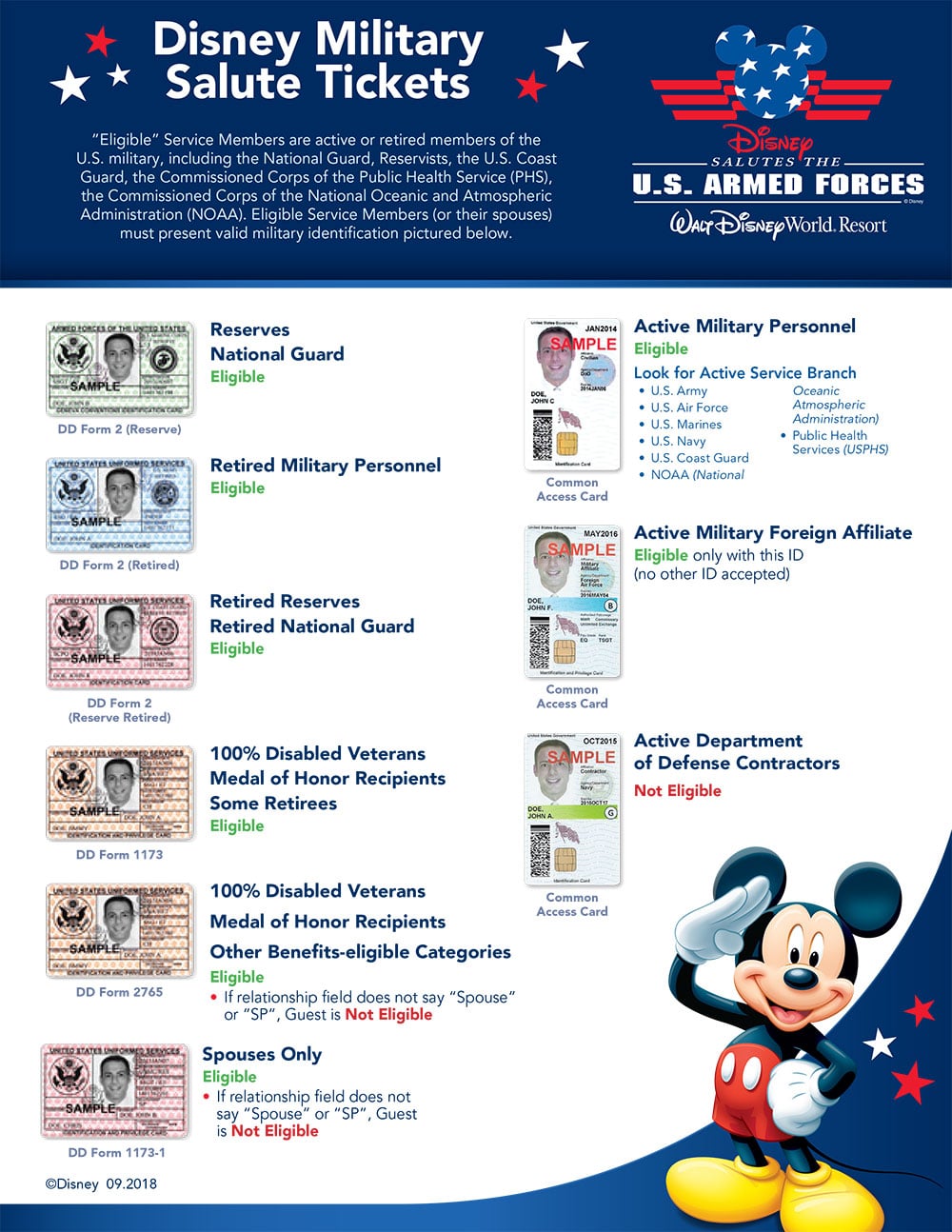

What benefits does a 100 disabled veteran get in florida. Veterans in Florida you may also call the Florida Veterans Support Line at 1-844-MyFLVet 693-5838 or 2-1-1. 100 permanently and totally disabled service-connected veterans are entitled to a free five year hunting and fishing license. 100 percent disabled veterans can present their Veteran Health Identification Card to gain entry to Department of Defense DoD and Coast Guard installations some commissary stores and at the point of sale at commissaries exchanges and Morale Welfare and Recreation MWR retail activities to complete their transactions. Any property serving as the primary residence of a veteran who is certified by the state of Florida or the United States Department of Veterans Affairs as 100 percent permanently or totally disabled as a direct result of military service is automatically exempt from all taxes.

Educational Assistance for Dependents. Benefits for spouses dependents and survivors Health care. Commissary and Exchange Benefits for 100 Percent Disabled Veterans. There are also provisions made for qualifying surviving spouses of the veteran for the same type of property tax benefit.

Housing Benefits for Veterans in Florida Florida VA housing benefits include property tax exemptions for veterans with service-related disabilities or surviving spouses of veterans who died in the line of duty. Additional VA housing assistance programs include home loans such as Purchase Loans or Interest Rate Reduction Refinance Loans IRRRL. Department of Veterans Affairs certified. Must be rated a 100 disabled veteran by the VA.

Dental treatment for 100 disabled veteran benefits. Eligible resident Veterans with a US. Earned VA monetary benefits. No-fee Florida driver licenses are available to 100 disabled veterans who are qualified to obtain a driver license according to the Florida Department of Veterans Affairs.

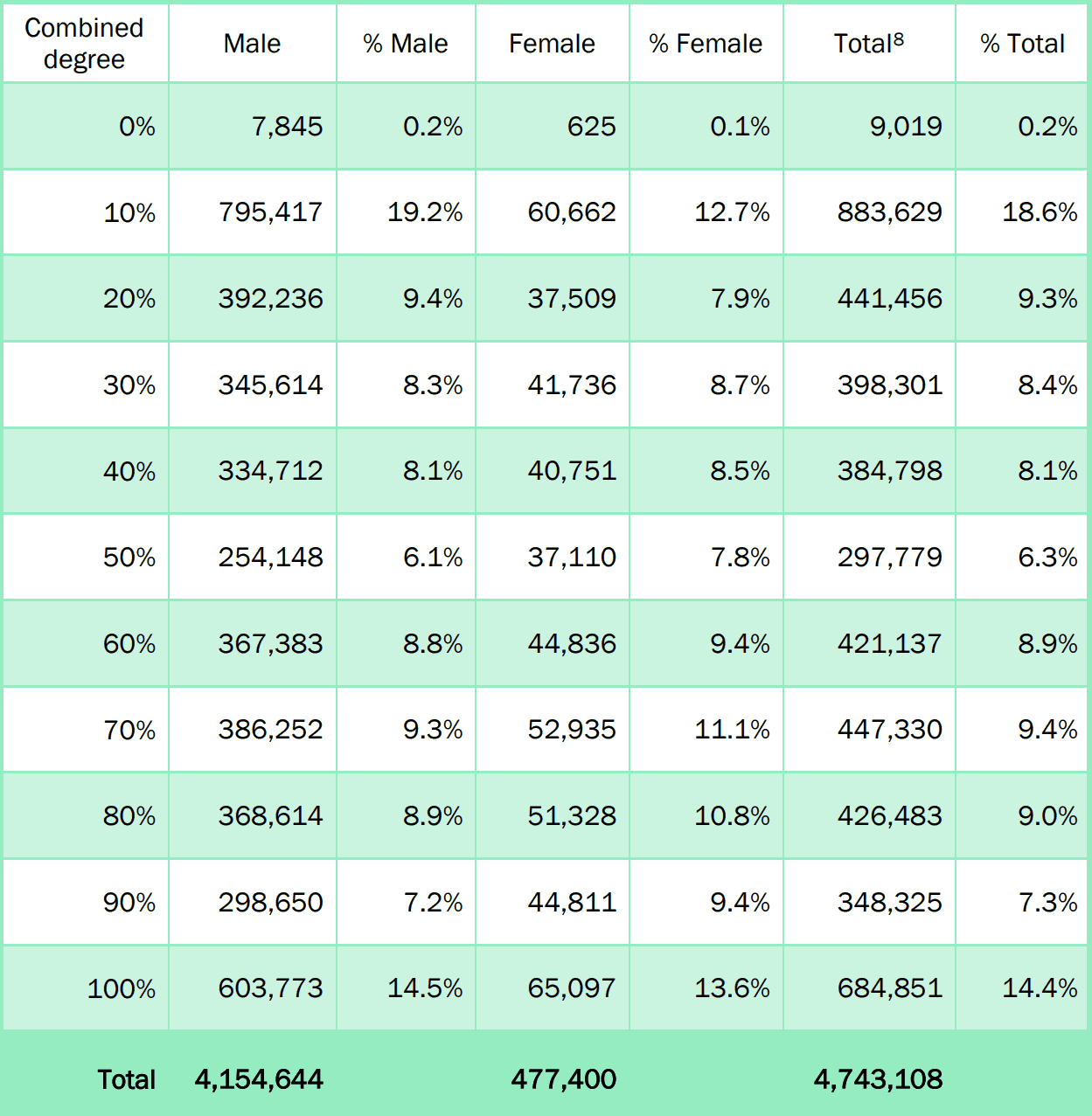

Florida Homestead Property Tax Exemption for Disabled Veterans 10 to 100 BUT not Permanent in Nature. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child. A disabled veteran in Florida may receive a property tax exemption of 5000 on any property they own if they are 10 percent or more disabled from a result of service. 100 Disabled veterans are eligible for no-fee licensesID cards.

Under chapter 35 Must be rated a 100 disabled veteran by the VA. Visit the Florida Department of Veterans Affairs website for more. Florida Veterans Crisis Line For 24-hour counsel call the National Veteran Crisis Hotline at 1-800-273-8255. Civilian health and medical program for dependentssurvivors CHAMPVA.

You are NOT alone. A disabled veteran in Florida may receive a property tax discount on a primary residence based on the amount of disability the applicant is VA-rated at. Find out if you may qualify for health care through our CHAMPVA program the Department of Defenses TRICARE program or one of our programs related to a Veterans service-connected disability.