Virginia Department Of Education Nap Credits

If you're searching for picture and video information related to the key word you've come to visit the ideal site. Our website provides you with suggestions for viewing the maximum quality video and image content, hunt and find more enlightening video articles and graphics that fit your interests.

comprises one of tens of thousands of video collections from various sources, especially Youtube, so we recommend this video that you view. You can also bring about supporting this site by sharing videos and graphics that you like on this blog on your social networking accounts like Facebook and Instagram or tell your closest friends share your experiences about the ease of access to downloads and the information you get on this site. This site is for them to stop by this site.

The Education Improvement Scholarships Tax Credits Program provides state tax credits for persons or businesses making monetary or marketable securities donations to foundations that provide scholarships to eligible students and children attending eligible private schools and eligible nonpublic pre-kindergarten programs.

Virginia department of education nap credits. The Neighborhood Assistance Act Tax Credit Program for Education is a Virginia tax incentive which promotes contributions to organizations whose primary function is to provide educational assistance to low income individuals or students with disabilities. In return for their contributions businesses trusts and individuals may receive tax credits equal to 65 percent of the donation that may be applied against their state income tax liability. I understand the information listed above is shared with the Virginia Department of Taxation and the Department of Education to track tax credits issued under the Neighborhood Assistance Tax Act. LCNV specially applied to be part of this program for the first time starting on July 1 2010 as a way to thank its loyal donors like you with a tax credit.

But you need to plan ahead because these credits are in limited supply. Review the credits below to see what you may be able to deduct from the tax you owe. The Neighborhood Assistance Program is administered by the Virginia Department of Education. The purpose of the Neighborhood Assistance Program NAP is to encourage businesses trusts and individuals to make donations to approved 501c 3 organizations for the benefit of low-income persons.

All three sections of the TCR must be completed before the NAP organization submits a request via the NAP system to the Virginia Department of Education VDOE Tax Credit Programs. To claim the credit on the Virginia income tax return. To encourage support for charitable organizations servicing low-income communities NAP provides a 65 Virginia state tax credit in exchange for charitable gifts to approved NAP nonprofit organizations. Please sign date and return this form to the NAP organization for completion.

The Virginia Department of Education DOE administers a program allowing individuals and businesses to receive state tax credits for donations to approved nonprofit organizations that provide scholastic. How does the Neighborhood Assistance Program. An authorized representative of the NAP organization must sign and submit the original TCR Form along with appropriate documentation of the donation to the Virginia Department of Education 21thFloor PO. These tax credits can then be used on your Virginia state tax return to reduce your tax owed dollar-for-dollar.

The NAP tax credit certificate will be mailed directly to the donor. The Neighborhood Assistance Act Tax Credit Program for Education administered by Virginia Department of Education the Department allows individuals or businesses to receive state tax credits - up to and including 65 percent of the qualified donation for eligible donations made to approved neighborhood organizations. The program has 17 million in tax credits where 8 million is allocated for the Virginia Department of Social Services VDSS to administer for General Human Services organizations and 9 million is allocated for Department of Education DOE to administer for Education organizations. The Neighborhood Assistance Program only.

In Virginia both the Neighborhood Assistance Program NAP and the Education Improvement Scholarships offer a state tax credit of up to 65 of your total charitable contribution. The Virginia Department of Education VDOE has been working closely with the Governors Office the Virginia Department of Health and other state agencies to ensure our schools and communities have the most up-to-date information and resources. NAP Organizations Make Community Impact. Code of Virginia Under this tax credit program individuals or business firms may receive state tax credits for eligible contributions made to neighborhood organizations providing neighborhood assistance in the form of education to low-income persons or eligible students with disabilities.

The program is called the Virginia Neighborhood Assistance Program NAP. The NAP non-profit organization will forward the completed donor form to the Department of Social Services or the Department of Education to have your NAP tax credit certificate issued. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. Visit COVID-19 Virginia Public Schools for access to the latest information.

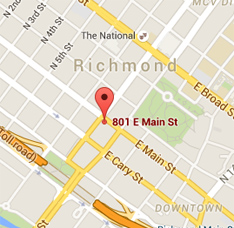

To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. Box 2120 Richmond VA 23218-2120 Attention. If you procrastinate you are likely to miss out. Virginia is among several states offering valuable tax credits in return for donations of cash or securities to approved NAP organizations.

Completed TCR and supporting documentation must be submitted no later than 40 days from the latest date of donation. Neighborhood Assistance Tax Credit Program for Education. 17 million in tax credits o8 million for general human services organizations Administered by the Virginia Department of Social Services VDSS o9 million for education organizations Administered by the Department of Education DOE Organizations are approved for 12-months July 1stJune 30th. A tax credit certificate will be mailed to you from the Virginia Department of Social Services.

The Virginia Department of Education VDOE administers the Neighborhood Assistance Program allowing individuals and businesses to receive state tax credits for donations to approved nonprofit organizations that provide scholastic instruction or scholastic assistance to lowincome persons or eligible students with a disability.