Va Unemployment Taxes Withheld

If you're looking for picture and video information related to the keyword you've come to pay a visit to the ideal blog. Our website provides you with hints for viewing the maximum quality video and picture content, hunt and locate more enlightening video articles and images that match your interests.

includes one of thousands of movie collections from various sources, particularly Youtube, so we recommend this movie for you to see. It is also possible to bring about supporting this website by sharing videos and images that you enjoy on this blog on your social media accounts like Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information you get on this website. This site is for them to stop by this website.

State Income Tax Range.

Va unemployment taxes withheld. This form will show the amount of unemployment compensation received during 2020 and any federal income tax withheld. State Taxes on Unemployment Benefits. See IRS Publication 505 Tax Withholding and Estimated Tax or see Form 1040-ES. Not the normal VEC unemployment one Right now.

Its tempting to opt out of withholding tax on your unemployment benefits. They can request that federal income taxes start to be withheld from their unemployment compensation by filling out a form W-4V and submitting it to their local unemployment office. The tax bill racks up quick. Form 1040-ES Estimated Tax for Individuals Publication 505 Tax Withholding and Estimated Tax.

Its really making the tax return high for amount due. Opt to withhold taxes from your benefits. If you choose to have income tax withheld from your benefits The total federal tax withheld will appear in Box 4. Need to make estimated tax payments.

When you receive benefits you can usually choose to have income taxes withheld from your compensation to avoid owing a large amount of tax on your tax returns. 65 on more than. You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. Did anyone here get a form back that showed taxes were withheld from the PUA unemployment.

State Taxes on Unemployment Benefits. Upon request you can have taxes withheld directly from your unemployment check. However some states require that you withhold additional money from employee wages for state unemployment taxes. If your small business has employees working in Virginia youll need to pay Virginia unemployment insurance UI tax.

Even if you havent done it yet you can still elect to withhold your tax liability directly from your unemployment income. Without it showing any taxes taken out. Different states have different rules and rates for UI taxes. Some states only allow a person to withhold a standard 10 for federal taxes Jaeger said so keep this in mind when planning for your 2020 taxes.

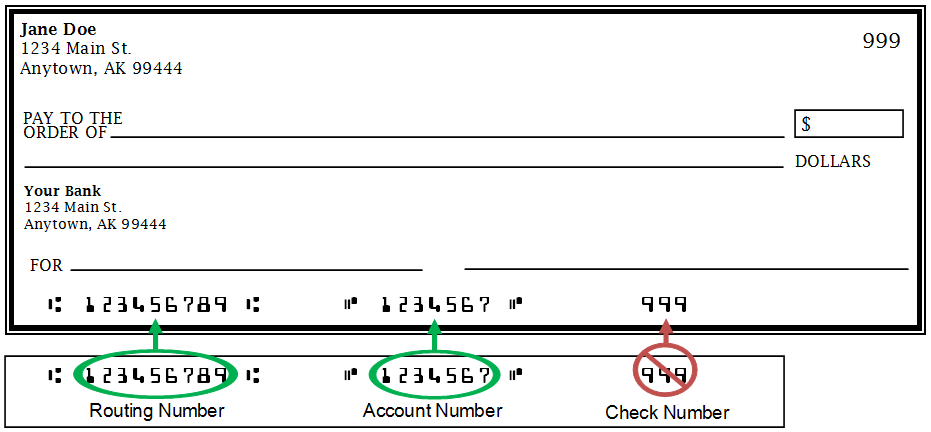

You must submit Form VA-6 and all W-2 and 1099 forms electronically. 575 on more than. The VA-6 is due to Virginia Tax by Jan. A flat federal tax rate of 10 of the benefits paid can be withheld from each payment according to the Labor Department.

You can request to have taxes similarly withheld from your unemployment payments when you apply for them or by filing a Form W-4V with your state unemployment office. Some states that border each other have entered into agreements related to allowing an employee who lives in one state but works in a neighboring state to have their withholding tax paid to the work state. A large number of people receiving unemployment benefits dont know that the benefits are taxable that taxes are not automatically withheld or that unemployment pay can impact other tax. For those already collecting unemployment Greene-Lewis says Americans.

31 of the following calendar year or within 30 days after the last payment of wages by your company. 3 on up to 10000 of taxable income. Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. In Virginia state UI tax is just one of several taxes that employers must pay.

You must indicate that you choose to have federal taxes withheld from your unemployment payment or we will not withhold them. The UI tax funds unemployment compensation programs for eligible employees. When you file Form VA-6 you must submit each federal Form W-2 W-2G 1099 or 1099-R that shows Virginia income tax withheld. State Income Tax Range.

There are no taxes on unemployment benefits in Virginia. The 1099G that came back doesnt show any line about tax with holding. Simply fill out Form W-4V Voluntary Withholding Request and send it to. That extra 600 is also taxable.

Go to the IRS website. Federal withholdings are 10 percent of your gross benefit payment. But foregoing that option is an expensive choice. This is the preferred strategy because its automated and the estimated taxes never hit your checking account.

Federal law allows you to have a flat 10 withheld from your benefits to cover your tax liability. IR-2020-185 August 18 2020. 2 on up to 3000 of taxable income. The state tax withheld will appear in Box 11.

WASHINGTON With millions of Americans now receiving taxable unemployment compensation many of them for the first time the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return next year. Unemployment compensation is subject to tax in West Virginia. Each state sets a different range of tax rates. Both the state unemployment tax and withholding tax should generally be paid to the employees work state but there are exceptions.

Taxpayers should report this information along with other income on their 2020 federal tax return.