Veterans Spousal Support Guidelines

If you're searching for video and picture information linked to the keyword you have come to visit the right site. Our site provides you with suggestions for viewing the maximum quality video and image content, search and locate more enlightening video articles and graphics that fit your interests.

includes one of thousands of video collections from various sources, particularly Youtube, so we recommend this video for you to view. This blog is for them to visit this site.

You can still file a claim and apply for benefits during the coronavirus pandemic.

Veterans spousal support guidelines. Find out if you qualify and how to apply. The ruling is likely to affect mostly former spouses of veterans with 10 to 50 disability ratings. In Arizona a divorced individual with a spousal maintenance obligation can ask the court for a modification if there are significant changes to their circumstances and their ability to cover the agreed-upon amount financially. A large difference in earnings.

Spousal support in Virginia gets paid when two key factors are met between the couple. In response to this change brought about by the TCJA the Virginia legislature revised the pendente lite spousal support guidelines effective July 1 2020. 26 x Payors Income 58 x Payees Income. Calculate alimony payments and child support if applicable by entering some basic information about your family in the calculator form below.

Pendente Lite spousal support is calculated pursuant to Section 161-278171Pendente Lite means pending the litigationIt is intended to provide an amount of support until a court has the opportunity to have a full trial on whether spousal support will be awarded at all Section 20-1071B and if so the amount of spousal. Pendente Lite spousal support is calculated pursuant to Section 161-278171. Pendente lite spousal support calculation. So 30 percent of Norms 100000 is 30000 reduced by half of Normas pay 200002 10000 so Norm would pay Norma 20000 over the year or 1667 a month.

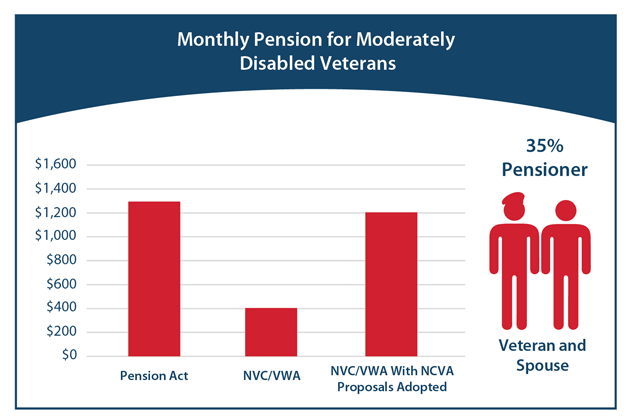

Prior to 2012 a spouses VAC disability benefits were included in their income for the purposes of calculating support. Cases With Minor Children. Regarding spousal support this ruling clarifies that VA disability pay cannot be considered community property and cannot be divided as such regardless of the effects on former spouses. Issue Positions of the Parties.

Tax Effects of Alimony Spousal Support New Tax Rules as of 112019 under the TCJA. As the survivor of a Veteran or service member you may qualify for added benefits including help with burial costs and survivor compensation. Fairfax Circuit Court decided the higher breadwinner should pay 30 percent of her or his income less half the amount of the lower breadwinners income. The exact amount received will depend on a number of different factors listed later in this article.

A VA Survivors Pension offers monthly payments to qualified surviving spouses and unmarried dependent children of wartime Veterans who meet certain income and net worth limits set by Congress. This is usually interpreted as date of marriage to date of. Eligibility for support In Virginia the court allows spousal support to be awarded to a spouse only when its necessary. Veterans Disability and Alimony in Arizona.

If you earn 40000 a year and your spouse earns 50000 a year youre not likely to receive an award of alimony in these counties because he earns only 25 percent more than you. Spouse will be contractually liable borrower is relying on the spouses income to qualify borrower is relying on alimony child support or separate maintenance payments from the spouse or former spouse or borrower resides andor the property is in a community property state. The formula restricts spousal support to situations where one spouse outearns the other by 50 percent or more. When deciding whether to award support to a spouse the court considers the factors and circumstances that contributed to the dissolution of the marriage including grounds such as adultery.

These guidelines are universally applied. Lines 3 and 4 If spousal support is paid by one parent-party to the other parent-party pursuant to an order or written agreement between theparties subtract that amount under the payors column and add the amount under the payees column use plus and minus signs appropriately. The point of local guidelines in Virginia spousal support cases is to have more consistency in results among cases. When it comes to temporary support there are only certain cases where the court will look beyond the guidelines.

Among other claims she sought increased child support child support for the eldest son and arrears for the three children of the marriage. In Virginia the rule of thumb is that spousal support awards are often set for 50 the length of the parties marriage. If the parties have minor children in common the presumptive amount of an award of pendente lite spousal support and maintenance shall be the difference between 26 percent of the payor spouses monthly gross income and 58 percent of the payee spouses monthly gross income. Spousal support guidelines of Virginia.

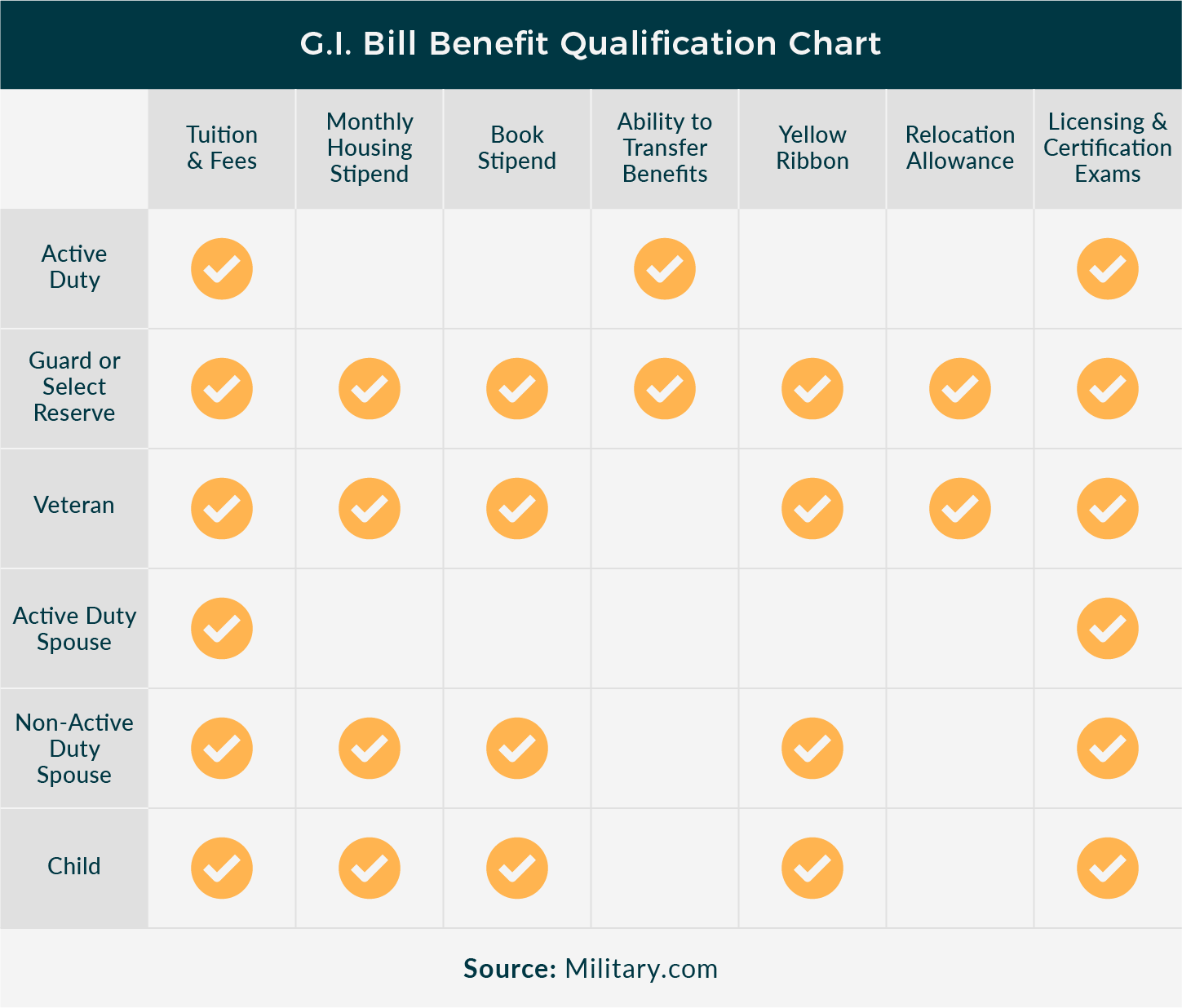

This spousal support calculator estimates support payments using the Canadian Spousal Support Advisory Guidelines the SSAGS. As the spouse or dependent child of a Veteran or service member you may qualify for certain benefits like health care life insurance or money to help pay for school or training. Pendente Lite means pending the litigation It is intended to provide an amount of support until a court has the opportunity to have a full trial on whether spousal support will be awarded at all Section 20-1071B and if so the amount of spousal support applying the factors spelled out in. Be Careful About Using Pendente Lite Support.

If the individual responsible for paying spousal maintenance obtains a court order for modification the former spouse can appeal the courts decision. A significant amount of time married. Effective July 1 2020 the pendente lite spousal support guidelines in Virginia are. If none insert none under both columns.