Va Unemployment Tax Rate 2020

If you're looking for video and picture information related to the key word you've come to visit the ideal site. Our site gives you hints for seeing the highest quality video and image content, search and locate more enlightening video content and images that match your interests.

comprises one of tens of thousands of movie collections from various sources, especially Youtube, so we recommend this video for you to see. This site is for them to stop by this site.

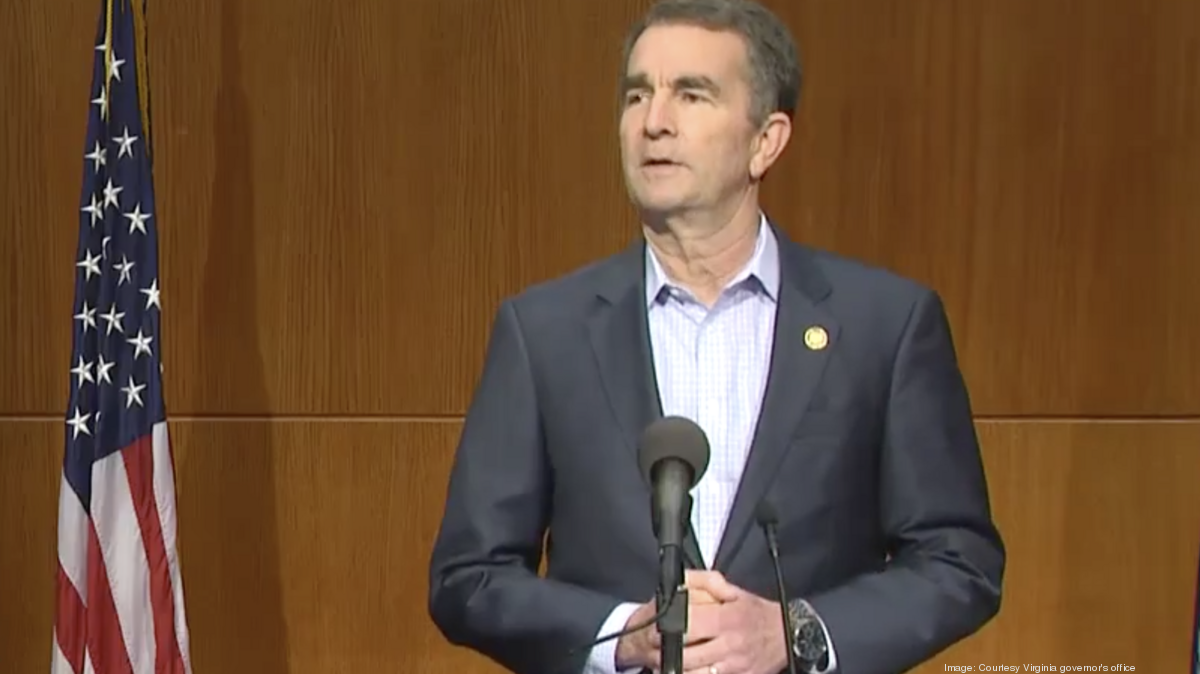

That wont happen Gov.

Va unemployment tax rate 2020. Established employers are subject to a lower or higher rate than new employers depending on an experience rating. Lets get this question out of the way quickly for those needing only one answer. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in. Here is a list of the non-construction new employer tax rates for each state and Washington DC.

Virginia 250 011 62 8000 Washington. Virginia State Unemployment Tax Virginia has State Unemployment Insurance SUI which ranges from 011 to 621. The tax rate may vary each year depending on the claim towards unemployment funds of the State. Virginia law specifically exempts from unemployment taxes only nonprofits companies that have a 501 C3 federal tax exemption and have less than 4 employees for 20 weeks in the year.

The FUTA is determined based on employee wages and salaries. If approved by the governor and state legislature the top rate will drop to 55 for the 2020 tax year. November 2020 Local Unemployment Rates. Was 102 in July 2020 according to the Bureau of Labor Statistics and that was actually down almost a percentage point from June.

Virginias income tax brackets were last changed thirteen years ago for tax year 2007 and the tax rates have not been changed since at least 2001. The Virginia unemployment rate rose to 49 percent in December while total nonfarm payroll employment increased by 800. The Virginia unemployment rate rose to 49 percent in December while total nonfarm payroll employment increased by 800 November 2020 Local Unemployment Rates Virginias Seasonally Adjusted Unemployment Rate Decreased to 49 Percent in November. 2019 legislation HB 198 freezes the taxable wage base at 16500 for 2020 under the bill language from July 1 2019 to October 29 2020 so the Division of Unemployment Insurance and the Unemployment Compensation Advisory Council.

The federal unemployment tax rate is not the same as the state unemployment tax rate. The new employer rate usually applies for at least one year. This will prevent Virginias struggling businesses from having to devote critical resources to higher state payroll taxes. Depending on where you are located you may be responsible for paying both.

Ralph Northam announced. In recent years the overall beginning rate has been roughly between 285 and 325. 1 That represents a lot of Americans who will find themselves grappling with taxation of their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns. RICHMOND Virginias seasonally adjusted unemployment rate fell 03 percentage points in November to 49 percent which is 22 percentage points above the rate from a year ago.

If youre a new employer your rate will be between 251 and 621. Virginia has four marginal tax brackets ranging from 2 the lowest Virginia tax bracket to 575 the highest Virginia tax bracket. For 2020 the FUTA tax rate is projected to be 6 per the IRS. - Updated on May 07 2020 - 1100 AM by 123PayStubs Team.

All other non-profit employers are required to file as is any other business Churches however are always exempt from UI reporting. For 2020 the standard tax rate for new employers is 25 and the tax rate for new employers that are out-of-state contractors is 62. Virginias Seasonally Adjusted Unemployment Rate Decreased to 49 Percent in November. Its worth noting that youll also need to pay SUTA taxes thanks to the State Unemployment Tax Act for your employees as well.

Note that some states require employees to contribute state unemployment tax. Employers receive a Base Tax Rate. October 2020 Local Unemployment Rates. This 7000 is known as the taxable wage base.

SUI tax rate by state. The wage base for SUI is 8000 of each employees taxable income. Virginias unemployment tax rates for experienced employers range from 01 to 62 in 2020 a spokeswoman for the state Employment Commission said Jan. Only then the State will send details about the unemployment tax rate to the employer each year.

2013 legislation HB 168 increased the SUI taxable wage base to a minimum of 10500 and a maximum of 18500 by tying the wage limit to the balance of the states unemployment trust fund the higher the trust fund balance the lower the taxable wage base. The FUTA tax applies to the first 7000 in wages you pay an employee throughout the calendar year. The FUTA rate in 2020 is six percent. Localities can add as much as 5 and the average combined rate is.

According to the release Unemployment Insurance Employer Tax Rates for 2021 are assigned by the previous calendar year from July 1 2019 to June 30 2020. In recalculating the tax rate for 2021 Executive Order Seventy-Four requires that the VEC not penalize businesses for lay-offs that occurred during the pandemic from April through June 2020.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)