What Is Virginia Unemployment Compensation

If you're searching for video and picture information linked to the keyword you've come to visit the right blog. Our site gives you suggestions for seeing the highest quality video and picture content, hunt and find more informative video content and graphics that match your interests.

includes one of tens of thousands of video collections from several sources, particularly Youtube, therefore we recommend this movie for you to see. This blog is for them to visit this site.

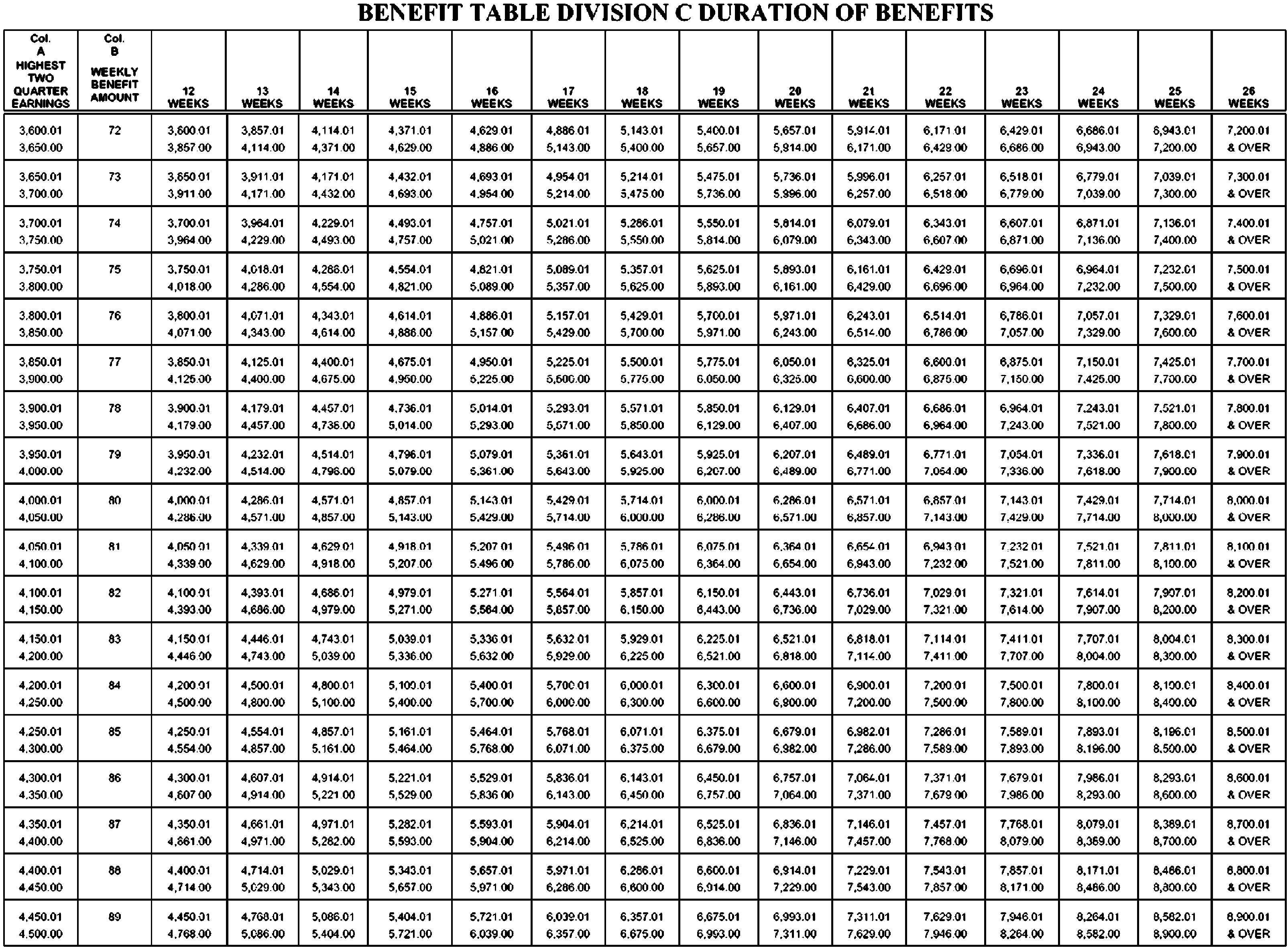

To receive the maximum unemployment benefit in Virginia you must have earned at least 1890001 in two quarters during the base period.

What is virginia unemployment compensation. With Mixed Earner Unemployment Compensation a person who made more money from self-employment or a contracting job -- that requires a 1099 form -- could receive an extra 100 a week. Pandemic Unemployment Compensation PUCAdditional 300 per week through March 14 2021. The maximum weekly unemployment benefit amount is 37800 and the minimum is 6000. Box 26441 Richmond VA 23261-6441.

866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. That extra 600 is also taxable. This handbook explains the requirements for obtaining unemployment benefits under the Virginia Unemployment Compensation Act. The Coronavirus Aid Relief and Economic Security CARES Act provided for the Federal Pandemic Unemployment Compensation FPUC program when President Trump signed it into law on March 27 2020.

Pandemic Emergency Unemployment Compensation PEUC is an emergency program designed to help Americans affected by the COVID-19 pandemic. Pandemic Unemployment Assistance PUA. State Taxes on Unemployment Benefits. Confidential unemployment compensation information may be requested and utilized for other governmental purposes including verifying an individuals eligibility for other governmental programs.

It also increases the number of weeks of benefits an individual may claim through the PEUC program from 13 to 24. However each state sets its own rules for eligibility benefit amounts filing procedures and more. Virginia Relay call 711 or 800-828-1120. If you exhausted the original 39 weeks you will then be considered for an additional 11 weeks of PUA benefits under this legislation.

Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. State Income Tax Range. 65 on more than. This comes out to an annual salary of approximately 3780000.

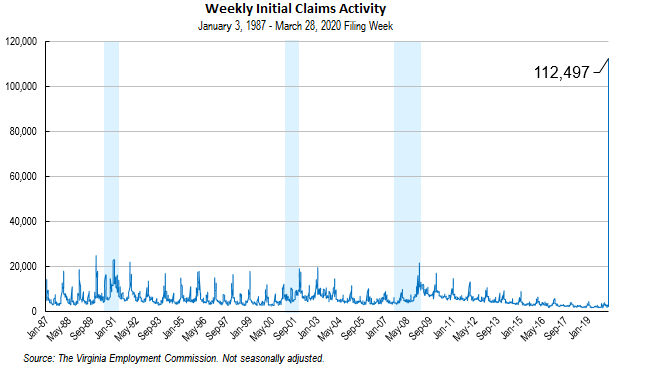

The basic structure of the unemployment system is the same from state to state. The FPUC program provided an additional 600 per week in unemployment compensation per recipient through July 2020. What you can expect. The Virginia Employment Commission VEC administers the unemployment compensation program that provides temporary financial assistance to individuals who become unemployed through no fault of their own.

The Virginia Unemployment Compensation Act Annotated is a handy desk reference for Virginia general practitioners and employment specialists alike. Unemployment compensation generally provided by an unemployment check or a direct deposit provides partial income replacement for a defined length of time or until the worker finds employment. Cant find what youre looking for. Contact us if something is missing that shouldnt be or you need additional assistance.

Emergency Unemployment Compensation EUC and Extended Benefits EB. Can I Receive Partial Unemployment Benefits. Benefits are paid through taxes on employers covered under the Virginia Unemployment Compensation Act. There are two parts to the program.

The second coronavirus relief package includes an extra 300 per week on top of regular state-issued unemployment payments for every unemployed person half of the extra benefits people were getting via the CARES Act. Unemployment compensation is subject to tax in West Virginia. You must report the refusal of any job offers and be prepared to substantiate the reason why you rejected the offer. Certain criteria such as pay distance and other factors may allow you to refuse an offer but still keep your benefits.

Virginia making payments in backlogged unemployment cases By SARAH RANKIN December 11 2020 GMT RICHMOND Va. The first payable week in this scenario would be for the week ending January 2 2021. All of the CARES Act unemployment compensation programs are extended for an additional 11 weeks through March 13 2021. Pandemic Emergency Unemployment Compensation PEUCAllows individuals receiving benefits as of March 14 2021 to continue through April 5 2021 as long as the individual has not reached the maximum number of weeks.

An unemployment extension is administered by the federal government in partnership with Virginia. The Virginia Unemployment Compensation Act requires that claimants provide the name of the employers contacted for work so it is essential that you keep good records as you will be asked to present them to the VEC. Unemployment compensation is available to those who are temporarily out of work without fault on their parts. EUCs federal unemployment extension was temporarily enacted during the 2008 recession to prevent harm to unemployed individuals.

AP Virginia has begun paying unemployment benefits to some of the tens of thousands of people whose claims had previously been on hold - in some cases for many months - because they were awaiting a staff review.