What Is The Pension Levy In Ireland

If you're searching for picture and video information linked to the key word you have come to pay a visit to the right blog. Our website gives you suggestions for seeing the maximum quality video and image content, search and find more informative video content and graphics that fit your interests.

includes one of tens of thousands of video collections from various sources, particularly Youtube, so we recommend this movie that you see. This blog is for them to stop by this website.

Your age today will determine what age you are eligible to receive the statesocial welfare pension.

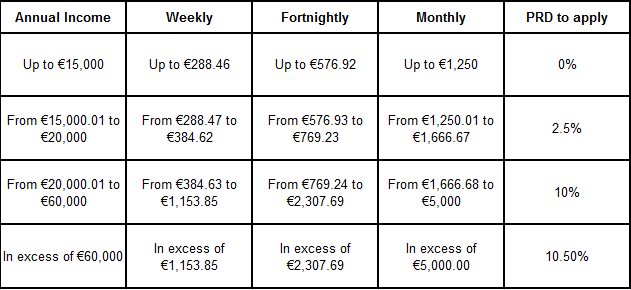

What is the pension levy in ireland. The 06 per cent levy was applied to the full value of funds invested in private sector pension schemes on January 1st of the respective year. Age 66 from 2014. The pension levy rates are as follows. With the massive pension problem looming in the future it will be difficult to rely on the Old Age Pension the need for private pension funding is greater than it has ever been if people want to have some sort of life in retirement.

The state social welfare pension is payable from the following ages. Age 67 from 2021. The pension levy which on average is around 5pc per worker was introduced in 2009 as an emergency measure after the property market collapsed and the banking system imploded. The bulk of the required 2bn saving 14bn is to come from a pension related levy on all public servants including local authority employees.

If the occupational pension is paid from within Ireland it is taxed by PAYE in the same way as a wage or salary. An AMRF is a fund for people under 75 with a retirement income of less than 12700 a year. You can only withdraw a maximum of 4 of the fund each year. It will suggest the levy worth roughly 2500 for the average worker is converted into a pension contribution to take account of a dramatic fall in the value of private sector workers pensions.

In 2014 the Minister said he was ending the levy as. Issuing a P45 to an employee The Department of Finance indicates that once a P45 has been issued to an employee from whom the Pension Levy has been deducted a statement of Pension Related Deductions should accompany the P45. The current state social welfare pension is 11976 per year or 23030 per week as of January 2012. But last year the minister decided to increase the levy to 075pc of the assets of pension funds for.

You can use any social insurance PRSI contributions you may have paid in a country covered by EC Regulations or a country with which Ireland has a bilateral Social Security Agreement to satisfy the 520 260 paid contributions requirement for a pro rata pension a proportionate pension. The levy was originally applied at a rate of 06pc every year on the value of pension assets. When the pension levy was introduced first it was supposed to be 06 of your fund value for 4 years. This means that you get your tax credits in the normal way.

The SPNC is financed through general taxation and is paid according to need. The Pension Levy will display separately on the Employees Payslip under its official title of Pension Related Deduction. You can transfer a maximum of 63500 from your existing pension fund into the AMRF. The levy is to take the form of a stamp duty payable by pension funds and plans approved under Irish legislation namely occupational pension schemes Retirement Annuity Contracts and Personal Retirement Savings Accounts.

The levy has since.