What Is The Maximum Income To Be Eligible For Va Benefits

If you're looking for picture and video information related to the key word you have come to visit the ideal site. Our website gives you hints for seeing the highest quality video and picture content, search and find more enlightening video content and graphics that match your interests.

comprises one of tens of thousands of video collections from several sources, particularly Youtube, therefore we recommend this video for you to see. This site is for them to stop by this site.

To reapply for enrollment of your health-care benefits or update your information visit.

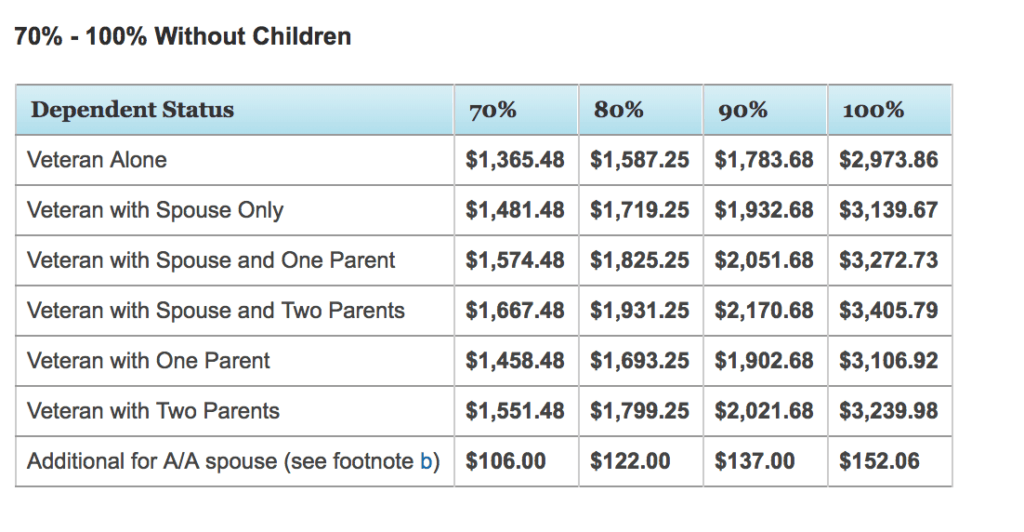

What is the maximum income to be eligible for va benefits. Your VA pension 17549 for the year or 1462 paid each month. Households earning as much as 5000 a month or more might still qualify even though this current income is greater than the MAPR. You may be eligible for more than one Priority Group. Withdrawals from IRAs 401ks and other retirement accounts are considered income.

VA will only consider a Veterans gross household income and deductible expenses from the previous year. If eligible your pension benefit is the difference between your countable income and the annual pension limit set by Congress. You also qualify for Aid and Attendance benefits based on your disabilities. Your yearly income 10000.

Countable income includes income from most sources as well as from any eligible dependents. Net worth is also a consideration for enrollment based on means test. VA considers income to be anything that comes through the door as cash or the equivalent of cash in a given year. The home page for the Department of Veterans Affairs provides links to veterans benefits and services as well as information and resources for other Departmental programs and offices.

VA divides this amount by 12 and rounds to the nearest dollar. You and your spouse have a combined yearly income of 10000. Income and Net Worth Limitations. This difference is your yearly pension entitlement.

A claimant has assets of 129000 and annual retirement income of 10000. Example 2 The net worth limit is 129094 and the maximum annual Pension rate MAPR is 13752. This change makes VA health care benefits more affordable to lower- income Veterans who have no service-connected condition or other qualifying factors. Your MAPR amount 27549.

Income is not the only issue. Virginias asset limit is 2000. VA then subtracts your countable income from the MAPR. The Veterans Pension program provides monthly payments to wartime Veterans based on need.

Based on eligibility and income some veterans may have to pay copay for treatment and some may not be eligible for enrollment. It generally includes. There is a net worth limitation that must be met. Therefore hisher net worth is not excessive for VA Pension.

This limit goes up to 3000 if your household includes at least one elderly 60 or disabled person. Review VA pension eligibility requirements to find out if you qualify based on your age or a permanent and total non-service-connected disability as well as your income and net worth. This doesnt include one vehicle per adult 18 in the household. Can I get food stamps if Im unemployed.

If the active duty occurred after September 7 1980 you must. Veterans must have at least 90 days of active duty including one day during a wartime period. The US Department of Veterans Affairs provides patient care and federal benefits to veterans and their dependents. For certain Veterans the VA National Income Threshold based on previous years gross household income andor net worth is used to determine eligibility for Priority Group 5 assignment and cost-free VA health care.

This is the approximate amount of your monthly pension payment. Child Earned Income Exclusion. Pension benefits are needs-based and your countable family income must fall below the yearly limit set by law. Because income is 0 the claimants net worth is 116000.

VA deducts certain expenses you pay such as unreimbursed medical expenses from your annual household income.