What Is The Dollar Amount For 100 Va Disability

If you're searching for video and picture information linked to the key word you have come to pay a visit to the right blog. Our website provides you with suggestions for seeing the highest quality video and image content, search and locate more informative video articles and graphics that match your interests.

includes one of tens of thousands of video collections from various sources, particularly Youtube, therefore we recommend this movie that you view. It is also possible to bring about supporting this site by sharing videos and images that you enjoy on this site on your social media accounts like Facebook and Instagram or educate your closest friends share your experiences about the ease of access to downloads and the information that you get on this website. This site is for them to stop by this website.

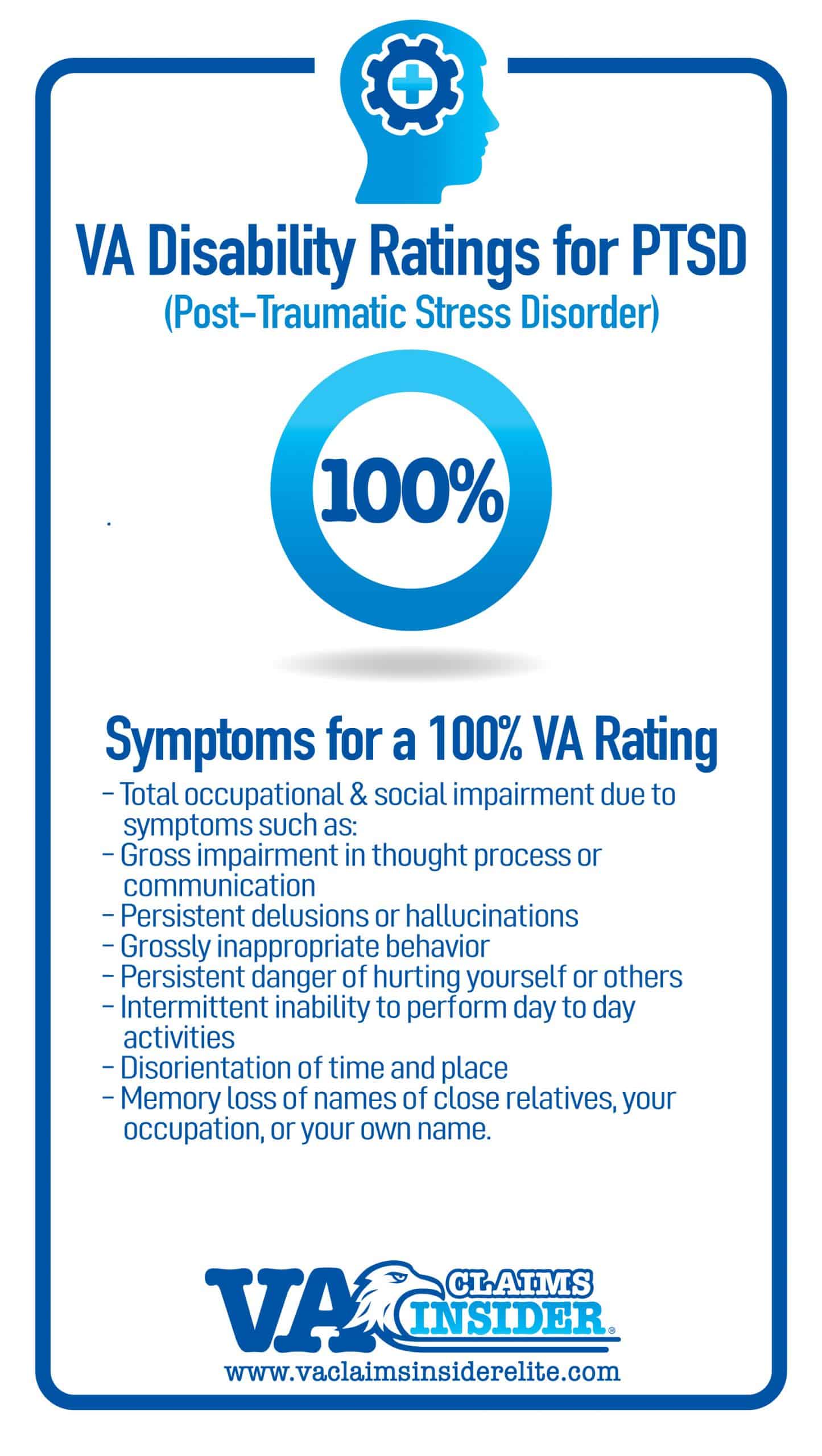

Compensation Like those receiving benefits for 100 percent disability ratings veterans who qualify for TDIU benefits receive monthly payments from the VA.

What is the dollar amount for 100 va disability. The total amount payable is 182471. Amounts Paid For Disability Compensation Veterans are eligible for monthly disability compensation that is tax-free if they have a disability rating allocated by the VA for a service-related condition Determining disability rating. A retiree with a pension of 3000 a month and a 100 combat related disability would waive all of his retirement on his VA claim form and receive 3000 VA compensation and after approval for CRSC receive 3000 as tax free CRSC. Add 11100 additional for AA spouse to the rate for a 70 veteran with dependency code 12 169617.

Our VA Disability Chart details the current monetary amounts give for a 100 VA Disability Rating. As of 2020 the monthly compensation for a single 100 disabled veteran is 310604. The amount can increase depending on the number of dependents a veteran has. 70 100 Without Children.

The rating and compensation criteria fall under SMC S. For each additional child under age 18 add another 8605. If you do not have any dependents your monthly tax-free payment would be 305713 Individual Unemployability IU is also called Total Disability Individual Unemployability TDIU. If the veteran is currently at a 100 va disability rate and VA finds that the veteran is housebound they will pay the veteran at the 100 rate with an additional 375 per month.

A 100 disability compensation rating is the maximum permitted by law. The total amount payable is 180717. 30 60 With Children. 70 100 With Children.

This change wont make a huge. 90 disability rating in US. How VLG Can Help. Where the veteran has a spouse who is determined to require AA add the figure shown as additional for AA spouse to the amount shown for the proper dependency code.

These mileage subject to a deductible of 3 for a one way trip 6 for a round trip with a maximum of 18 per or the amount after six. Even though it is easy to come up with the correct dollar amount however the numbers may not always make sense. Average Indexed Monthly Earnings First the SSA will determine your AIME. Or talk with a Veterans United loan specialist at 855-870-8845 about your path to homeownership.

The exact monetary amount of compensation given for a 100 VA Disability Rating is the same for every veteran but does change for factors like children spouses etc. Longevity earned retired pay is normally calculated at 25 per year of active duty service multiplied by your high three base pay. If there is a spouse and child monthly compensation is 340604. In order to be eligible for housebound benefits the veteran must have.

Published on November 21st 2019 The exact amount of Individual Unemployability pay you receive depends on how many dependents you have. To do this the SSA will adjust or index your lifetime earnings to account for the increase in general wages that happened during the years you worked. To find the amount payable to a 70 disabled Veteran with a spouse and four children one of whom is over 18 and attending school take the 70 rate for a veteran with a spouse and 3 children 164271 and add the rate for one school child 18200. 80 disability rating in US.

100 disability rating in US. With spouse and 2 parents no children 70 disability rating in US. The amount of CRSC is the lesser of the dollar amount of VA disability compensation awarded for combat related disabilities OR the amount of longevity earned retired pay. The total amount payable is 195017.

See how your disability rating affects your VA Home Loan benefit. Many veterans with a 100 VA Disability Rating also qualify for additional. If our prediction holds true this means Disabled Veterans with a current VA disability rating of 10 of higher would receive a 11 increase in their VA disability pay rate for calendar year 2021. 100 disability rating in US.

In previous years the amount was rounded down to the nearest dollar. If the disabled veteran is married the compensation is 327922. For example if you were previously getting 1000 per month tax-free a 11 VA pay increase is 11 so a veterans VA disability compensation pay in 2021 would go up to 1011 per month. Mileage Reimbursement is at the rate of 415 cents per mile.

2014 was the first year the VA has included amounts above a flat dollar amount. A veteran with a 50 disability rating however receives only 77000. Monthly Social Security disability benefits range from 100 to 3148. The average disability benefit for a recipient of SSDI in mid-2020 was 1259 per month but a beneficiary can receive up to 2861.

These percentages guide the precise dollar amount VA must pay to a disabled veteran. For instance a veteran with no dependents who is 100 disabled currently receives 267300 according to the Rate Tables. CRSC replaces waived longevity pay up to the dollar amount of VA compensation for combat related disabilities. These benefits vary from 117 to 2527 per month as of 2008 contingent upon the level of disability.