What Is Pennymac Interest Rate

If you're searching for picture and video information related to the key word you have come to pay a visit to the ideal site. Our website gives you hints for seeing the highest quality video and image content, search and find more enlightening video content and images that fit your interests.

includes one of tens of thousands of movie collections from several sources, especially Youtube, so we recommend this video for you to see. This site is for them to visit this website.

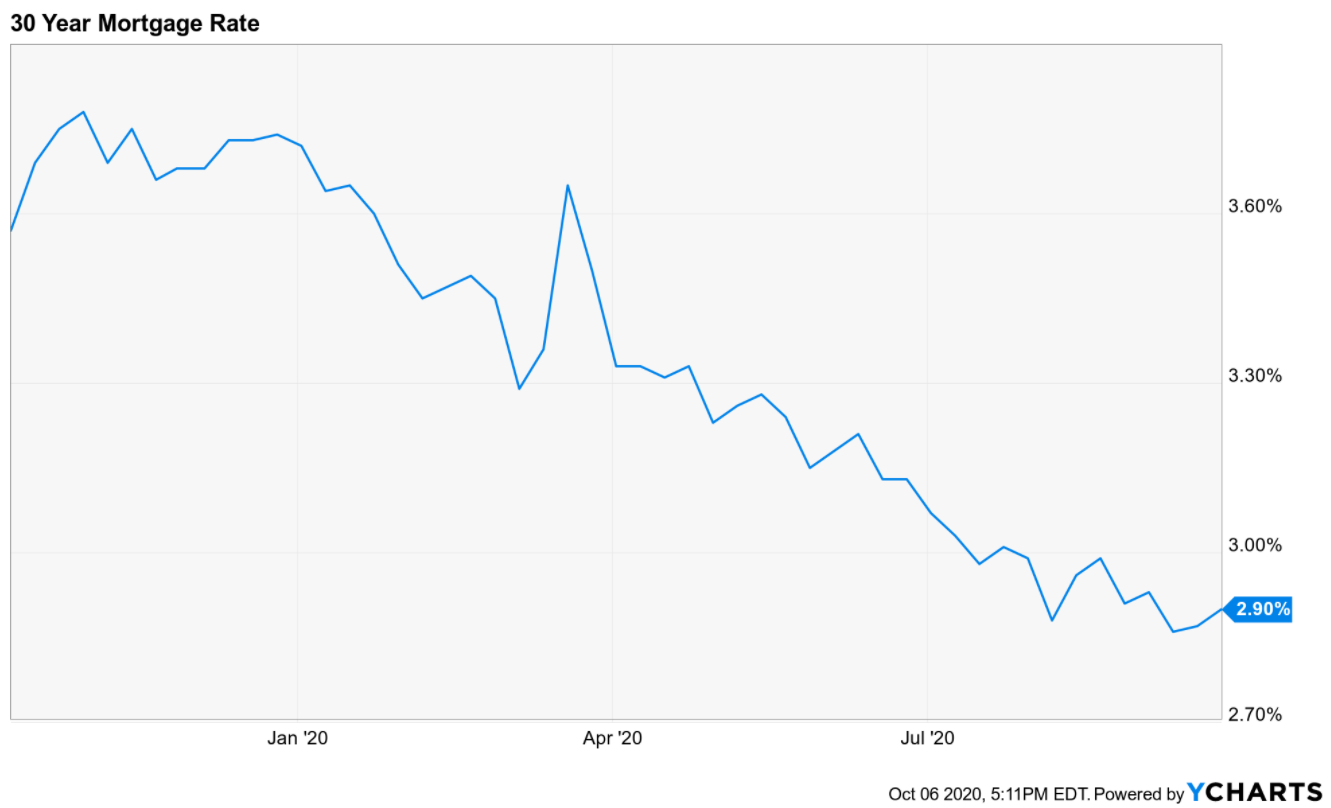

According to the lending insurance firm FreddieMac these interest rates are about average.

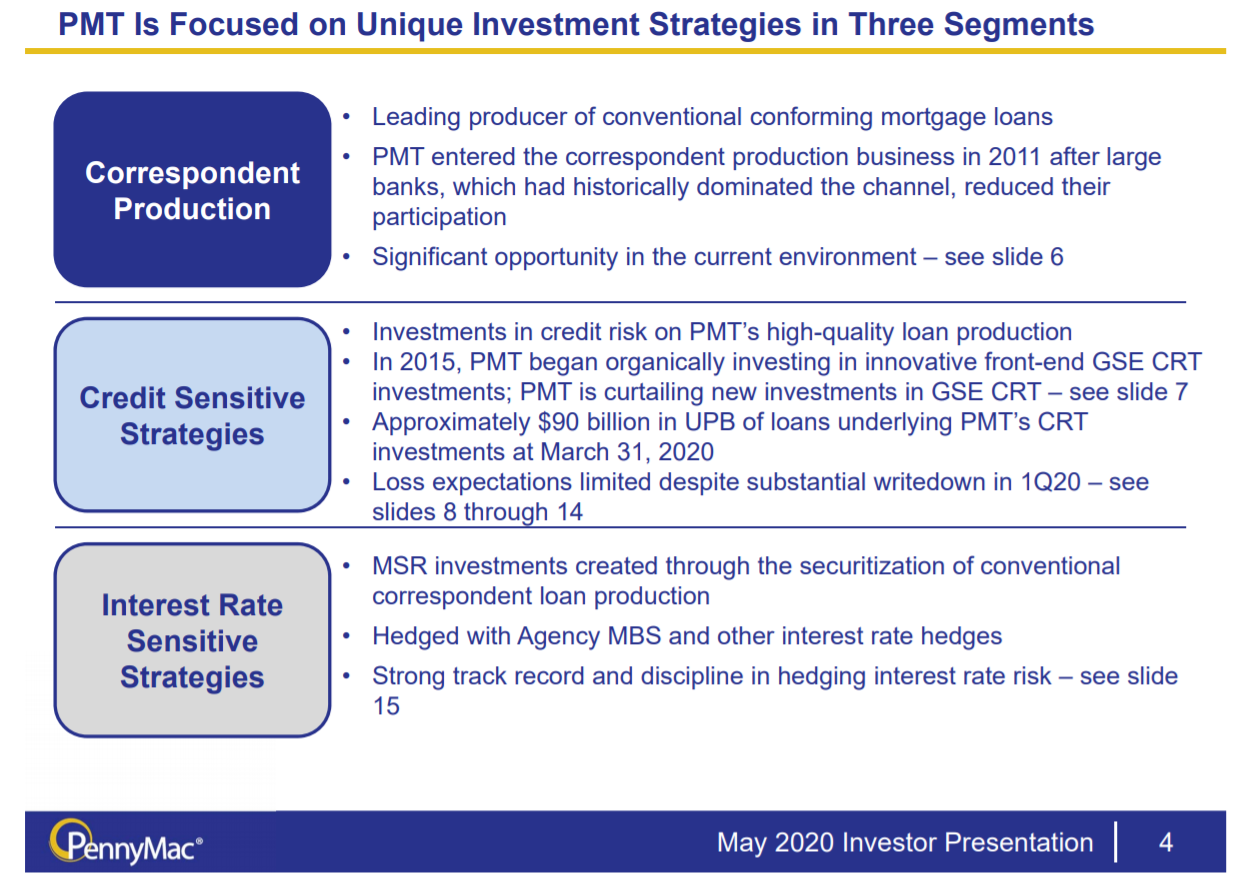

What is pennymac interest rate. Fixed-rate mortgages are available for terms ranging from 10 to 30 years. Your monthly payment will be 141444 and the total interest will be 14611326. As of this writing a 15-year mortgage has an interest rate of 25 while 20- and 30-year mortgages have a 3 rate for qualified borrowers. PennyMac Loan Services consists of three primary businesses.

PennyMac acquires newly originated loans from small banks and independent originators. PennyMac works to find the best home loan solution for you whether youre buying a new home or refinancing your current loan. It can be used to lower the interest rate on your mortgage. One of the perks that come with this lender is that you get a free rate lock with your loan.

The payment on a 220000 20-year Fixed-Rate is 116600 for 240 months at 25 and 265 Annual Percentage Rate APR. Lock in your low rate today. Qualified borrowers can secure a PennyMac fixed-rate mortgage with a down payment as low as 3 percent and can select from a loan term of 15 20 or 30 years. 1 Reason PennyMac Financial Services Is Beating the Market Falling interest rates have created a refinance wave and this financial company is benefitting.

Pennymac Home Loans Mortgagee Clause It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. PennyMac offers a wide range of loan products and types. The largest revenue driver was from gains on loans held for sale which increased 362. Interest rate shocks Servicing values run the gamut from 07 of the loan value to 14 of the loan value.

Citation needed Correspondent Lending. PennyMac headquartered in Westlake Village California was founded in 2008. PennyMac has reached a lot of big milestones recently having modified its 17500 th loan in August and reaching almost 3000 employees. Rates on 15-year streamline FHA refinances start at 4250 APR.

PennyMac offers a wide variety of refinancing options including fixed- and adjustable-rate conventional loans FHA loans and VA loans. The PennyMac Loan Services fixed-rate mortgage calculator will give the following results. Adjustable-rate mortgage loans are available in 31 51 71 and. Are there any special programs.

PennyMac Financial Services portfolio consists of 225 billion in loans valued at 29. PennyMac saw the same trends as in Q1 of lower interest rates increased demand and higher production volume. Theres also cash-out and IRRRL options. You can view current rates for some of the most common terms on the companys website but if you dont find what youre looking for you can get a custom quote online or by calling the company.

View live mortgage rates any time on PennyMacs website. Rates on longer 30-year streamline options are actually lower with a starting APR of 2500. Those homeowners looking to get lower payments by extending their mortgage terms may be able to do so through PennyMac without a massive increase in interest costs. This payment assumes 80 loan-to-value LTV and 0619 points due at closing.

Today its a publicly traded direct national lender that offers a wide range of loan options. This conventional loan option allows borrowers to lock down an affordable interest rate for the full loan term offering exceptional long-term stability and predictable monthly payments. Like most lenders your mortgage rate with PennyMac is determined by a wide range of factors including your credit score and loan type. Both the FHA and VA offer beneficial streamline refinancing programs to qualifying borrowers.

As far as mortgages offered PennyMac has 30-year 20-year and 10-year Fixed Rate Mortgages as well as 5 and 7 year Adjustable Rate Mortgages. As of December 2013 PennyMac is the largest non-bank correspondent lender in the United States and the 3rd largest overall according to Inside Mortgage Finance. By communicating with customers primarily through telephone and. Assume you take a 100000 PennyMac Loan Services loan for 360 months 30 years with the interest rate of 15 and the additional principal of 150.

Opting for a streamline refinance can be a viable option for borrowers who want a lower interest rate or need to transition from an adjustable-rate mortgage ARM to a fixed-rate loan. The payment on a 220000 30-year Fixed-Rate is 89800 for 360 months at 275 and 2848 Annual Percentage Rate APR.