What Is A Va Waiver In Military Retirement Pay

If you're searching for video and picture information linked to the key word you have come to pay a visit to the right site. Our site gives you hints for seeing the highest quality video and picture content, search and locate more enlightening video articles and images that fit your interests.

comprises one of thousands of movie collections from several sources, especially Youtube, so we recommend this movie for you to see. You can also contribute to supporting this website by sharing videos and graphics that you like on this blog on your social media accounts like Facebook and Instagram or educate your closest friends share your experiences concerning the simplicity of access to downloads and the information that you get on this website. This blog is for them to visit this site.

It is still a good deal to do because VA disability is not taxed while military retirement is taxed.

What is a va waiver in military retirement pay. Two Ways to Prepare. The VA waiver ie an amount equal to your total VA compensation will continue to be subtracted from veterans service retired pay. There is no application for CRDP. Military retirement pay or VA disability compensation.

If you want to waive your military retired pay to receive credit for military service in the computation of your FERS or CSRS benefit you should write the Retired Pay Operations Center at least 60 days before your planned retirement. Virginia Income Tax Exemption on Retired Military Pay received by Medal of Honor Recipients. Military retirement pay is accountable to federal income tax. CPT Todd Military Lawyer replied 1 year ago Its because you dont have a combat related disability.

Department of Defense Department of Veterans Affairs Military Employment Verification Warrior Care Website Defense Contract Mgmt Agency DoD. They waive only so much of their retired pay as is equal to the amount of VA disability compensation to which they are entitled. CRDPCRSC Open Season The 2021 CRDPCRSC Open Season is January 1-31 2021. After retirement veterans specify the number of exemptions theyre eligible for on their W-4.

As noted by the posters above the VA waiver amount is restored by CRDP when the VA rating is 50 or more. A VA waiver is a situation where a person receives a certain percentage of disability from the VA and in order to get it they have to waive a portion of their military retirement in order to get it. Send your waiver to. Below 50 the waived amount of retired pay is not restored by DFAS.

12316 and 38 USC. This is known as the VA waiver or VA offset. Military members had to choose which payment they wanted to receive. However CRSC reimburses all or some of veterans VA waiver in a separate check from their branch of service.

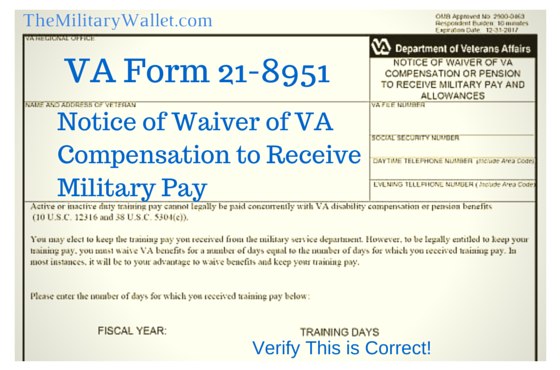

VA waiver on your RAS is the amount of retired pay that you waived in order to receive tax free VA compensation. VA Waiver and Retired Pay. We need this information to determine whether you choose to waive your VA compensation or pension or your military pay and allowances for the days for which you received training pay 10 USC. Some retirees who receive VA disability compensation may also receive CRDP or CRSC payments that make up for part or all of the DoD retired pay that they waive to receive VA disability pay.

If you want to waive your military retired pay to receive credit for military service in the computation of your FERS or CSRS benefit you should write the Retired Pay Operations Center at least 60. 2021 Cost of Living Adjustment and Pay Schedule There is a 13 percent Cost of Living Adjustment COLA for most retired pay and Survivor Benefit Plan annuities and the Special Survivor Indemnity Allowance SSIA effective Dec. Concurrent Retirement Disability Pay. Comparing CRSC and CRDP.

We estimate that you will need an average of 10 minutes. If they chose to receive both forms of payment they had to offset or waive a portion of their military retirement pay equal to the amount they received from the VA. Retirement pay will be restored for veterans who are eligible. Defense Finance and Accounting Service US.

Veterans would receive a check from the Defense Finance and Accounting Service DFAS with their full retired pay. Title 38 United States Code allows us to ask for this information. Any veteran in receipt of military retired pay must waive their retired pay if they want to receive VA compensation Exceptions are 100 disabled and Individual Unemployability. The reason is because of double-dipping laws that state you cant be paid twice by the government for the same event.

These two laws authorize a member to waive entitlement to retired pay. Check out our new helpful FAQs. Provide for Loved Ones. Veterans frequently waive only so much of their retired pay as is equal to the amount of VA.

The amount deducted from their pay for federal withholding tax each month is based on this exceptions number. If you receive VA compensation for your VA disability military retired pay is reduced by the VA waiver. Military retirement income received by those awarded the Medal of Honor can be subtracted from federal. A waiver is the relinquishment of all or a portion of one benefit to qualify for another benefit.

In the case of military retirement pay the VA waiver is eliminated. Va waiveroffset on my retirement pay Gross pay is 4122 and va waiver is 1297 Military Lawyer.