What If I Received A Stimulus Check For A Deceased Spouse

If you're searching for picture and video information related to the keyword you've come to pay a visit to the right site. Our website gives you hints for viewing the highest quality video and image content, hunt and locate more enlightening video content and images that fit your interests.

comprises one of thousands of movie collections from several sources, especially Youtube, therefore we recommend this movie that you view. This site is for them to stop by this site.

If you received a stimulus check made out to a deceased relative or a direct deposit into one of their accounts that you control or even if you and a deceased spouse received a joint stimulus.

What if i received a stimulus check for a deceased spouse. Or in many cases people who were recently widowed received 2400 rather than 1200 because the IRS thought they were still married based on their last tax return. When the first coronavirus stimulus checks arrived an unknown number of people were surprised to discover that their deceased loved one received 1200. If the payment was received in the form of a paper check you should a write Void in the endorsement section on the back of the check b mail the voided check to the IRS and c include a. In response to the novel coronavirus Congress took action in 2020 and authorized multiple stimulus checks to be.

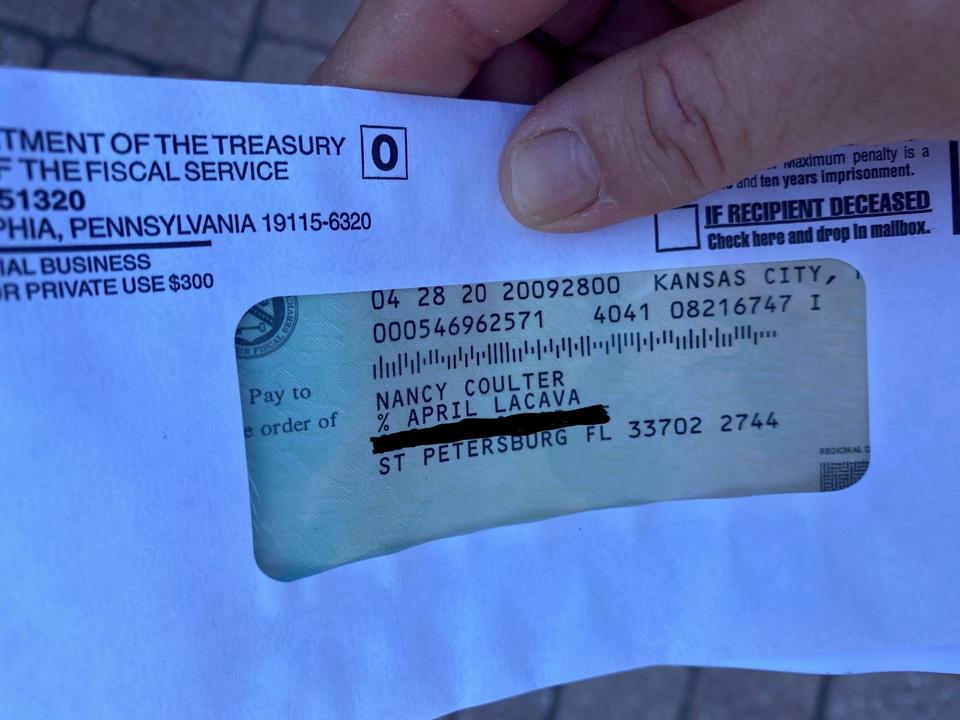

Now the IRS has. Unfortunately that meant some joint. It is because of this that if a couple filed their taxes jointly and one spouse has passed away since then there is a possibility that the IRS is not aware yet. If its a paper check write the word void in the endorsement area on the back.

Congress made clear that payments are still available to families of the deceased. If youre on the receiving end of a stimulus check that was issued to a loved one whos no longer with us your best bet is to hang onto it but not spend it. Some stimulus checks have been delivered to people who have died according to some taxpayers. A payment wont be issued to someone who has died before January 1 2020.

That would mirror what happened this past spring when deceased individuals were among the. The public is receiving their stimulus check based on what was filed on either their 2018 or 2019 tax return. If you received a stimulus check for a deceased family member youre in a tough situation. What to Do If You Get a Stimulus Check for a Deceased Person Then the IRS went a step further.

Basically if you received a paper stimulus check from the Treasury Department and it hasnt been deposited you should write VOID on the back pop it in the mail to your regional IRS location and include a note stating the reason for returning the check the IRS says. Thats because as the IRS hurries to get much-needed money into Americans. The IRS says that a stimulus payment made to someone who died before receiving it should be returned to the government. The IRS is checking to make sure that checks arent issued to people who died in 2019 or earlier.

If one spouse died and another is alive you would have to return the payment for the deceased spouse by writing a check to the Treasury. If you filed a joint return in 2019 and your spouse died before January 1 2020 you wont receive a 600 payment for your deceased spouse but youll still be issued up to 600 for you and 600 for any qualifying children if all other eligibility criteria are met. The Internal Revenue Service said individuals who got a 1200 stimulus payment intended for someone whos deceased or incarcerated should return the money but left open the question of how the. The entire payment should be returned unless it was made payable to joint.

For example if you were married and your spouse passed. Dead people may get some of the 600 stimulus checks the federal government began issuing Tuesday night. Forbes writes that if one spouse is alive and the other has died then you would need to return the payment for the deceased spouse by writing a check to the Treasury. If you filed a joint return in 2019 and your spouse is deceased you wont receive a 600 payment for your deceased spouse but youll still be issued up to 600 for you and 600 for any qualifying children if all other eligibility criteria are met.

One of these being stimulus checks delivered to individuals who are deceased. One thats coming to light. Mail the voided check to the IRS location for your state along with a note that includes the name of the deceased. For many taxpayers double-checking the IRS math then venturing to the post office with a check made.