What Do I Do If My Deceased Spouse Received A Stimulus Check

If you're looking for picture and video information related to the keyword you've come to pay a visit to the right site. Our website provides you with hints for viewing the maximum quality video and picture content, search and find more enlightening video content and images that fit your interests.

includes one of thousands of video collections from several sources, especially Youtube, so we recommend this video for you to see. You can also bring about supporting this site by sharing videos and images that you like on this site on your social networking accounts like Facebook and Instagram or tell your closest friends share your experiences concerning the simplicity of access to downloads and the information that you get on this site. This site is for them to visit this website.

This means the checks no longer need to be sent back which the agency previously said may need to happen.

What do i do if my deceased spouse received a stimulus check. If you filed a joint return in 2019 and your spouse died before January 1 2020 you wont receive a 600 payment for your deceased spouse but youll still be issued up to 600 for you and 600 for any qualifying children if all other eligibility criteria are met. The IRS says that a stimulus payment made to someone who died before receiving it should be returned to the government. Return it if the recipient was dead on the date the payment was received says the IRS. If you received a 2400 payment based on a joint tax return and your spouse has died since then youre expected to keep your 1200 and return their 1200.

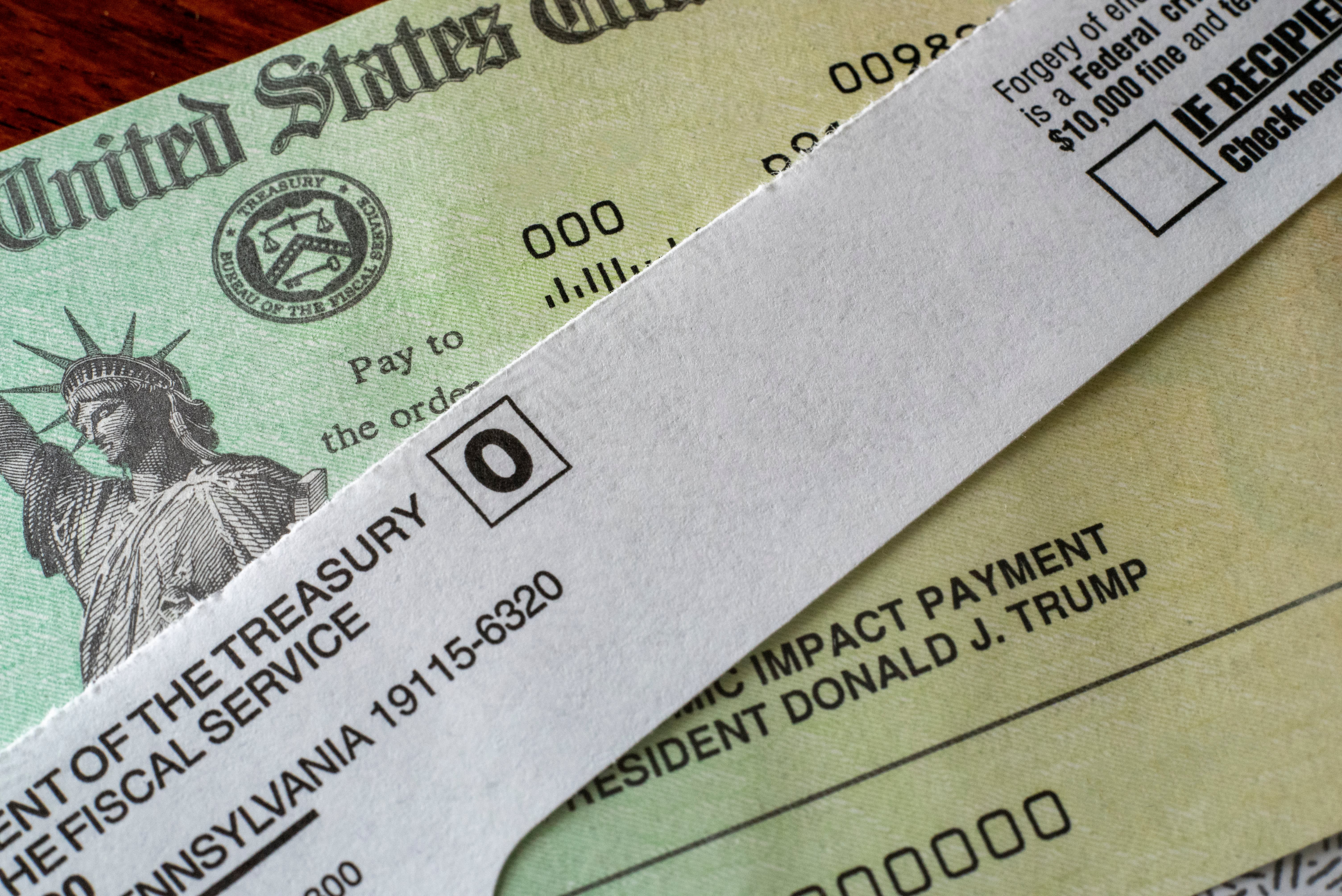

One of these being stimulus checks delivered to individuals who are deceased. For example if you were married and your spouse passed. If your spouse passed away in early 2020 before COVID and then you got a stimulus check that was for you and your deceased spouse the IRS is saying you have to pay back the portion that went to. Most of the American population has by now received a stimulus check which is the part of the 2 trillion total spending package approved by Congress and signed by President Donald Trump.

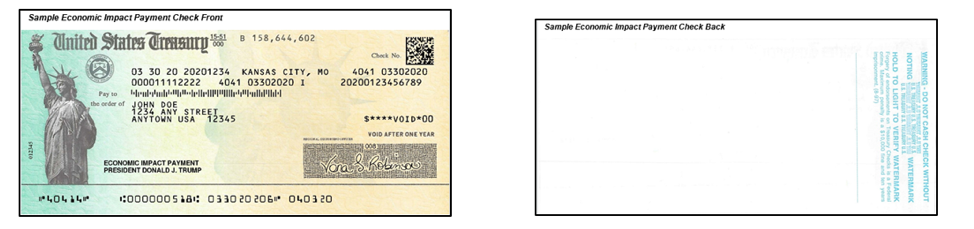

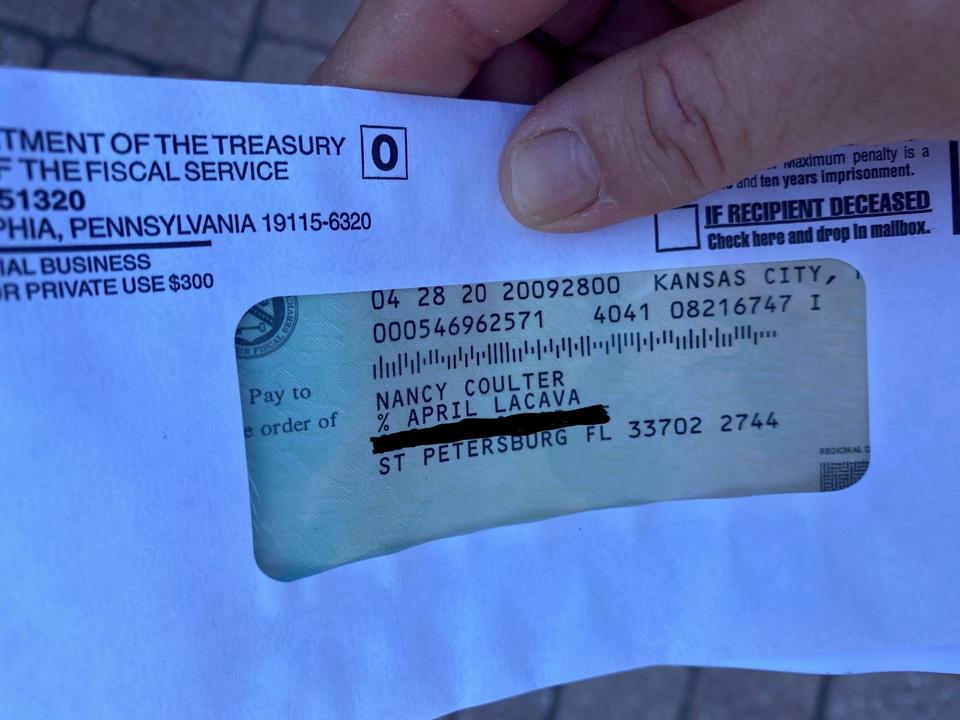

If you received a stimulus check for a deceased family member youre in a tough situation. The agency is supposed to check death records before it makes payments but. If you filed your taxes jointly with your spouse and your spouse has died the IRS doesnt necessarily know it yet. Basically if you received a paper stimulus check from the Treasury Department and it hasnt been deposited you should write VOID on the back pop it in the mail to your regional IRS location and include a note stating the reason for returning the check the IRS says.

If the payment was received in the form of a paper check you should a write Void in the endorsement section on the back of the check b mail the voided check to the IRS and c include a note. The tax agency announced that it will reissue payments to surviving spouses of deceased people who were unable to deposit the initial stimulus checks paid to both the deceased and surviving spouse. So if your loved one was alive then but deceased now you need to watch your account or the mailbox closely. In response to thousands of questions and complaints the IRS on May 6 announced that taxpayers should not cash a stimulus check sent to a deceased person or use directly deposited stimulus funds.

A payment wont be issued to someone who has died before January 1 2020. It is because of this that if a couple filed their taxes jointly and one spouse has passed away since then there is a possibility that the IRS is not aware yet. In addition to new explanations about dead people and the incarcerated being ineligible for payments the IRS has a new entry in its stimulus payment FAQ page Q41 explaining how to return a stimulus check. The public is receiving their stimulus check based on what was filed on either their 2018 or 2019 tax return.

The entire payment should be returned unless it was made payable to joint. The federal government had sent stimulus payments to about 11 million dead people totaling nearly 14 billion. If one spouse died and another is alive you would have to return the payment for the deceased spouse by writing a check to the Treasury. For many taxpayers double-checking the IRS math then venturing to the post office with a check made.

The IRS is canceling stimulus checks sent to dead people according to Business Insider.