What Do I Do If I Received A Stimulus Check For My Deceased Spouse

If you're looking for picture and video information related to the key word you've come to pay a visit to the right site. Our website gives you hints for seeing the highest quality video and picture content, hunt and find more informative video articles and graphics that match your interests.

comprises one of tens of thousands of movie collections from several sources, particularly Youtube, therefore we recommend this movie for you to view. This site is for them to stop by this website.

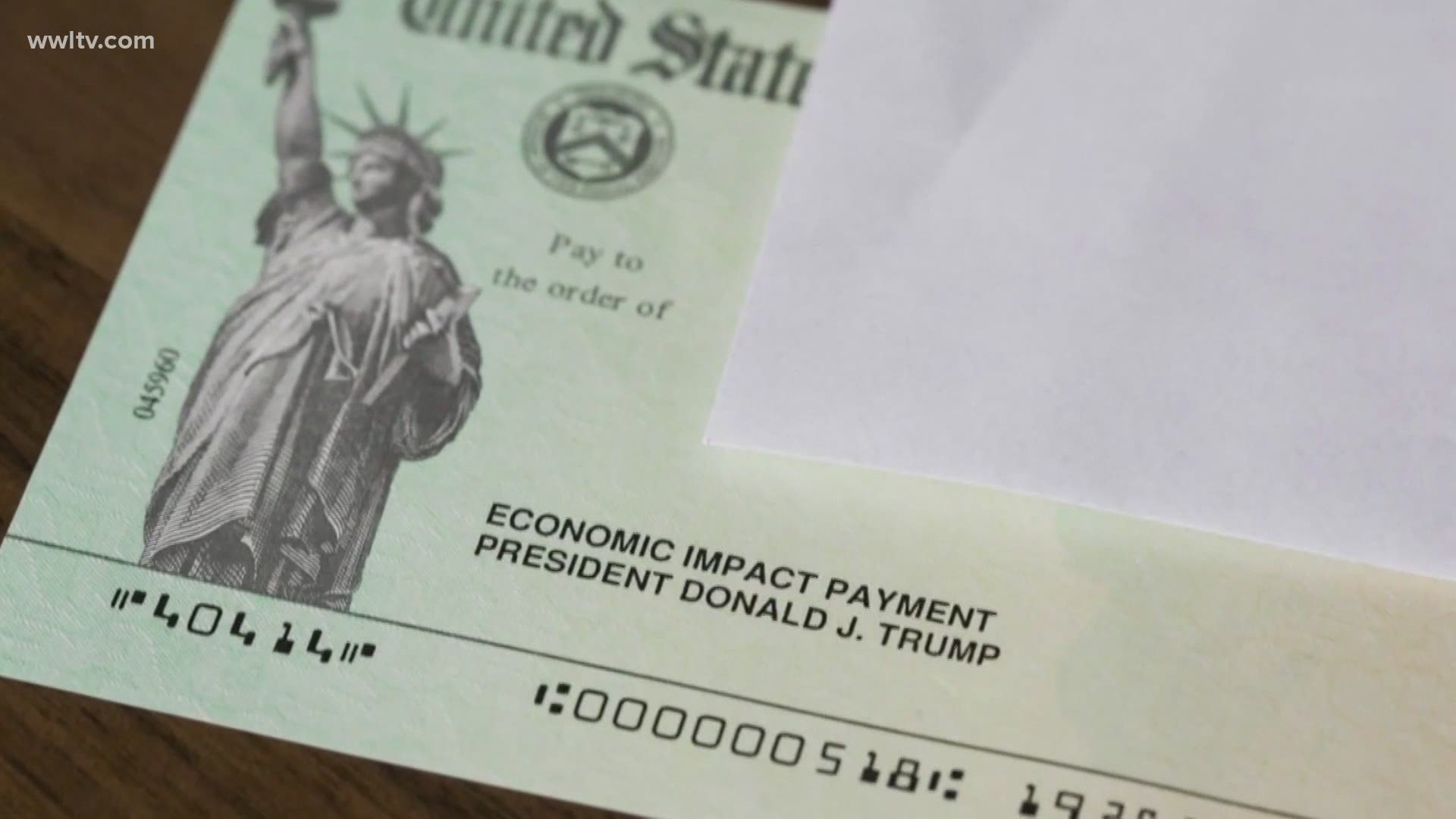

The IRS says it has canceled outstanding checks from the first stimulus that were made out to the dead.

What do i do if i received a stimulus check for my deceased spouse. Individuals who died in 2020 may be eligible for a Recovery Rebate Credit on their 2020 taxes if they did not receive a second stimulus check. In addition to new explanations about dead people and the incarcerated being ineligible for payments the IRS has a new entry in its stimulus payment FAQ page Q41 explaining how to return a stimulus check. What to Do If You Get a Stimulus Check for a Deceased Person Then the IRS went a step further. Though the IRS may not have a legal leg.

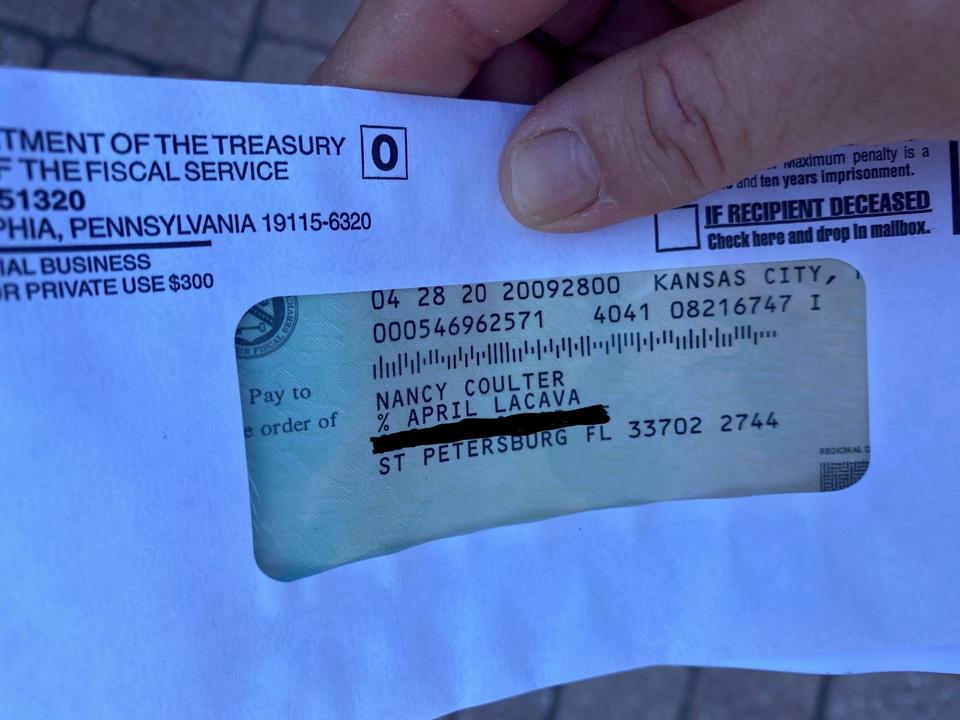

It started cancelling uncashed checks sent to deceased people. If you received a stimulus check for a deceased family member youre in a tough situation. Unfortunately that meant some joint. The public is receiving their stimulus check based on what was filed on either their 2018 or 2019 tax return.

It is because of this that if a couple filed their taxes jointly and one spouse has passed away since then there is a possibility that the IRS is not aware yet. If you received a payment via debit card or direct deposit for a deceased person you must return it. For many taxpayers double-checking the IRS math then venturing to the post office with a check made. The IRS has repeatedly said it doesnt expect people to.

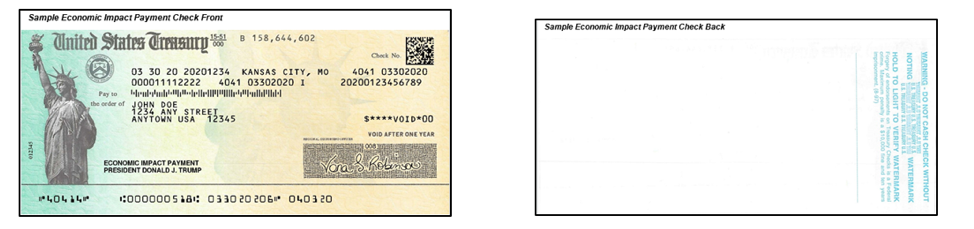

If you received a stimulus check made out to a deceased relative or a direct deposit into one of their accounts that you control or even if you and a deceased spouse. So if your loved one was alive then but deceased now you need to watch your account or the mailbox closely. Basically if you received a paper stimulus check from the Treasury Department and it hasnt been deposited you should write VOID on the back pop it in the mail to your regional IRS location and include a note stating the reason for returning the check the IRS says. Write a note to include with the check explaining why it is being returned.

Forbes writes that if one spouse is alive and the other has died then you would need to return the payment for the deceased spouse by writing a check to the Treasury. If the payment was a paper check and you already cashed it you should a mail your own check or money order to the IRS b make your check payable to US. Treasury and write 2020EIP and the. Return the entire payment unless the payment was made to joint filers and one spouse had not died before receipt of the payment in which case you only need to return the portion of the payment.

Mail the check and the note to the IRS location based on the state you live in. The entire payment should be returned unless it was made payable to joint. If youre on the receiving end of a stimulus check that was issued to a loved one whos no longer with us your best bet is to hang onto it but not spend it. See what you should do to notify Social Security of a death So if you receive a check for a deceased loved one can you keep the money.

If you received an erroneous direct deposit or you already cashed the paper check. One of these being stimulus checks delivered to individuals who are deceased. And if you filed a joint return in 2019 and your spouse died before January 1 2020 you wont receive a 600 payment for your deceased spouse but youll still be eligible for your check plus. Congress put a firewall in place to limit the number of deceased recipients this time.

In response to thousands of questions and complaints the IRS on May 6 announced that taxpayers should not cash a stimulus check sent to a deceased person or use directly deposited stimulus funds. The IRS says that a stimulus payment made to someone who died before receiving it should be returned to the government. The list of addresses is available on the IRS website.