What Benefits Does A 100 Disabled Veteran Get In Texas

If you're looking for video and picture information linked to the key word you've come to pay a visit to the ideal site. Our site gives you hints for seeing the maximum quality video and picture content, search and locate more enlightening video content and images that fit your interests.

comprises one of tens of thousands of movie collections from various sources, especially Youtube, so we recommend this video that you view. You can also contribute to supporting this website by sharing videos and images that you enjoy on this site on your social networking accounts like Facebook and Instagram or tell your closest friends share your experiences about the ease of access to downloads and the information that you get on this website. This blog is for them to stop by this website.

Property taxes in Texas are locally assessed.

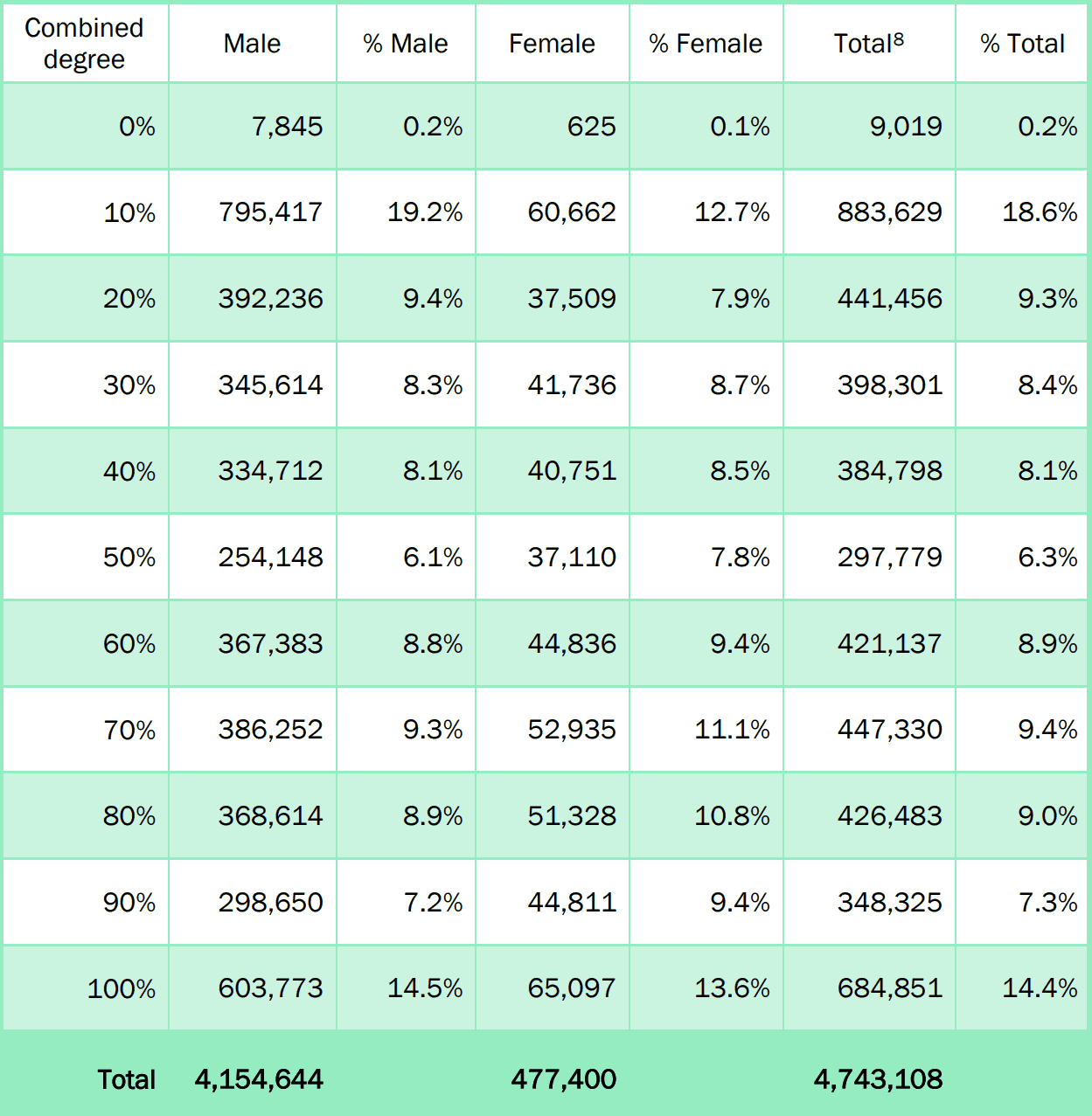

What benefits does a 100 disabled veteran get in texas. You know that as a disabled veteran you are eligible for many benefits the problem is knowing what they are and how to get them. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child. Again TDIU pays the same monthly compensation rate as a 100 VA disability rating which as of December 2020 was 314642. Veterans with 10 - 90 VA disability.

Texas Property Tax Exemption for Totally Disabled Veterans. There are many things you may be eligible for including free. A disabled Veteran who receives from the US. What do I need to know about the VA and Social Security programs.

The Texas Veterans Commission serves veterans their families and survivors in matters pertaining to VA disability benefits and rights. Department of Veterans Affairs due to a 100 percent disability rating or determination of individual unemployability by the US. Qualifying Veterans pay only 3 for their Disabled Veteran DV or Purple Heart license plate and nothing for a Legion of Valor license plate. VA Total Disability Individual Unemployability sometimes referred to as TDIU Individual Unemployability or just IU is an extra benefit for qualifying disabled veterans to be paid at the 100 VA disability rate even if they are rated below 100 percent scheduler.

Texas Veteran Financial Benefits Disabled Veterans Property Tax Exemption Total property tax exemption for 100 disabled veterans and their surviving spouses. Disabled Veteran Property Tax Exemption Texas. TxDOT has other categories of free or significantly discounted license plates for Texas Veterans as well as for their surviving spouses and family members. Department of Veterans Affairs 100 disability compensation due to a service-connected.

Disability compensation is a monthly tax-free benefit paid to Veterans who are at least 10 disabled because of injuries or diseases that were incurred in or aggravated during active duty or active duty for training. Veterans Who Have a VA Compensation Rating of 100 PT Starting March 17 2014 veterans who have a VA compensation rating of 100 permanent and total PT may receive expedited processing of applications for Social Security disability benefits. Department of Veterans Affairs. VA outlines TDIU regulations under 38 CFR 416 which encompasses subsections a and b.

Tax Code Section 11131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the US. Contact the Texas Veterans Commission at 877-898-3833 for more information.