What Benefits Do 100 Disabled Veterans Get In Texas

If you're searching for picture and video information linked to the key word you've come to pay a visit to the right blog. Our website gives you hints for viewing the maximum quality video and image content, search and find more informative video content and graphics that fit your interests.

includes one of thousands of movie collections from several sources, especially Youtube, therefore we recommend this video that you see. It is also possible to bring about supporting this site by sharing videos and graphics that you like on this blog on your social media accounts like Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information you get on this website. This blog is for them to visit this website.

In Texas a veteran with a disability rating of.

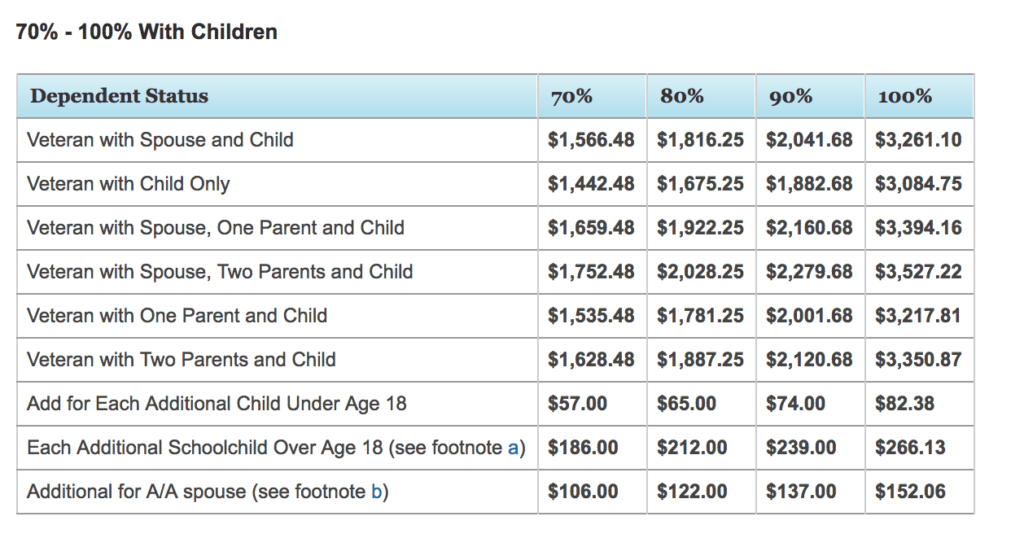

What benefits do 100 disabled veterans get in texas. In addition to veterans benefits available to you through the federal Department of Veterans Affairs VA you are also eligible for benefits through the Texas Veterans Commission. The Texas Veterans Commission serves veterans their families and survivors in matters pertaining to VA disability benefits and rights. 30- 49 percent may receive a 7500 property tax exemption. Texas veterans with VA disability ratings between 10 and 100 may qualify for property tax exemptions starting at 5000 for 10-29 disability and ending at a full exemption for those VA-rated as 100 disabled.

Texas Law Provides a waiver of drivers license fees except for individuals who have been convicted for certain sexual crimes and license plate fees for veterans with a service-related disability rating of 60 or greater. Department of Veterans Affairs 100 disability compensation due to a service-connected. The agency represents veterans in VA disability claims and during the VA appeals process and assists dependents with survivor benefi ts. The Hazlewood Act is a State of Texas benefit that provides qualified veterans spouses and dependent children with an education.

Tax Breaks For Disabled Veterans and Surviving Dependents. Tax Code Section 11131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the US. Department of Veterans Affairs due to a 100 percent disability rating or determination of individual unemployability by the US. In 2018 Congress signed the John S.

Department of Veterans Affairs. The Texas Hazelwood Act is an education benefit providing eligible veterans up to 150 credit hours of tuition exemption at a state-supported college or university. There are many things you may be eligible for including free. Saltwater fishing endorsement with a red drum tag.

You know that as a disabled veteran you are eligible for many benefits the problem is knowing what they are and how to get them. There is also no Texas military retirement income tax. Legacy Act Child Hazlewood Act for SpouseChild. 70- 100 percent may receive a 12000 property tax exemption.

The Super Combo License Package includes. Veterans with a full 100 disability rating are fully exempt from property taxes. 50- 69 percent may receive a 10000 property tax exemption. See all Texas Veterans Benefits.

Upland game bird endorsement. McCain National Defense Authorization Act in which 100 percent disabled veterans became eligible for Space Available Travel Space-A flights. Texas Veteran Financial Benefits The Texas Income Tax Break Since the State of Texas features no personal income tax military members living there will enjoy more savings at tax time than they might in states where personal income tax is collected. Texas Veteran Education Benefits.

Those over the age of 65 may also qualify for additional property tax exemption programs. Migratory game bird endorsement. Federal Duck Stamp is NOT included but. Veterans and their families can use Space-A flights to travel around the country and world at little to no cost.

The benefits available to veterans who are residents of Texas include educational benefits employment rights mortgage assistance and a property tax exemption.