What Are The Benefits For A 100 Disabled Veteran In Florida

If you're searching for video and picture information related to the keyword you have come to pay a visit to the right blog. Our website gives you suggestions for seeing the highest quality video and picture content, hunt and find more enlightening video content and images that fit your interests.

comprises one of thousands of video collections from several sources, especially Youtube, therefore we recommend this movie for you to view. This site is for them to stop by this site.

Florida Business Fee Waivers For Veterans.

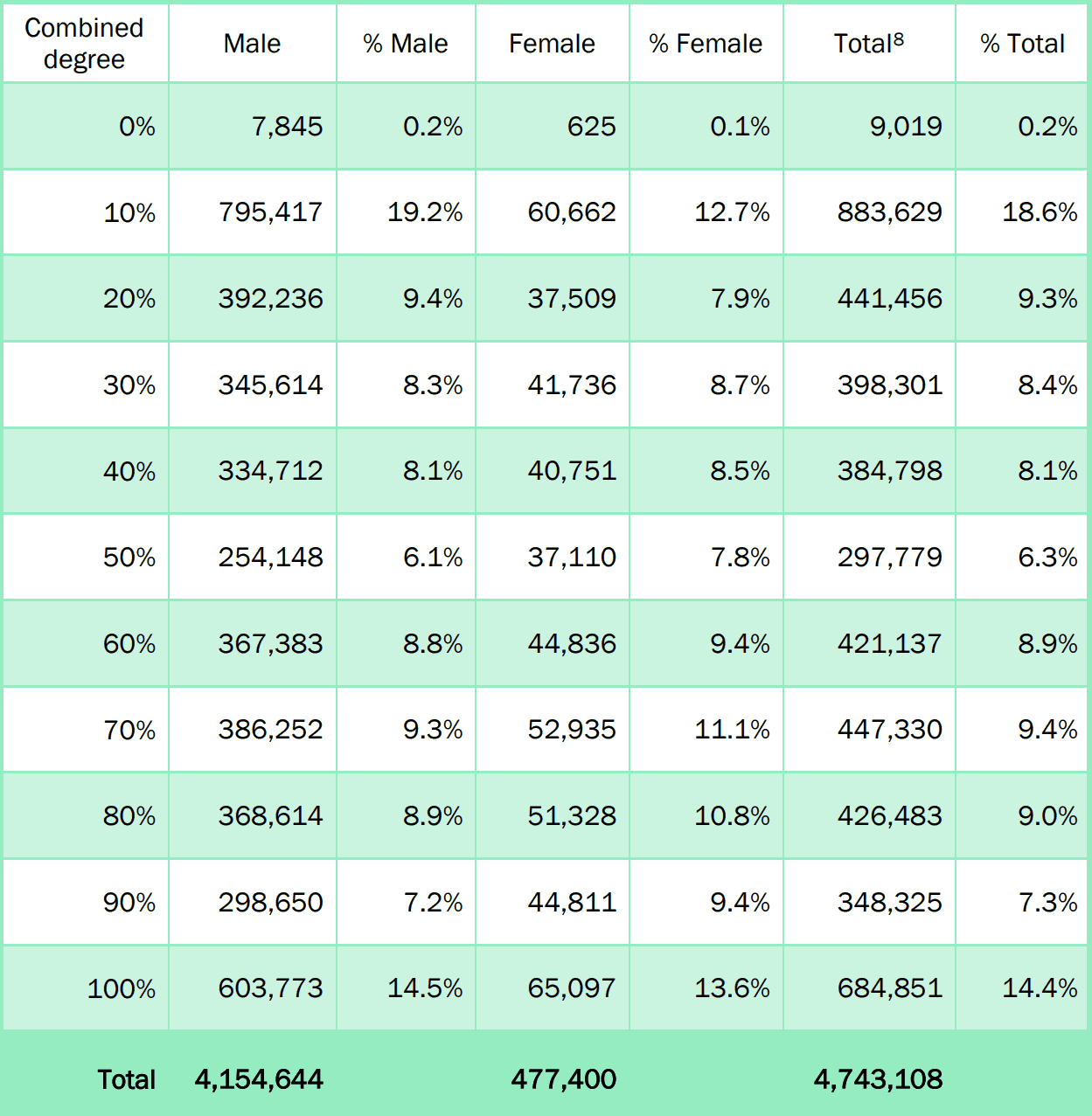

What are the benefits for a 100 disabled veteran in florida. TDIU is awarded in circumstances in which veterans are unable to secure or follow substantially gainful. Department of Veterans Affairs certified. However their programs processes and criteria for receiving benefits are very different. A disabled veteran in Florida may receive a property tax exemption of 5000 on any property they own if they are 10 percent or more disabled from a result of service.

Florida Veterans Benefits Guide. Total disability based on individual unemployability TDIU is a disability benefit that allows for veterans to be compensated at VAs 100 percent disability rate even if their combined schedular rating does not equal 100 percent. A VA compensation rating of 100 Permanent and Total does not guarantee that you will receive Social Security disability benefits. Commissary and Exchange Benefits for 100 Percent Disabled Veterans.

There are also provisions made for qualifying surviving spouses of the veteran for the same type of property tax benefit. It also contains useful phone numbers and website addresses for additional information. Click here to view the 2020 edition of the Florida Veterans Benefits Guide. Any honorably discharged veteran who has been determined by the US Department of Veterans Affairs to have a 100 total and permanent service-connected disability rating or has been determined to have a service-connected disability rating for compensation of 100 and is in receipt of disability retirement pay from any branch of the US Armed Forces and is qualified to obtain a drivers license is exempt from certain driver license fees.

Florida County and Municipal Fee Exemptions For Disabled Veterans. Florida Veterans Crisis Line For 24-hour counsel call the National Veteran Crisis Hotline at 1-800-273-8255. Both Social Security and VA pay disability benefits. This annual guide helps connect Floridas veterans and their families with earned federal and state benefits services and support.

Veterans who are VA-rated with a 100 disability are exempt from building license and permit fees designed to make a residence habitable and safe. A disabled veteran in Florida may receive a property tax discount on a primary residence based on the amount of disability the applicant is VA-rated at. Opioid Addiction is a disease and can be treated. The discount is a percentage equal to the percentage of the veterans permanent service-connected disability as determined by the United States Department of Veterans Affairs.

Florida provides four-year college educational opportunities for dependent children and spouses of veterans who died from a service connected disability or who are 100 percent service-connected. Filing for TDIU with 90 Percent Disability Rating. Certain restrictions may apply. Veterans surviving spouse if the spouse holds the legal or beneficial title to the homestead permanently resides there and has not remarried.

To be approved for Social Security benefits you must meet Social. Veterans in Florida you may also call the Florida Veterans Support Line at 1-844-MyFLVet 693-5838 or 2-1-1. Eligible resident Veterans with a US. Earned VA monetary benefits.

100 percent disabled veterans can present their Veteran Health Identification Card to gain entry to Department of Defense DoD and Coast Guard installations some commissary stores and at the point of sale at commissaries exchanges and Morale Welfare and Recreation MWR retail activities to complete their transactions. Florida Homestead Property Tax Exemption for Disabled Veterans 10 to 100 BUT not Permanent in Nature.