Virginia Unemployment Taxes Household Employees

If you're looking for video and picture information linked to the key word you've come to pay a visit to the right site. Our website gives you hints for viewing the maximum quality video and picture content, hunt and find more enlightening video articles and graphics that match your interests.

includes one of thousands of video collections from several sources, especially Youtube, therefore we recommend this video for you to see. This blog is for them to visit this website.

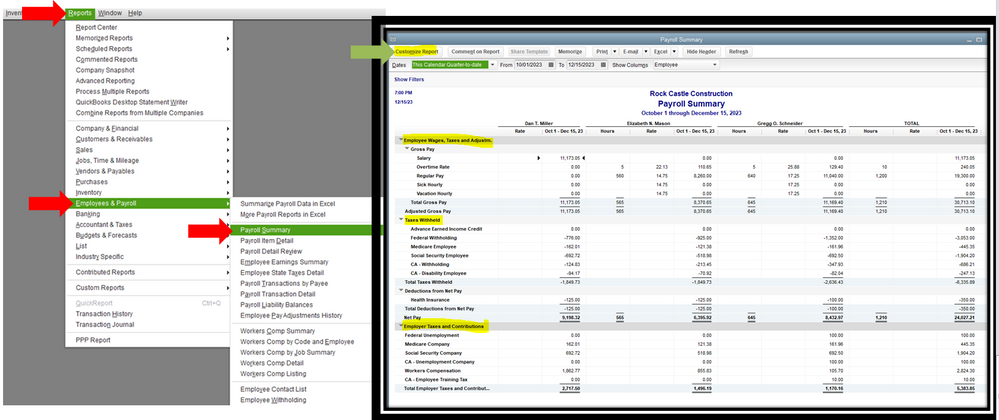

To do this you will need to register for withholding tax file income tax withholding returns and pay the income tax to Virginia.

Virginia unemployment taxes household employees. General employers are liable if they have had a quarterly payroll of 1500 or more or have had an employee for 20 weeks or more during a calendar year. If your small business has employees working in Virginia youll need to pay Virginia unemployment insurance UI tax. Have your employee complete this form which dictates how Virginia income tax is withheld. You can avoid owing tax with your return if you pay enough tax during the year to cover your household employment taxes as well as your income tax.

Use this box to indicate you are a new household employer registering with the Virginia Department of Taxation. Employers who discontinue or sell their business should notify the Commission. File this application to establish a Virginia Unemployment Insurance tax account with the Virginia Employment Commission. Who do I contact if I have questions.

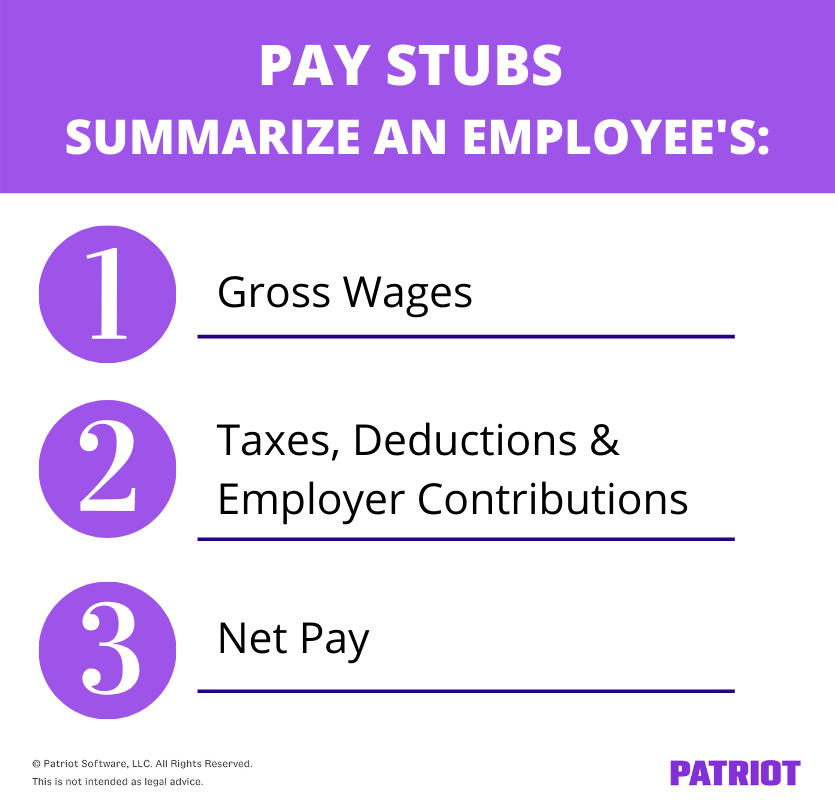

V New Household Employer. Use Schedule H to figure your total household employment taxes social security Medicare FUTA and withheld federal income taxes. Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. Household Employer Annual Summary of Virginia Income Tax Withheld.

Employers must register as soon as they hire an employee. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. In West Virginia the new employer SUI state unemployment insurance rate is 270 percent on the first 12000 of wages for each employee. Employers are liable for West Virginia unemployment tax if they pay wages of at least 1500 during a calendar quarter or employ at least one worker for some part of a day in 20 different weeks in a calendar year.

For more information about using Schedule H see Schedule H under What Forms Must You File later. VIRGINIA HOUSEHOLD EMPLOYMENT TAX RESPONSIBILITIES. Pay the amount due by April 15 2021. RICHMOND Virginias seasonally adjusted unemployment rate fell 03 percentage points in November to 49 percent which is 22 percentage points above the rate from a year ago.

Annual Filing Option for Household Employers Nanny Tax. V Convert My Existing Account. Liability VEC FC27 employeraccountsvecvirginiagov. Our goal is to provide information and assistance to help you build a quality workforce and to help your business grow.

Household Employment in Virginia Minimum Wage. Generally employers who pay wages to employees in the state of Virginia are required to deduct and withhold state income tax from those wages. Unemployment insurance tax must be paid on the amount of annual wages paid to an individual in any calendar year up to the taxable wage base. File this application to establish a Virginia Withholding Account with the Virginia Department of Taxation.

Unemployment Insurance Information for Employers The Virginia Employment Commission offers many programs and services for employers. Household employees in Virginia are required to be paid at least time and a half for hours worked over 40 in a. Step 1 - If you are a household employer and you qualify for the annual filing check the appropriate box on Form R-1H. Different states have different rules and rates for UI taxes.

If you have previous employees you may be subject to a different rate. If you paid cash wages to household employees totaling more than 1000 in any calendar quarter during the calendar year or the prior year you generally must pay federal unemployment tax FUTA tax on the first 7000 of cash wages you pay to each household employee. Add these household employment taxes to your income tax. Employers with previous employees may be subject to a different rate.

In Virginia state UI tax is just one of several taxes that employers must pay. Withhold Social Security and Medicare taxes from their employees paycheck each pay period. Employer Voucher for Payment of Virginia Income Tax Withheld Semiweekly File Online. State Unemployment Tax.

According to household survey data in November the labor force expanded by 16323 or 04 percent to 4286658 as the number of unemployed residents fell by 12464. These are sometimes referred to as the Virginia nanny tax obligations. Agricultural Domestic and 501C3 Non-Profit employers have different thresholds for liability. As an employer required to file withholding returns you must register for withholding tax file income tax withholding returns.

Household employees must be paid at least the highest of federal state or the applicable local minimum. Work Opportunity Tax Credit WOTC is a federal tax credit available to all private sector businessesIt was designed as an incentive to employers to hire individuals in certain targeted groups who consistently experience high rates of unemployment due to a variety of employment barriers. In Virginia there is a new employer state unemployment insurance tax of 25 on the first 8000 of wages for each employee. Frequency of Tax Filings You may have the option of reporting and paying the Virginia income tax withheld from your employees on an annual basis.

Use this box if you are currently registered with the Virginia Department of Taxation. However Virginia makes it a bit easier for household employers. Household employers have four primary tax responsibilities.