Virginia Unemployment Tax Rate Table

If you're searching for picture and video information linked to the key word you've come to visit the ideal blog. Our site gives you suggestions for viewing the highest quality video and picture content, hunt and locate more informative video articles and images that match your interests.

includes one of thousands of video collections from several sources, particularly Youtube, therefore we recommend this video for you to see. It is also possible to bring about supporting this website by sharing videos and graphics that you enjoy on this blog on your social networking accounts such as Facebook and Instagram or educate your closest friends share your experiences about the simplicity of access to downloads and the information that you get on this website. This blog is for them to stop by this website.

Withholding Formula and Tables for 2019 and After All the tables on pages 1 through 10 have been updated.

Virginia unemployment tax rate table. The Maryland Department of Labor Licensing Regulation announced today that unemployment tax rates for 2021 are to be determined with the states highest unemployment tax rate table. Virginia Income Tax Rate 2020 - 2021. The amounts in the tables are approximate. Virginias maximum marginal income tax rate is the 1st highest in the United States ranking directly below Virginias.

Others may qualify for an experience base rate or receive an assigned base tax rate. Virginias income tax brackets were last changed thirteen years ago for tax year 2007 and the tax rates have not been changed since at least 2001. Ralph Northam announced Tuesday. The tax rates are updated periodically and might increase for businesses in certain industries that have higher rates of turnover.

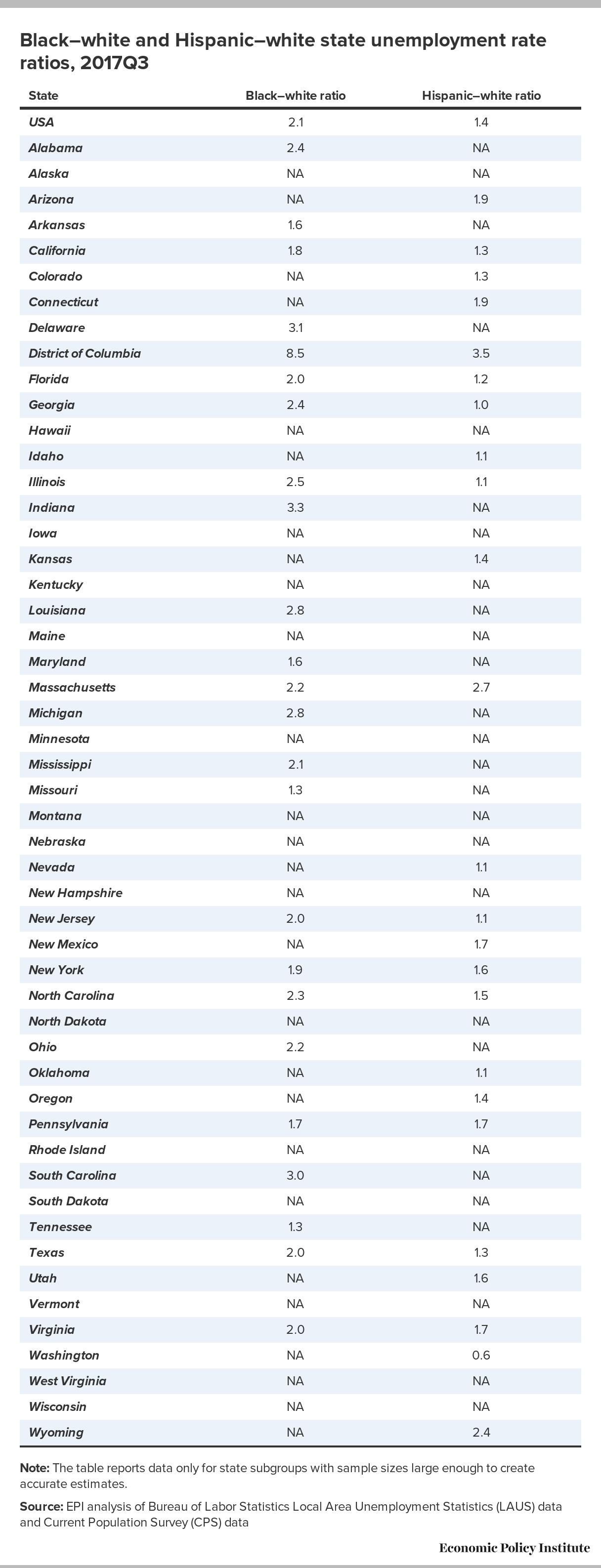

Virginia has State Unemployment Insurance SUI which ranges from 011 to 621. Use the formula below for exact amounts. Each state has its own SUTA tax rates and taxable wage base limit. The Virginia tax rate and tax brackets are unchanged from last year.

Subject to the provisions of 602-533 the experience rating tax rate for each employer for the calendar year 1982 and subsequent years shall be the percent in the column corresponding to the employers benefit ratio except that if the employers benefit ratio exceeds 62 percent the column under 62 percent shall be the appropriate column and. In most cases youll be credited back 54 of this amount for paying your state taxes on time resulting in a net tax of 6. Tax Rate Calculations Unemployment Benefit Charges Strategies for Maximizing Business Opportunities Employer Conference New Employer Tax Rates Assigned the new employer base tax rate plus pool cost charge and fund building charge If acquiring an existing business-assigned the predecessor tax rate unless waived Out-of State Contractors-Assigned the maximum tax rate Experience Rating. Virginia state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VA tax rates of 2 3 5 and 575 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

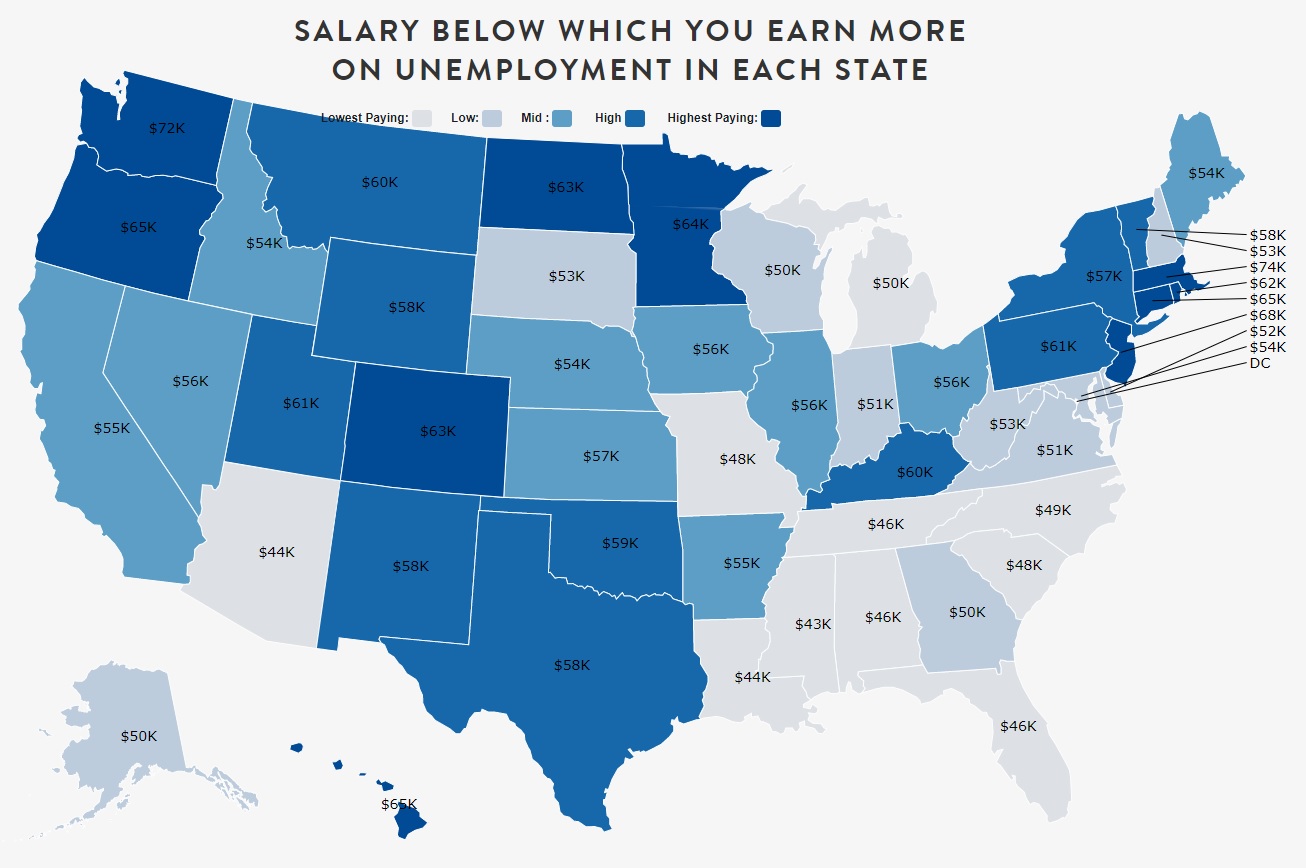

Virginia has four marginal tax brackets ranging from 2 the lowest Virginia tax bracket to 575 the highest Virginia tax bracket. TAX RATE SCHEDULE IF YOUR VIRGINIA TAXABLE INCOME IS. This 6 federal tax is to cover unemployment. Work Opportunity Tax Credit WOTC is a federal tax credit available to all private sector businessesIt was designed as an incentive to employers to hire individuals in certain targeted groups who consistently experience high rates of unemployment due to a variety of employment barriers.

If you change addresses you must give the VEC the new address to receive your 1099G. Virginia collects a state income tax at a maximum marginal tax rate of spread across tax brackets. SUTA tax rates will vary for each state. SUI tax rate by state.

12000 12000 Wisconsin. Businesses that laid off or furloughed employees in the beginning of the pandemic wont see their unemployment insurance tax rate go up for having done so Gov. Here is a list of the non-construction new employer tax rates for each state and Washington DC. If youre a new employer your rate will be between 251 and 621.

New Virginia employers receive the initial base tax rate of 25 plus add-ons until eligible for a calculated rate. If youre a foreign contractor doing business in Virginia your UI rate is 621. 124 to cover Social Security and 29to cover Medicare. However unemployment benefits paid during fiscal 2020 are not to be included in the calculation of an employers tax rate under an executive order 20-12-10-01 signed December 10 2020 by Governor Larry.

Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in. The Virginia Employment Commission will send you and the IRS Form 1099G at the years end detailing the benefits you received plus any federal tax withholdings elected. But not your tax of excess over over is over 3000 5000 60 3 3000 5000 17000 120 5 5000 17000 720 575 17000 TAX TABLE The tax table can be used if your Virginia taxable income. This 153 federal tax is made up of two parts.

Unlike the Federal Income Tax Virginias state income tax does not provide couples filing jointly with expanded income tax brackets. 8000 8000 Virgin Islands. Not over 3000 your tax is 2 of your Virginia taxable income. Each state has a range of SUTA tax rates ranging from 065 to 68.

SUTA Tax Rates and Wage Base Limit. The wage base for SUI is 8000 of each employees taxable income. Rates are assigned by calendar year based on the individual situation of the employer.