Virginia Unemployment Rate Tax

If you're searching for picture and video information linked to the key word you have come to visit the ideal site. Our site gives you suggestions for viewing the highest quality video and picture content, hunt and find more informative video content and graphics that match your interests.

includes one of thousands of movie collections from various sources, especially Youtube, therefore we recommend this video that you see. It is also possible to bring about supporting this site by sharing videos and images that you like on this blog on your social networking accounts like Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information that you get on this website. This blog is for them to stop by this site.

Box 26441 Richmond VA 23261-6441.

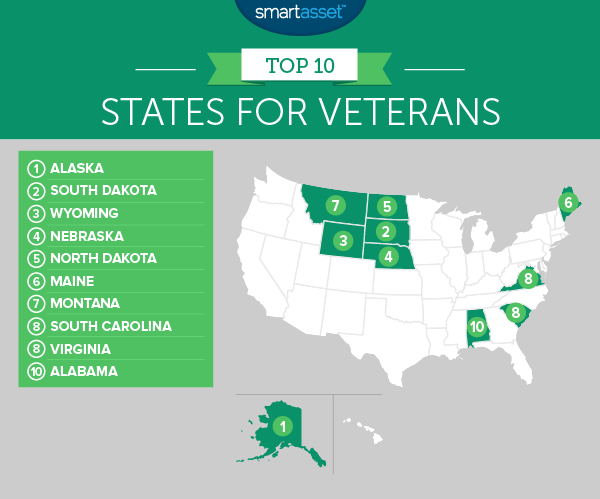

Virginia unemployment rate tax. Data refer to place of residence. The Virginia Employment Commission VEC administers the unemployment compensation program that provides temporary financial assistance to individuals who become unemployed through no fault of their own. You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. When your application is entered in our database we will send you a new employer packet with any tax reports that need to be filed along with additional information about our reporting requirements.

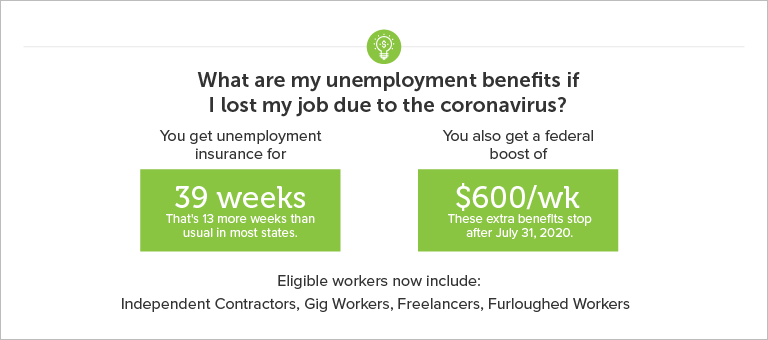

That extra 600 is also taxable. RICHMOND Virginias seasonally adjusted unemployment rate edged slightly upward 01 of a percentage point in December to 49 percent which is 22 percentage points above the rate from a year agoAccording to household survey data in December the labor force increased by 1017 essentially unchanged to 4288955 as the number of unemployed residents increased by 4459. Need to make estimated tax payments. The Unemployment Insurance Employer Tax Rates for 2021 are assigned based on a businesss actions from the previous fiscal year.

According to the release Unemployment Insurance Employer Tax Rates for 2021 are assigned by the previous calendar year from July 1 2019 to June 30 2020. That wont happen Gov. Estimates for the current month are subject to revision the following month. Federal withholdings are 10 percent of your gross benefit payment.

Work Opportunity Tax Credit WOTC is a federal tax credit available to all private sector businessesIt was designed as an incentive to employers to hire individuals in certain targeted groups who consistently experience high rates of unemployment due to a variety of employment barriers. You must indicate that you choose to have federal taxes withheld from your unemployment payment or we will not withhold them. The FPUC program provided an additional 600 per week in unemployment compensation per recipient through July 2020. July 1 2019 to June 30 2020.

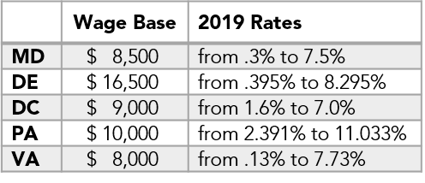

866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. This rate remains the same for 36 consecutive months ending on June 30. Here is a list of the non-construction new employer tax rates for each state and Washington DC. See IRS Publication 505 Tax Withholding and Estimated Tax or see Form 1040-ES.

2019 legislation HB 198 freezes the taxable wage base at 16500 for 2020 under the bill language from July 1 2019 to October 29 2020 so the Division of Unemployment Insurance and the Unemployment Compensation Advisory Council. In recent years it has been comprised of a Base Tax Rate thats been steady at 25 plus so-called add-ons consisting of a Pool Cost Charge and Fund Building Charge. Virginia Employment Commission Employer Accounts PO. Most new employers begin with a rate of 27.

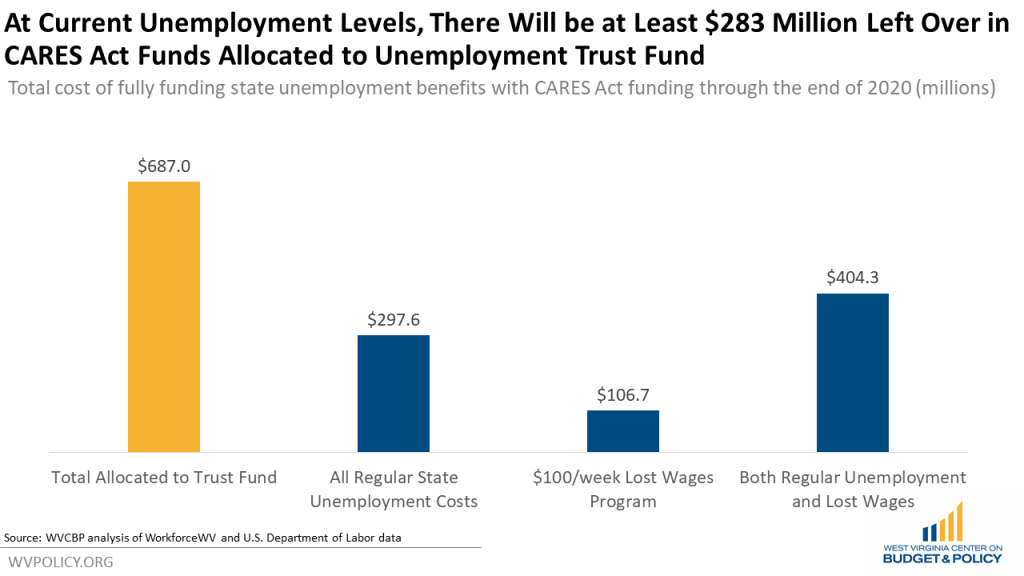

Information concerning employer contribution rates can be obtained by calling the Contribution Receipts Unit of our Unemployment Compensation Division at 304-558-2676 or 304-558-2233. In recalculating the tax rate for 2021 Executive Order Seventy-Four requires that the VEC not penalize businesses for lay-offs that occurred during the pandemic from April through June 2020. Virginias unemployment trust fund is all but depleted and the state could have turned to businesses to replenish it with a tax rate spike in 2021. Rates shown are a percentage of the labor force.

According to household survey data in November the labor force expanded for the seventeenth consecutive month by 13326 or 03 percent to set a new record high of 4441018 as the number of unemployed decreased by 521. New Virginia employers receive the initial base tax rate of 25 plus add-ons until eligible for a calculated rate. Both of the latter charges which fluctuate each year are much less than 1. The Virginia unemployment rate rose to 49 percent in December while total nonfarm payroll employment increased by 800 November 2020 Local Unemployment Rates Virginias Seasonally Adjusted Unemployment Rate Decreased to 49 Percent in November.

Benefits are paid through taxes on employers covered under the Virginia Unemployment Compensation Act. Ralph Northam announced. RICHMOND Virginias seasonally adjusted unemployment rate held steady in November at 26 percent which is 02 percentage point below the rate from a year ago. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001.

Box 26441 Richmond VA 23261-6441. Note that some states require employees to contribute state unemployment tax. 2013 legislation HB 168 increased the SUI taxable wage base to a minimum of 10500 and a maximum of 18500 by tying the wage limit to the balance of the states unemployment trust fund the higher the trust fund balance the lower the taxable wage base. Others may qualify for an experience base rate or receive an assigned base tax rate.

Virginia Relay call 711 or 800-828-1120. SUI tax rate by state.