Virginia Unemployment Compensation Law

If you're searching for picture and video information linked to the key word you've come to pay a visit to the right blog. Our site gives you suggestions for viewing the highest quality video and picture content, hunt and find more enlightening video articles and images that fit your interests.

includes one of thousands of video collections from various sources, especially Youtube, so we recommend this movie for you to view. You can also contribute to supporting this website by sharing videos and images that you like on this blog on your social networking accounts such as Facebook and Instagram or educate your closest friends share your experiences about the ease of access to downloads and the information you get on this site. This blog is for them to stop by this website.

For anemploying unit to incur liability under the West Virginia Unemployment Compensation Law employees must perform their work in West Virginia or outside the United States if the employers base of operations is in West Virginia.

Virginia unemployment compensation law. -- An Administrative Law Judge or a panel of Administrative Law Judges or the Board of Review in unemployment compensation claims or labor dispute cases. If the VEC denies your claim for benefits on these grounds you have the right to appeal this decision. He has in the highest two quarters of earnings within his base period been paid wages in employment for employers that are equal to not less than the lowest amount appearing in Column A of the Benefit Table appearing in 602-602 on the line which extends through Division C and on which in Column B of the Benefit Table appears his weekly. 602-100 et seq and are therefore subject to the state unemployment insurance tax including for example those that.

The chapters of the acts of assembly referenced in the historical citation at the end of this section may not constitute a comprehensive list of such chapters and may exclude chapters whose provisions have expired. Elimination of pension reduction based on fund solvency as follows. Contact a knowledgeable Virginia Unemployment Benefits Lawyer and get help. Virginia Relay call 711 or 800-828-1120.

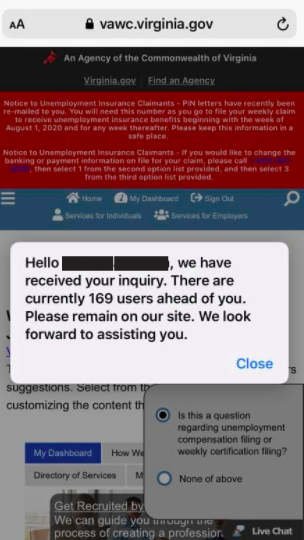

Virginia Beach Unemployment Compensation Attorneys The Virginia Employment Commission VEC will deny unemployment benefits if it has reason to believe that you were fired for misconduct or if you quit your job without good cause. AP Virginia has begun paying unemployment benefits to some of the tens of thousands of people whose claims had previously been on hold - in some cases for many months - because they were awaiting a staff review. By SARAH RANKIN December 11 2020. Individuals who receive unemployment benefits may also be.

The purpose of this chapter is to provide reasonable and effective means for the promotion of social and economic security by reducing as far as practicable the hazards of unemployment. The offset requirement is codified at 602-604 captioned Reduction of benefit amount. State officials decided to go ahead and pay certain applicants while their claims make their way through the determination process. Cant find what youre looking for.

Find out how much you should be paying to attract and retain the best applicants and employees with customized information for your industry location and job. You may file a claim for unemployment insurance UI benefits with the Virginia Employment Commission VEC. Virtually all employers are covered by the Virginia Unemployment Compensation Act VA Code Sec. Receive council from accomplished Unemployment Benefits Lawyers and gain knowledge and information before making crucial decisions.

By amount of pension. Wages shall be deemed payable to an individual with respect to any week for which wages are due. Our extensive listing of lawyers can assist you in any part of Virginia and help advise you on how to deal with all of your legal issues. This title shall be known and may be cited as the Virginia Unemployment Compensation Act Code 1950 60-1.

Not open for further replies. Contact us if something is missing that shouldnt be or you need additional assistance. VA workers compensation laws. Virginia Unemployment Compensation Law Discussion in Employment Labor Work Issues started by JLS09 Jan 24 2010.

The maximum benefit amount is 378 for up to 26 weeks. The Virginia Employment Commission VEC administers the unemployment compensation program that provides temporary financial assistance to individuals who become unemployed through no fault of their own. For a Limited Time receive a FREE Compensation Market Analysis Report. Not open for further replies.

Virginia Workers Compensation Law states that the employer must file an agreement for compensation in accepted claims 4. JLS09 Law Topic Starter New Member. Code 21A-1-1 et seq as amended. Box 26441 Richmond VA 23261-6441.

Benefits are paid through taxes on employers covered under the Virginia Unemployment Compensation Act. If VEC approves your claim you will receive a weekly benefit payment that is dependent on your past earnings. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. An unemployed individual shall be eligible to receive benefits for any week only if the Commission finds that.

Jan 24 2010 1. Virginia Unemployment Compensation Law Discussion in Employment Labor Work Issues started by JLS09 Jan 24 2010. Employers who neglect or refuse to attain Workers Compensation Insurance Virginia can be assessed a civil penalty of up to 5000. Virginias Benefits Offset Statute.

Virginia workers compensation and unemployment services.