Virginia Military Retirement Tax Calculator

If you're searching for picture and video information linked to the keyword you've come to visit the ideal blog. Our site gives you hints for viewing the highest quality video and image content, search and locate more informative video articles and images that match your interests.

includes one of thousands of video collections from various sources, particularly Youtube, therefore we recommend this movie that you view. It is also possible to contribute to supporting this site by sharing videos and images that you like on this site on your social networking accounts such as Facebook and Instagram or tell your closest friends share your experiences concerning the simplicity of access to downloads and the information you get on this website. This blog is for them to visit this website.

20000 for those ages 55 to 64.

Virginia military retirement tax calculator. If your total military income is more than 30000 you do not qualify for the deduction. For every 100 of income over 15000 the maximum subtraction is reduced by 100. Fixed Date Conformity in Virginia. Up to 3500 is exempt Colorado.

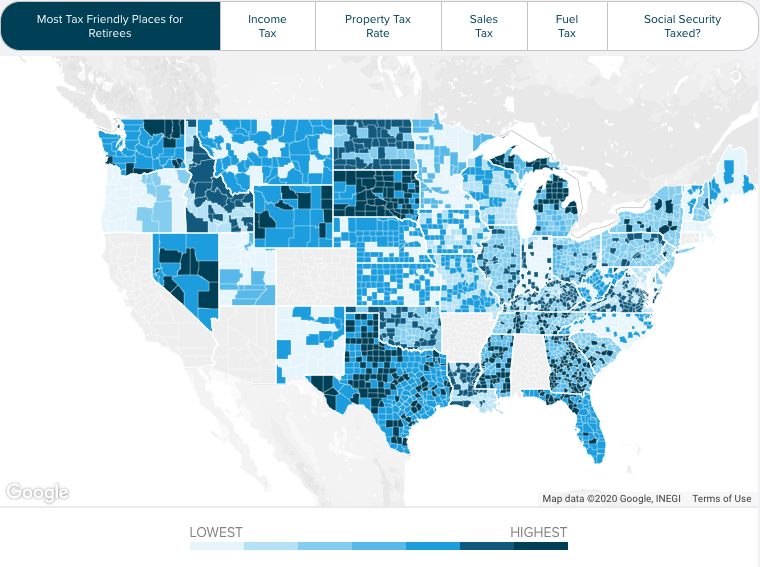

Military personnel stationed inside or outside Virginia or National Guard service members may be eligible to subtract up to 15000 of military basic pay received during the taxable year. Other types of retirement income such as pension income and retirement account withdrawals are deductible up to 12000 for seniors. Tools Tips Calculators. As described below Virginias sales taxes and property taxes are also quite low.

And 7500 for military retirees under age 55 increasing to 10000 in 2021 and 15000 in 2022 and 2023. Youll notice we havent hit upon state taxes yet. In addition to that 53 rate localities in the Northern Virginia Central Virginia and Hampton Roads regions collect a 07 sales tax bringing the total in these areas to 6. Up to 2000 of retirement income is exempt for taxpayers under age 60.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Arizona Military retirement pay may be excluded from state taxation up to 3500. To calculate estimating retirement pay. Your retirement benefit is subject to federal income taxes as well as state income taxes if you live in a state that taxes income.

Free Help with your Taxes. To use our Virginia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Social Security retirement benefits are not taxed in Virginia. Based on changes in Virginia Law this calculator will provide the best estimate if you were off active duty prior to 2018.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. If you live outside Virginia contact your states taxation agency for information on state income taxes. You should consider your situation. What Form Should I File.

For every 1 over 15000 the deduction is reduced by 1. Our Virginia Military Retirement Divorce Calculator assumes that your military time was served while on active duty and not reserve duty. Military retirement pay is partially taxed in. Military retirement pay is subject to tax as income.

The Member Calculator does not use information from your VRS record. This is because many states tax military retirement pay differently. Virginia also has relatively low retirement taxes. There are 23 states that either dont have an income tax or dont tax military retirement pay and over 20 that offer special considerations on pensions or military retirement income.

For example if an individual is an E-6 with 20 years of military service and a basic pay of 324330 per month the equation would run. Military retirement income received by those awarded the Medal of Honor can be subtracted from federal gross income for tax purposes. Death Gratuity New Retired Benefits Program. Up to 24000 of military retirement pay is exempt for retirees age 65 and older.

By contrast cities in Halifax County collect a 1. 324330 20 Years 64866 64866 25 162165. Military retirees ages 55 - 64 can exclude up to 20000 in any one tax year from their retirement pay those 65 and over can exclude up to. Basic Pay Number of Years Active-Duty 25.

With the Member Benefit Estimator you enter information to estimate your retirement benefit for the defined benefit component of your plan including average final compensation age months of service date you expect to retire and a benefit payout option. If you are a resident of Virginia you may be able to subtract up to 15000 of military pay. You can also add a copy of the Virginia Tax Reform Calculator to your won website to allow your users to use the tool whilst browsing your. BRS Comparison Calculator BRS Calculator High-3 Calculator Final-Pay Calculator REDUX Calculator RMC Calculator SCAADL Calculator Benefits.

The first 3500 of military retirement pay is exempt. Colorado Depending on age up to 24000 of military retirement pay may be exempt from state taxes. The exception is if you retired under the guaranteed benefit formula for work-related disability. The base statewide sales tax rate of 43 in Virginia is combined with a statewide local rate of 1 meaning the effective floor for sales taxes in Virginia is 53.

Virginia Taxes on Retired Military Pay. Delaware Taxpayers up to the age of 60 may exclude up to 2000 of military retirement pay military retirees aged 60 or older exclude up to 12500. You must be on extended active duty for more than 30 days. The Virginia tax Reform Calculator is updated as the tax laws change so you can check back as Virginia tax reforms solidify make a quick tax calculation and emailprint it for your reference or discussion on Virginia tax blogs Virginia tax websites etc.

Members may be eligible for these retirement payments or a smaller averaged amount categorized as High. Virginia Veteran Housing Benefits Income Tax Deduction. Learn more about Virginia Taxes on Retired Military Pay Virginia Income Tax Exemption on Retired Military Pay received by Medal of Honor Recipients. With the Member Calculator you enter information to estimate your retirement benefit including average final compensation age months of service date you expect to retire and a benefit payout option.

Reserve duty is calculated differently. Military personnel stationed inside or outside Virginia may be eligible to subtract up to 15000 of military basic pay received during the taxable year provided they are on extended active duty for more than 90 days. Basic Pay Special and Incentive Pays Allowances Tax Information Recoupment Retirement Calculators.