Virginia Education Tax Credit Program

If you're searching for video and picture information related to the keyword you've come to visit the ideal site. Our website gives you hints for viewing the highest quality video and image content, search and locate more enlightening video articles and images that fit your interests.

comprises one of tens of thousands of video collections from several sources, especially Youtube, so we recommend this video that you see. It is also possible to bring about supporting this site by sharing videos and graphics that you enjoy on this site on your social media accounts like Facebook and Instagram or educate your closest friends share your experiences concerning the ease of access to downloads and the information that you get on this site. This site is for them to visit this site.

This program provides state tax credits for persons or businesses making monetary or marketable securities donations that provide scholarships to eligible students for qualified educational expenses incurred in attending eligible non-public schools.

Virginia education tax credit program. The Virginia Education Improvement Scholarship Tax Credit program can offer support for thousands of low and middle- income families in Virginia. The Diocese of Arlington Scholarship Foundation DASF is part of the Virginia Education Improvement Scholarship Tax Credit Program which provides scholarships to low income new students to a Diocese of Arlington Catholic School. Virginia Education Improvement Scholarships Tax Credits Program. Virginia enacted the Education Improvement Scholarships Tax Credits Program in 2012 and launched the program in 2013.

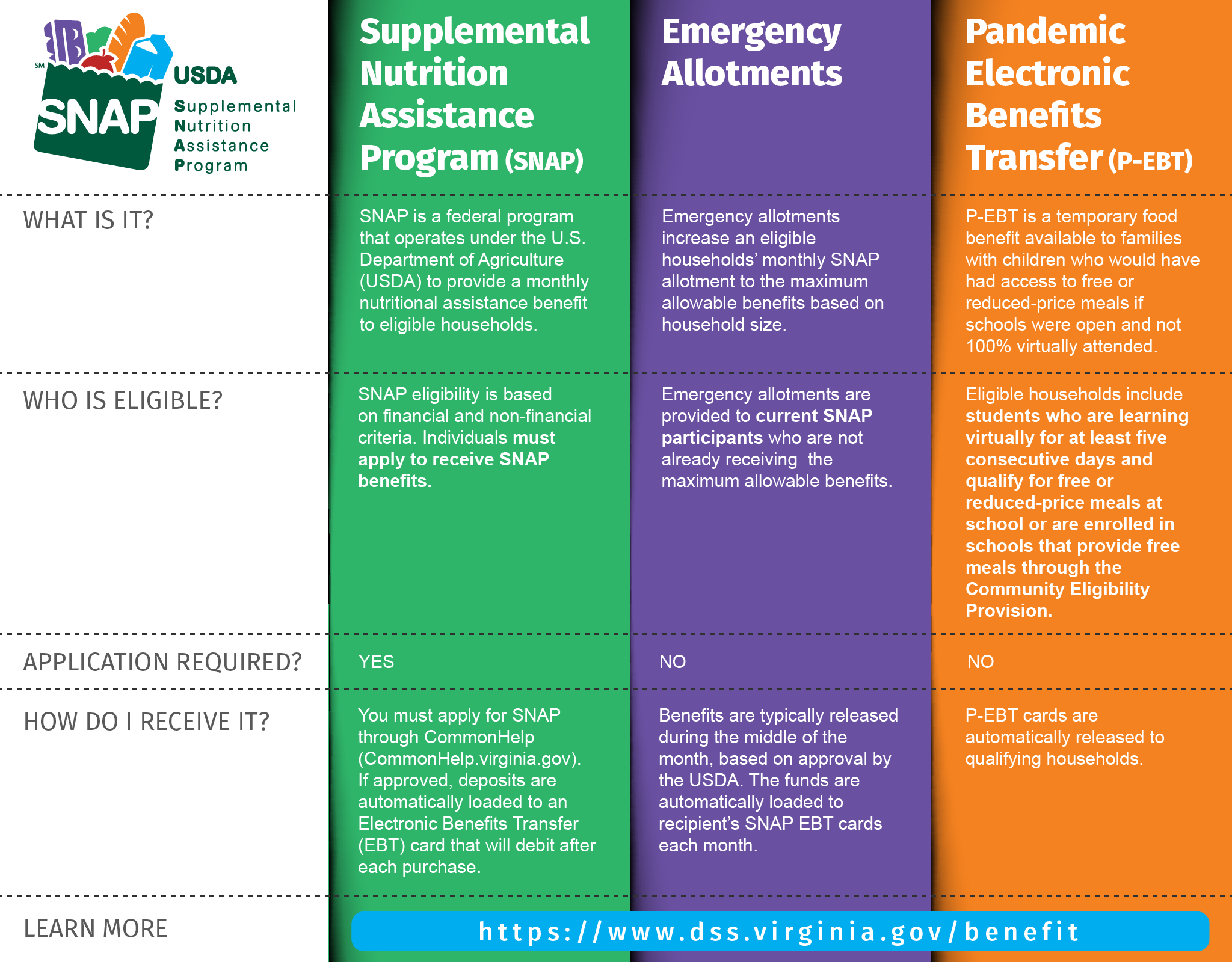

2363 students received scholarships to attend one of the 29 accredited Catholic. The Virginia Department of Education VDOE is seeking a qualified and experienced individual to administer two education tax credit programs the Neighborhood Assistance Program and the Education. In the Diocese of Richmond five years into Virginias historic Education Improvement Scholarships Tax Credits program EISTC donors provided over 11000000 in new scholarships for qualified students to attend Catholic K-12 schools and received most of their money back in federal and Virginia tax savings. The Virginia Neighborhood Assistance Act provides tax credits to individuals and businesses that make qualified donations directly to pre-approved Neighborhood Assistance Program organizations whose primary function is to provide educational or other qualified services for the benefit of low-income families.

In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. Also obtain the Virginia Department of Education Preauthorization Form from MPSF or the Catholic school of your choice. Send the completed Preauthorization and Letter of Intent to MPSF who will submit your Preauthorization Form by secure electronic dropbox to the VA DOE for approval of your Tax Credits. Virginia enacted the Education Improvement Scholarships Tax Credits Program in 2012 and launched the program in 2013.

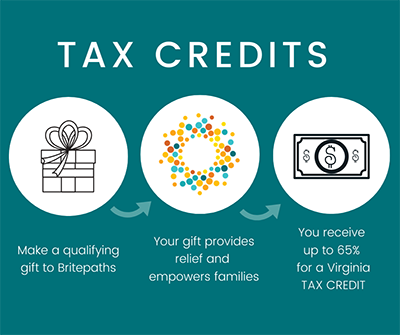

The Neighborhood Assistance Act Tax Credit Program for Education administered by Virginia Department of Education the Department allows individuals or businesses to receive state tax credits - up to and including 65 percent of the qualified donation for eligible donations made to approved neighborhood organizations. The paper request will be processed manually and the Preauthorization Notice will be mailed directly to the donor via US. Once you have the credit amount if this is the only credit youre claiming on your income tax return enter the amount on the Credits line line 25 on the 2019 Virginia Form 760 and write Trust Beneficiary Accumulation Distribution Credit to the left of the box. Donors receive 65 of their approved donation in Virginia tax credits.

Virginia Education Improvement Scholarships Tax Credits Program. The foundations then provide private school scholarships to students whose families meet the income requirements. This program offers a 65 percent tax credit to individuals and businesses to donate to qualified scholarship foundations. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page.

The Education Improvement Scholarships Tax Credits Program provides state tax credits for persons or businesses making monetary or marketable securities donations to foundations that provide scholarships to eligible students and children attending eligible private schools and eligible nonpublic pre-kindergarten programs. This program provides Virginia state tax credits for resident persons or businesses making monetary or marketable securities donations to approved scholarship foundations that provide scholarships to eligible students for qualified educational expenses incurred in attending eligible nonpublic schools. Obtain a blank Letter of Intent from the McMahon Parater Scholarship Foundation MPSF or the Catholic school of your choice. The foundations then provide private school scholarships to students whose families meet the income requirements.

Now if they take advantage of The Education Improvement Scholarship Tax Credits they will also receive a state tax credit of 65 of their donation or 6500. The Donor mails the completed Request for Preauthorization for Tax Credits form to Department of Education Tax Credit Programs 23rd Floor PO Box 2120 Richmond VA 23218-2120. This reduces their state tax bill. School Finance Neighborhood Assistance Act.

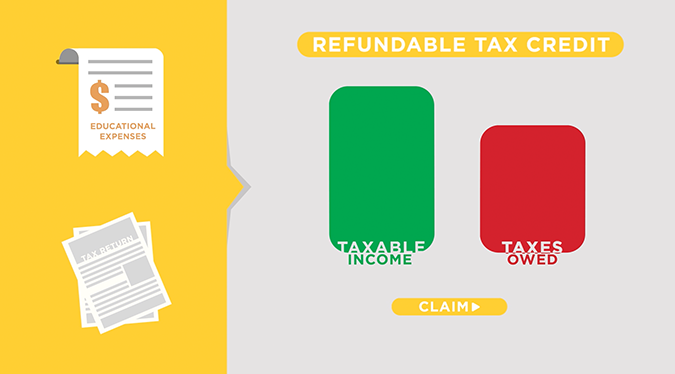

Donors who itemize also receive a Virginia tax deduction and a partial federal tax deduction. C Allowable Virginia tax credit to be claimed by the beneficiary. Scholarship tax credit programs of the United States of America also called tax credit scholarship education tax credit or tuition tax credit programs are a form of school choice that allows individuals or corporations to receive a tax credit from state taxes against donations made to non-profit organizations that grant private school scholarships. Virginia Education Improvement Scholarships Tax Credits Program.

The program offers opportunity for Virginia families to send their children to a school of their choice using private scholarships from scholarship foundations.