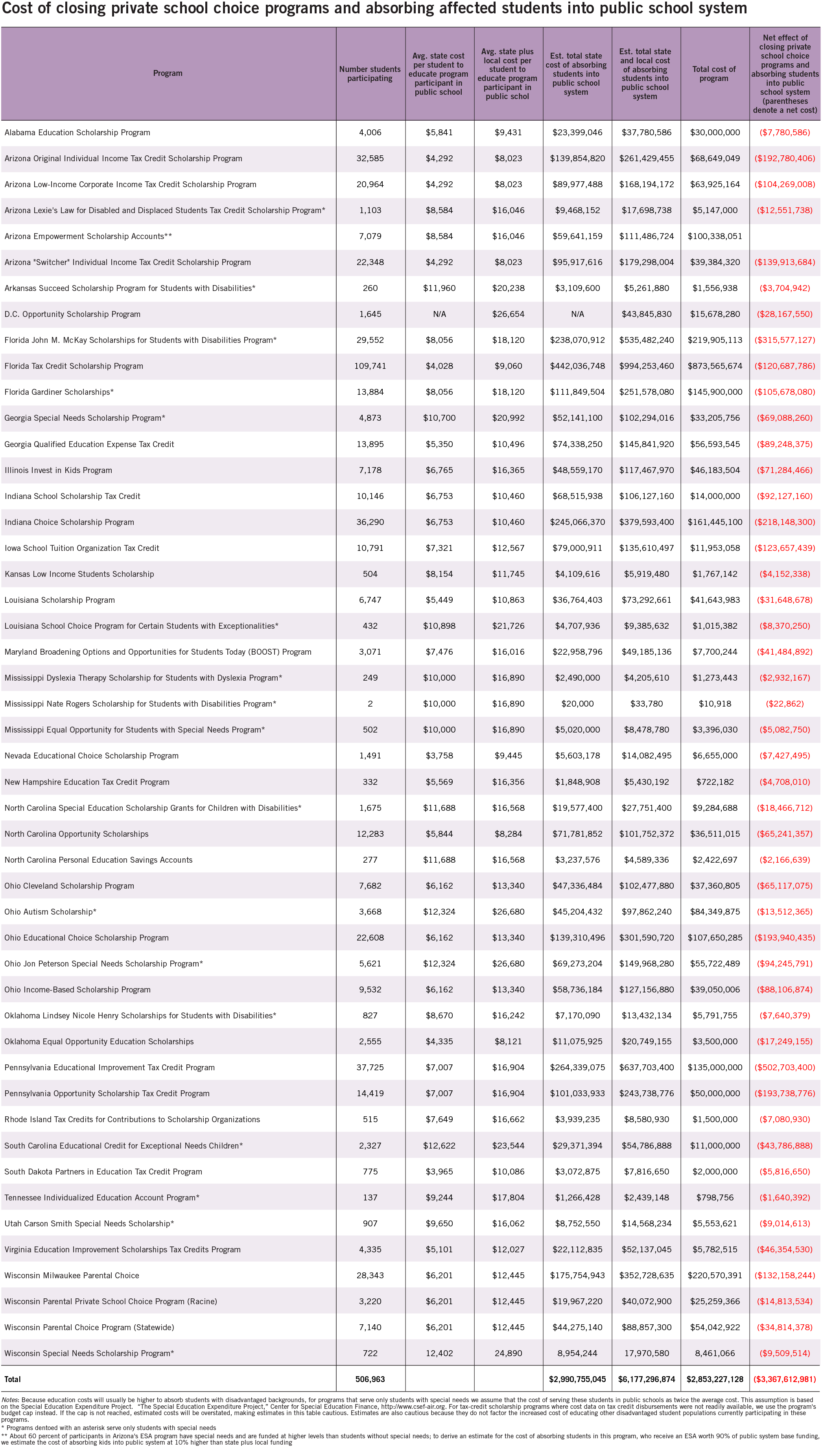

Virginia Education Improvement Scholarship Tax Credit Program

If you're looking for video and picture information related to the key word you have come to visit the ideal site. Our site provides you with suggestions for viewing the maximum quality video and image content, hunt and locate more enlightening video content and graphics that match your interests.

comprises one of tens of thousands of movie collections from various sources, particularly Youtube, therefore we recommend this video that you see. This site is for them to stop by this site.

Virginia Education Improvement Scholarships Tax Credits According to Virginias new Education Improvement Scholarships Tax Credits program donations to approved foundations will provide scholarships for low-income new students at non-public schools.

Virginia education improvement scholarship tax credit program. RVSF engages individuals and businesses in Virginia in community transformation through the Education Improvement Scholarships Tax Credits Program. Virginia enacted the Education Improvement Scholarships Tax Credits Program in 2012 and launched the program in 2013. 2017-2018 2018-2019. Donors to EISTC program-approved foundations can receive a 65 state tax credit for their donation in addition to federal or state tax deductions for their charitable gift.

The Education Improvement Scholarships Tax Credits Program provides state tax credits for persons or businesses making monetary or marketable securities donations to foundations that provide scholarships to eligible students and children attending eligible private schools and eligible nonpublic pre-kindergarten programs. Now if they take advantage of The Education Improvement Scholarship Tax Credits they will also receive a state tax credit of 65 of their donation or 6500. Eligible taxpayers can include both individuals and businesses. Education Improvement Scholarships Tax Credits Program.

The foundation enables donors to receive qualified tax credits while providing eligible children in Virginia the opportunity to receive Christian worldview education. In order for a donor to qualify for tax credits authorized by Section 581- 43925 et seq Code of Virginia. Scholarship Tax Credits Program Donations to Richmond Jewish Foundations Education Tax Credit Scholarship Fund will provide scholarships for low-income new students at non-public schools. Tax-credit scholarships allow taxpayers to receive full or partial tax credits when they donate to nonprofits that provide private school scholarships.

This program offers a 65 percent tax credit to individuals and businesses to donate to qualified scholarship foundations. This program provides state tax credits for persons or businesses making monetary or marketable securities donations that provide scholarships to eligible students for qualified educational expenses incurred in attending eligible non. Pursuant to Section 581-43928 D. Also obtain the Virginia Department of Education Preauthorization Form from MPSF or the Catholic school of your choice.

Individual or business donors then receive a 65 Tax Credit. Virginia enacted the Education Improvement Scholarships Tax Credits Program in 2012 and launched the program in 2013. The program offers opportunity for Virginia families to send their children to a school of their choice using private scholarships from scholarship foundations. This reduces their state tax bill.

Virginia Education Improvement Scholarships Tax Credits Program Obtain a blank Letter of Intent from the McMahon Parater Scholarship Foundation MPSF or the Catholic school of your choice. REQUEST FOR PREAUTHORIZATION FOR TAX CREDITS Keep a copy of this form for your records Tax credits can only be issued up to the amount preauthorized. In 2014-2015 the Virginia Education Improvement Scholarship Tax Credit served 1368 students by providing scholarships worth a little more than half of the average state per pupil funding. The Virginia Education Improvement Scholarship Tax Credit program can offer support for thousands of low and middle- income families in Virginia.

The Donor mails the completed Request for Preauthorization for Tax Credits form to Department of Education Tax Credit Programs 23rd Floor PO Box 2120 Richmond VA 23218-2120. VDOE must have issued a preauthorization Approval Letter to the donor on. Education Improvement Scholarships Tax Credits Program. Therefore the first possible school year that any students could have been tested for at least three years was the 2014-2015 school year.

The minimum donation amount is 500. We are pleased to share that the Educational Foundation is an approved scholarship foundation in the new Education Improvement Scholarships Tax Credits Program. Virginia Department of Education VDOE Education Improvement Scholarships Tax Credits Program REQUEST FOR PREAUTHORIZATION FOR TAX CREDITS Keep a copy of this form for your records Tax credits can only be issued up to the amount preauthorized. The paper request will be processed manually and the Preauthorization Notice will be mailed directly to the donor via US.

Code of Virginia eligible schools must annually provide to the Department of Education for each student any achievement test results and student information that would allow the Department to aggregate the. Student Achievement Test Results. The Education Improvement Scholarships Tax Credits Program became effective on January 1 2013 the middle of the 2012-2013 school year.