Virginia 100 Percent Disability Benefits

If you're looking for video and picture information linked to the key word you have come to visit the right blog. Our website provides you with suggestions for viewing the highest quality video and picture content, search and find more enlightening video articles and images that fit your interests.

comprises one of thousands of movie collections from various sources, especially Youtube, therefore we recommend this movie that you view. This site is for them to visit this website.

The Virginia Military Survivors and Dependents Education Program VMSDEP provides education benefits to spouses and children of military service members killed missing in action taken prisoner or who have been rated by the United States Department of Veterans Affairs as totally and permanently disabled or at least 90 percent permanently disabled as a result of military service.

Virginia 100 percent disability benefits. Department of Veterans Affairs Military Disability Retired Pay. The exemption is based on the veterans disability rating rather than the level of compensation. To make VA disability claims under SMC veterans must submit VA Form 21-2680. A 100 percent disability rating places you in Health Care Priority Group 1.

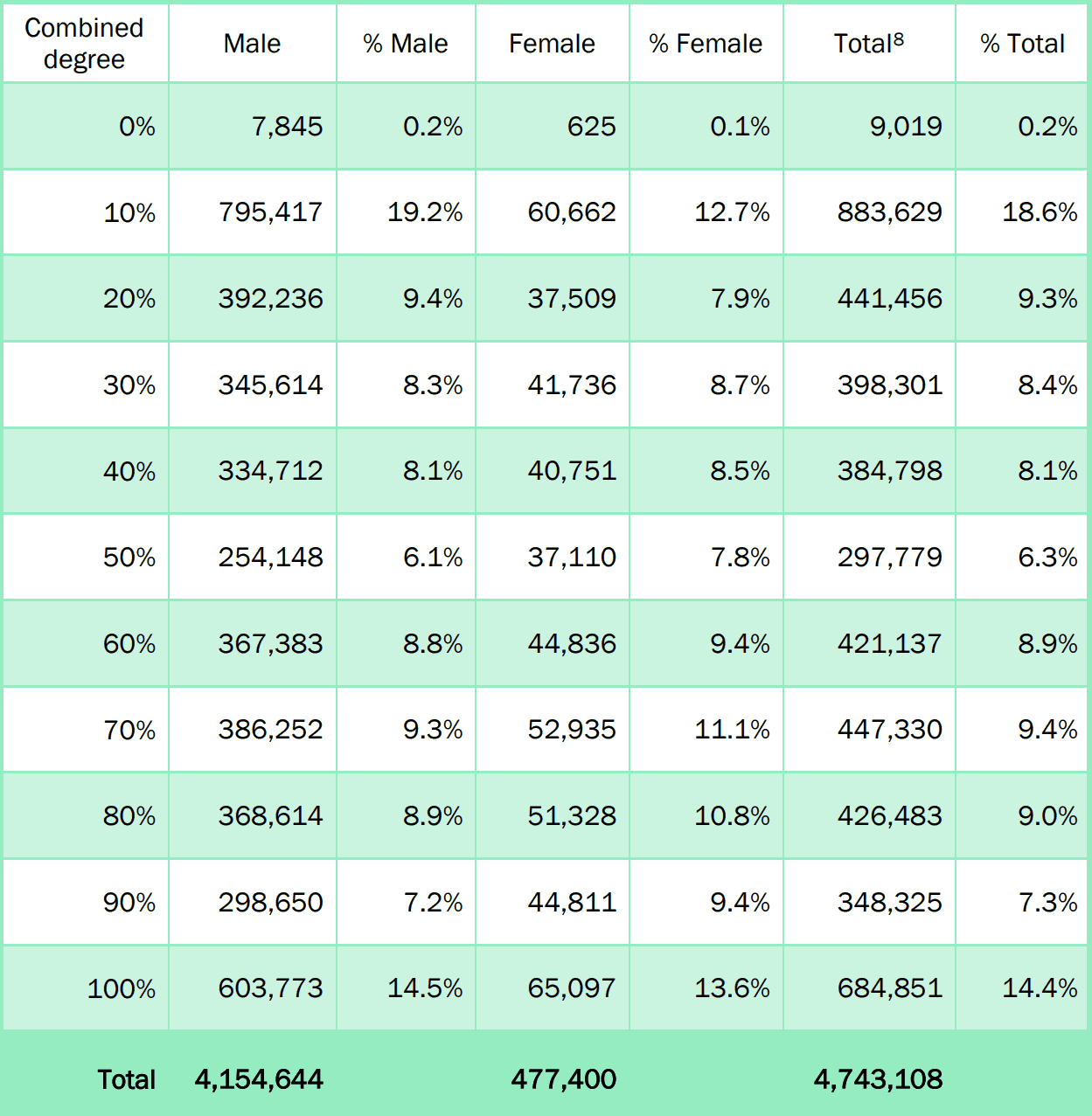

Your rating can range from 0 to 100 percent in 10 percent increments. VA disability benefits include military-related disability pay Dependency and Indemnity Compensation DIC and Special Monthly Compensation SMC. Department of Veterans Affairs is responsible for determining a veterans disability rating. Veterans rated by the VA as having a 100 permanent and total service-connected disability or who have a service-connected individual unemployable disability rating are exempt from paying real estate taxes on their primary residence.

There is also a textbook stipend. Good at any Virginia state school this benefit can be used concurrently with the GI Bill and when receiving this tuition assistance Guard members are charged at the in-state tuition rate. Question 2 amended the Virginia Constitution to provide veterans who have 100 percent service-connected permanent and total disabilities with a tax exemption for one automobile or pickup truck. Property tax exemptionA veteran with a 100 percent VA rated service-connected disability are exempt from paying tax on their principal residence and up to one acre of landThe exemption may be.

Veterans with 100 disability are provided a housing allowance which can be used for rent or the payment of a mortgage. Information on current federal state and local veterans programs entitlements and referral services is available in Virginia through a network of 34 benefit service offices. The Virginia Department of Veterans Services advocates for Virginia veterans and connects them to earned benefits and services they have earned. There are many benefits available if you have received a 100 percent rating.

West Virginia 100 Disabled Veteran Benefits. To apply for disabled veterans benefits claimants must submit VA Form 21-526EZ or 21-534EZ to apply for DIC. Virginia State Taxes on US. The eligibility for outpatient dental care is somewhat different from the eligibility requirements for most other VA medical benefits.

Veterans with 100 VA disability are eligible for free admission and parking and admission for the pass holder and anyone needed to assist them at Virginia state parks. There are several different types of 100 percent VA disability ratings according to Department of Veterans Affairs Code 3340. The pass also covers boat. In addition to monthly monetary benefits you may be able to get.

The Virginia National Guard State Tuition Assistance Program is available to Virginia National Guard members and funds 100 of tuition expenses after all Federal Tuition Assistance benefits have been used. If the veteran does not own a home the federal government will provide to the veteran with a grant that pays up to 50 percent of the homes value not exceeding 46000.