Veteranreservist Owned Small Business Fee Exemption

If you're searching for video and picture information related to the key word you have come to visit the right site. Our website provides you with hints for seeing the maximum quality video and picture content, hunt and locate more informative video content and images that match your interests.

comprises one of tens of thousands of video collections from several sources, particularly Youtube, therefore we recommend this video for you to view. This site is for them to visit this site.

On top of that veterans who file for their business any time before 2020 will enjoy five years of waiver from Texas franchise taxes.

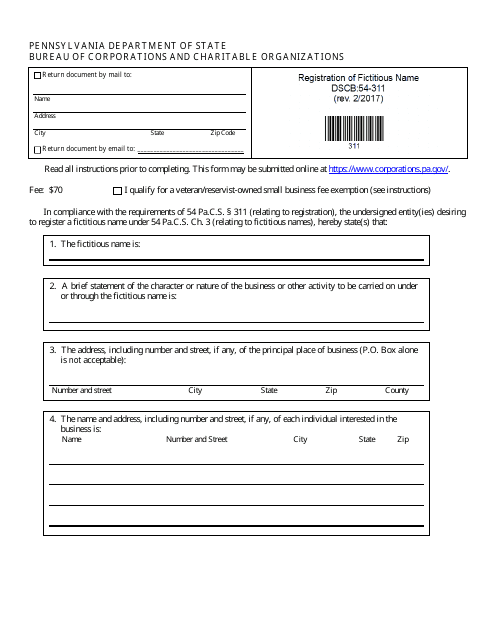

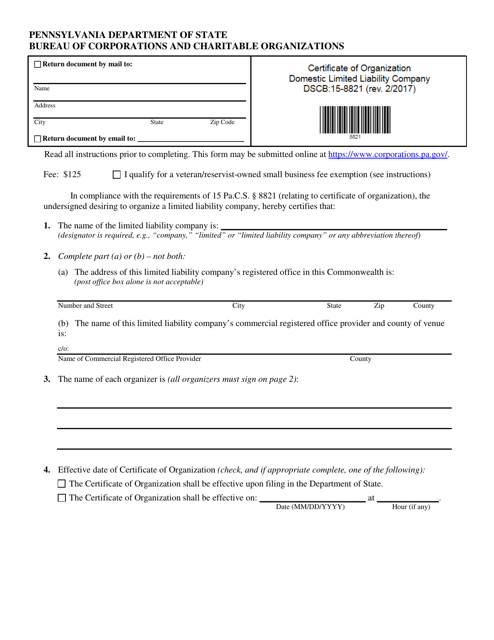

Veteranreservist owned small business fee exemption. A business fee is any fee required to be paid to the Commonwealth or a political subdivision for starting or opening a business within Pennsylvania. The term does not include a fee for. Harrisburg PA Governor Tom Wolf and Secretary of State Pedro A. These exemptions are effective until the fifth anniversary of the businesss formation.

Fraudulently obtain the VeteranReservist filing fee exemption. Section 9611 - Exemption a Payment--A veteran-owned or reservist-owned small business shall be exempt from the payment of a business fee. Texas filing fees start at 300 for corporations and limited liability companies and go up to 750 for limited partnerships. Costs for client meetings add up quickly.

However the money a veteran can save just on filing fees alone is quite significant. Assign transfer or attempt to assign or transfer a business filing fee exemption. Filers requesting a veteranreservist-owned small business fee exemption should attach proof of the veterans or reservists status to the Articles of Incorporation form when submitted. For veteran-owned and reservist-owned small businesses Act 135 of 2016 51 PaCS.

The provision has expired. Running a business incurs a lot of expenses. A new veteran-owned business that first qualified before Jan. Eliminating these fees for our military veterans and reservists is another way to foster the best possible business climate in Pennsylvania Governor Wolf said.

Business License Tax and Fee Waiver. A business fee is any fee required to be paid to the Commonwealth or a political subdivision for. Updated annually provides guidance for complying with the user fee program of the Internal Revenue Service as it pertains to requests for letter rulings determination letters Voluntary Correction Program VCP compliance statements etc on matters under the jurisdiction of the Commissioner Tax Exempt and. The exemptions from certain filing fees and the Texas franchise tax permitted by SB 1049 apply only to a veteran-owned business formed in Texas between January 1 2016 and January 1 2020.

1 A copy of a Federal DD-214 form. But youre in luck parking fees tolls and mileage on cars for business use can be deducted from your taxes. The 125 articles of incorporation fee is waived for veterans. Under Act 135 of 2016 veterans and reservists starting a small business in the Commonwealth are exempt from the payment of a business fee effective January 2 2017.

Do you drive a lot for work. An entity formed on or after Jan. CDRHs Small Business Program determines whether a business is qualified and certified as a small business and eligible for a reduced fee for some types of CDRH submissions that require a user fee. Use or attempt to use a business filing fee exemption in any manner contrary to this Act.

1 2020 continues to qualify. Thankfully there are lots of deductions you can take. Revenue Procedure 2020-4 2020-1 IRB and Revenue Procedure 2020-5 2020-1 IRB. 9610-9611 Veterans and reservists starting a small business in the Commonwealth are exempt from the payment of a business fee effective January 2 2017.

B Proof--A veteran or reservist must provide the department or licensing authority of a political subdivision with proof of the veterans or reservists status using any of the following with any business application. Or the date the taxable entity ceases to qualify as a new veteran-owned business. A qualifying new veteran-owned business is not subject to franchise tax for its initial five-year period but must file Form 05-163 Texas Franchise Tax No Tax Due Report PDF for each of those years. Cortes today advised military veterans and reservists they are now exempt from certain fees for business start-ups and professional licensure.

The Business License Tax and Fee Waiver benefit waives municipal county and state business license fees taxes and fees for veterans who hawk peddle or vend any goods wares or merchandise owned by the veteran except spirituous malt vinous or other intoxicating liquor including sales from a fixed location.