Veteran Dependent In State Tuition

If you're searching for video and picture information related to the key word you've come to visit the right site. Our website gives you suggestions for seeing the maximum quality video and picture content, search and find more informative video articles and images that match your interests.

includes one of tens of thousands of movie collections from several sources, particularly Youtube, so we recommend this video for you to see. This blog is for them to stop by this site.

This assistance provides admission to any eligible university and college in the State of Florida.

Veteran dependent in state tuition. On Veterans Day the White House announced that all 50 states. However not all states offer the same support each of them offering a variety of state-funded benefits and programs. Public IHLs must offer in-state tuition and fees to all covered individuals with Post-911 GI Bill and Montgomery GI Bill - Active Duty MGIB - AD benefits in order for programs to remain approved for GI Bill benefits for terms that began after July 1 2017. Because of the Higher Education Opportunity Act of 2008 states need to offer in-state tuition to military family members who live in the state due to their active duty military service.

In state tuition for military service members dependents and veterans State law provides exceptions for active-duty military personnel their dependents and veterans when it comes to being considered as domiciled in Virginia. There were some changes in 2018 so those that were currently enrolled would be entitled to full payment as well as the use of 10 semesters of education as long as their entitlements have been used by August 31 2020. According to CollegeBoard the average tuition and fees for public four-year institutions rose from 10210 in 2018 to 10440 in 2019. The dependent child must be between the ages of 18 to 22.

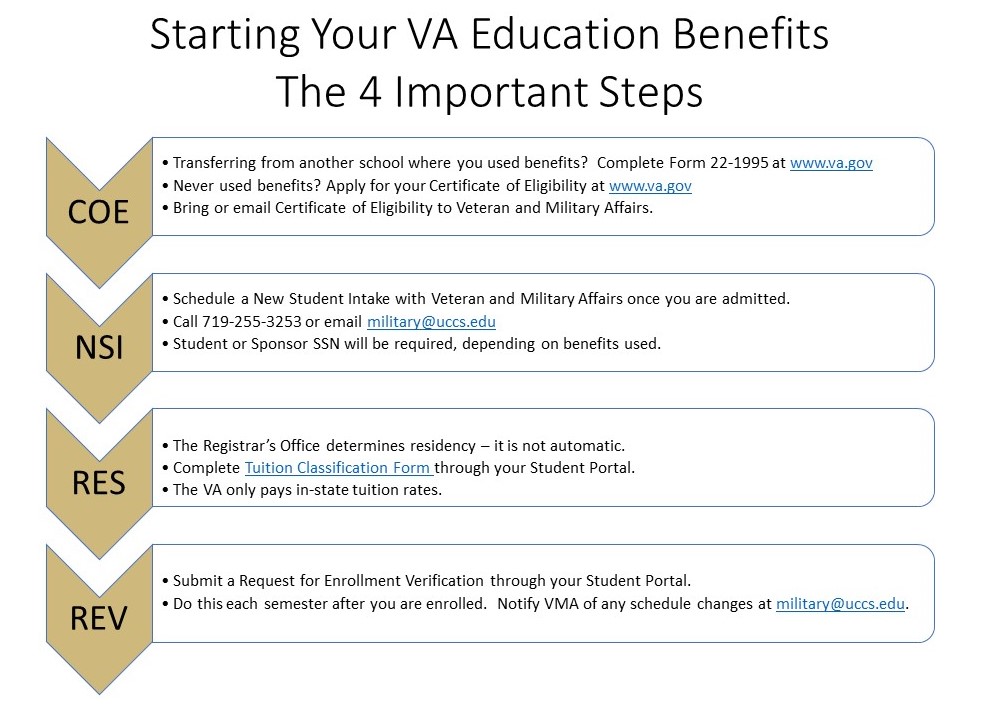

Student must apply each semester in conjunction with submitting a Veterans Registration Reporting Form VRRF A veteran who was discharged or released after a minimum of 90 days of military service less than three years before enrollment. Florida in State Tuition The Florida state provides a financial reward to the dependent of veterans to help them and assist them with their education. Therefore a spouse or dependent of a veteran may qualify for free college tuition. Students who qualify for this education program are exempt from paying tuition and school fees.

Eligibility for In-State Tuition. There are 2 main GI Bill programs offering educational assistance to survivors and dependents of Veterans. Over the same year the average cost of four-year private schools rose from 35680 to 36880. Children of service members who died in the line of duty may also be eligible for the Iraq and Afghanistan Service Grant as well as several national scholarships.

The Marine Gunnery Sergeant John David Fry Scholarship Fry Scholarship is for children and spouses of service members who died in the line of duty after September 10 2001. Get more information about the Fry Scholarship. It is true that this only applies to schools that accept certain types of federal funding but the. This means you may qualify for in-state tuition rates if Virginia is not your legal domicile.

Bill benefits within 3 years of the transferors discharge after serving 90 days or more on active duty are eligible for in-state tuition and fee assessment. Veterans Service-members Dependents Survivors and Spouses will receive a waiver that covers 100 of the difference between resident and non-resident tuition. Louisianas State Dependent Tuition Exemption program applies to qualifying dependents of veterans with VA-rated disabilities at 90 or higher as a result of military service or who died on duty or as a result of service-related issues during a wartime period. Wyoming provides a veteran tuition benefit in the form of free tuition and fees for overseas combat veterans surviving spouses and their dependents.

The dependents of the veteran who died in the line of duty get the opportunity to study and complete their degrees by having a scholarship. This means that for any active duty service member his or her spouse and dependents at any public college or university where they are stationed for 30 days should be able to receive the in-state tuition rate. Veterans and civilians only qualify for in-state tuition in the state in which they actually live. Dependents receiving Chapter 33 Post-911 or Chapter 35 Survivors and Dependents Educational Assistance of the GI Bill benefit or Fry Scholarship benefits will be eligible for in-state Penn State tuition regardless of where they reside.

Fortunately for veterans and dependents the GI Bill helps cover a significant portion of college-related costs. The Veterans Choice Act grants in-state tuition to. This means that military kids are eligible for in-state tuition where they are actually living in conjunction with their parents job. As the survivor of a veteran or service member you may be entitled to a full waiver of undergraduate tuition and fees from the Alaska Department of Military and Veterans Affairs.

The Higher Education Opportunity Act of 2008 requires that states offer in-state tuition to military family members who live in the state due to their active duty military members service. Dependent children and spouses of Veterans who are using transferred entitlement GI. Individuals must remain continuously enrolled to continue eligibility.