Va Waiver Of Compensation

If you're looking for video and picture information linked to the keyword you've come to pay a visit to the right site. Our site provides you with suggestions for viewing the highest quality video and image content, search and find more enlightening video content and graphics that fit your interests.

comprises one of tens of thousands of movie collections from various sources, especially Youtube, therefore we recommend this video that you view. It is also possible to contribute to supporting this site by sharing videos and images that you like on this site on your social networking accounts like Facebook and Instagram or educate your closest friends share your experiences concerning the simplicity of access to downloads and the information that you get on this site. This site is for them to visit this website.

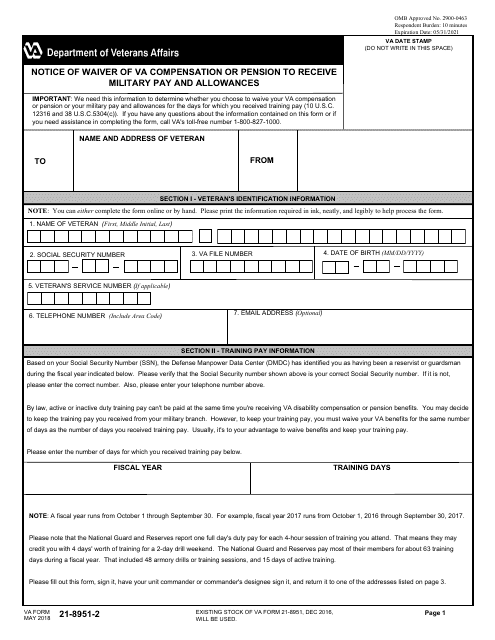

October 29 2020 Download VA Form 21-8951-2 PDF.

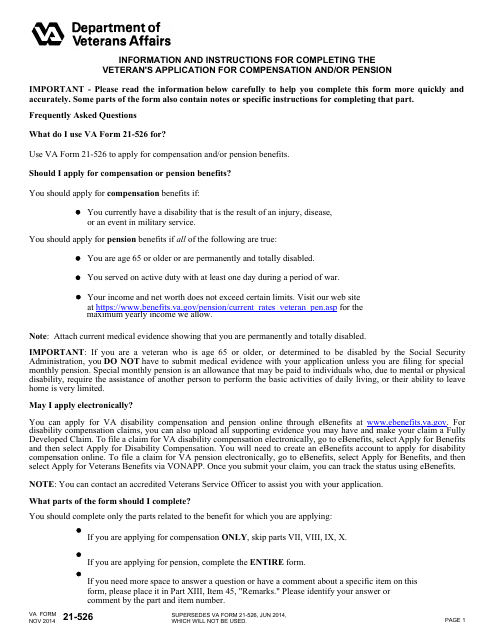

Va waiver of compensation. The amount subtracted from retired pay is known as the VA Waiveryou waive your retired pay to receive VA compensation. You will use this form to elect which pay you want to waive your VA pay or your military pay. VA Waiver and Retired Pay. However to keep your training pay you must waive your VA benefits for the same.

At the beginning of the year usually around February you should receive VA Form 21-8951 Notice of Waiver of VA Compensation or Pension to Receive Military Pay and Allowances. Combat Related Special Compensation. Notice of Waiver of VA Compensation or Pension to Receive Military Pay and Allowances Form last updated. Some retirees who receive VA disability compensation may also receive CRDP or CRSC payments that make up for part or all of the DoD retired pay that they waive to receive VA disability pay.

By law active or inactive duty training pay cant be paid at the same time youre receiving VA disability compensation or pension benefits. I do note that the waiver form VA Form 21-8951 does contain a block that one can check that elects a waiver of the military pay instead of the compensation. This is true only if we get the claim within one year of the date of the report of the Veterans actual or presumed death. Requests for waiver of repayment are processed in accordance with VA Financial Policy Volume XI.

But CRSC reimburses all or some of your VA waiver in a separate check from your branch of service. Refers to the monetary benefits a reservist or member of the National Guard receives for performing active or inactive duty training. Manage Your SBP Annuity. Dependency and Indemnity Compensation DIC For claims based on a Veterans death in service the effective date is the first day of the month in which the Veteran died or was presumed to have died.

If a waiver is granted in full or part you will not be required to pay the amount that was waived. C Waiver of fee-1 A fee may not be collected under this section from a veteran who is receiving compensation or who but for the receipt of retirement pay or active service pay would be entitled to receive compensation or from a surviving spouse of any veteran including a person who died in the active military naval or air service who died from a service-connected disability. The law requires that a military retiree waive a portion of their gross DoD retired pay dollar for dollar by the amount of their Department of Veterans Affairs VA disability compensation pay. The VA waiver an amount equal to your total VA compensation will continue to be subtracted from your service retired pay.

Veteran Benefits Administration VBA overpayments are governed by the Department of Veterans Affairs under US Code Title 38 Veterans Benefits. You will receive your VA disability payment around the first of the month and you will receive your drill pay at the normal payment schedule. This further suggests that they can do a retroactive waiver of military pay. It also means all retired pay becomes subject to the Former Spouse Protection Act and retired pay can be divided in a divorce.

VA Form 21-8951 Notice of Waiver of VA Compensation or Pension to Receive Military Pay and Allowances which is discussed elsewhere in this topic uses the terms. This is known as the VA waiver or VA offset. Veterans frequently waive only so much of their retired pay as is equal to the amount of VA disability compensation to which they are entitled. The elimination of the VA Waiver means all taxable retired pay is restored.

You may decide to keep the training pay you received from your military branch. Now switching over to the DoD side they do require that you waive your VA compensation in order to receive CRDP. Start an SBP Annuity. Provide for Loved Ones.

Two Ways to Prepare. Hello So after waiting on the phone for over and hour to speak to the VA the woman hangs up on me when I ask to speak to someone else becasuse she d VA Waiver of Compensation - Veterans Benefits Network. Thus veterans receiving CRSC will get three separate checks each month. The legislation provided that the difference be reduced by 10 a year after the first 500.

From what you are saying there is a waiver of military retired pay currently in effect since you are being paid compensation for the previous 20 percent rating. The monthly compensation payments vary by your disability ratingand if your rating is 30 or higherthe rates are increased depending number of dependents you have filed on your claim. Since this compensation is not taxable but retired. They waive only so much of their retired pay as is equal to the amount of VA disability compensation to which they are entitled.