Va Waiver Military Retirement Pay

If you're looking for picture and video information related to the keyword you have come to pay a visit to the right blog. Our website gives you hints for seeing the highest quality video and picture content, hunt and locate more informative video content and images that match your interests.

includes one of thousands of movie collections from several sources, particularly Youtube, therefore we recommend this movie that you see. This blog is for them to stop by this site.

The law requires that a military retiree waive a portion of their gross DoD retired pay dollar for dollar by the amount of their Department of Veterans Affairs VA disability compensation pay.

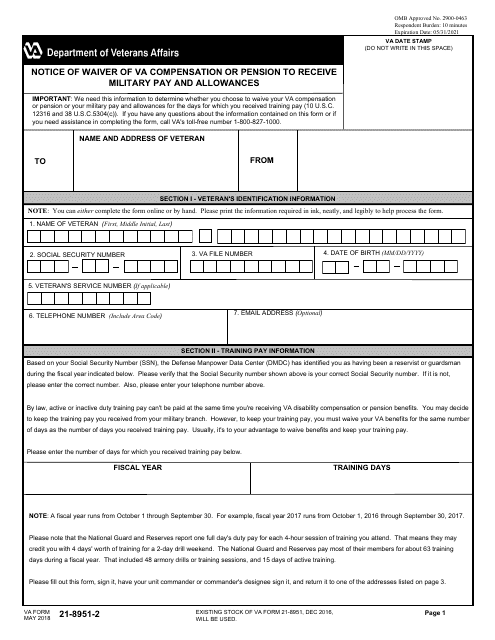

Va waiver military retirement pay. October 29 2020 Download VA Form 21-8951-2 PDF Helpful links Change your direct deposit information. The VA waiver is where you waive retired pay to receive VA compensation. 2020 Tax Year Statements. But 64128 of that is tax-free income.

Postal Service will be mailed no later than Jan. Since 2004 military retirees with a VA rated disability of 50 or more are no longer being required to waive military retirement pay to receive a VA disability compensation. It is still a good deal to do because VA disability is not taxed while military retirement is taxed. To comply with this law veterans who receive both service retired pay and VA disability compensation simultaneously are required to waive give up part of their service retired pay.

Department of Defense Department of Veterans Affairs Military Employment Verification Warrior Care Website Defense Contract Mgmt Agency DoD. A VA waiver is a situation where a person receives a certain percentage of disability from the VA and in order to get it they have to waive a portion of their military retirement in order to get it. Visit Keeping DFAS Up-to-Date for more details. Some states exclude military retired pay from state income taxes.

There is a 13 percent Cost of Living Adjustment COLA for most retired pay and Survivor Benefit Plan annuities and the Special Survivor Indemnity Allowance SSIA effective Dec. 2021 Cost of Living Adjustment and Pay Schedule. At any time retired military personnel can alter the amount of tax excluded from their retirement pay by completing a new W-4. Notice of Waiver of VA Compensation or Pension to Receive Military Pay and Allowances Related to.

Military retirement pay is subject to federal income tax but no FICA Social Security deductions. 15 2020 2020 tax statements for annuitants are available in myPay as of Dec. If you receive VA compensation for your VA disability military retired pay is reduced by the VA waiver. Those with a VA compensation rating of less than 50 can not receive both military retirement pay and VA compensation - it is an unfair law but it is the law.

This is known as the VA waiver or VA offset. 2020 tax statements for retirees are available in myPay as of Dec. Some retirees who receive VA disability compensation may also receive CRDP or CRSC payments that make up for part or all of the DoD retired pay that they waive to receive VA disability pay. When military retirement pay is waived in claims for Section 306 Pension or Old Law Pension 90 percent of the waived retirement pay counts as income following the 10-percent statutory exclusion per 38 CFR 3262e2 and 38 CFR 3262h.

Veterans Benefits Administration Form last updated. Comparing CRSC and CRDP. The 2021 CRDPCRSC Open Season is January 1-31 2021. Concurrent Retirement and Disability Pay CRDP allows military retirees to receive both military retired pay and Veterans Affairs VA compensation.

Veterans can contact their states veterans office for additional information about state taxes and military retirement pay. This was prohibited until the CRDP program began on January 1 2004. Concurrent Retirement Disability Pay. He would then receive 135872 as his military retirement pay 2000 64128 135872.

Under CRDP one can receive both military retirement and VA compensation provide one waives military retirement pay. CRDP is a phase in of benefits that gradually restores a retirees VA disability offset. The overall affect gives the veteran more spending power. VA Waiver and Retired Pay.

The amount the veteran receives in VA compensation is subtracted from the amount they receive in retired pay to avoid double-dipping. Two Ways to Prepare. Provide for Loved Ones. The total amount still equals 2000 per month.