Va Waiver Deduction From Retirement Pay

If you're searching for video and picture information linked to the keyword you have come to visit the right site. Our site gives you hints for viewing the highest quality video and picture content, hunt and find more enlightening video articles and graphics that fit your interests.

comprises one of thousands of video collections from several sources, particularly Youtube, therefore we recommend this video that you view. It is also possible to contribute to supporting this site by sharing videos and graphics that you like on this site on your social media accounts like Facebook and Instagram or tell your closest friends share your experiences concerning the simplicity of access to downloads and the information that you get on this site. This blog is for them to stop by this site.

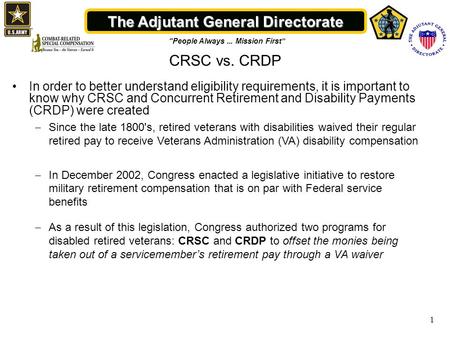

As noted by the posters above the VA waiver amount is restored by CRDP when the VA rating is 50 or more.

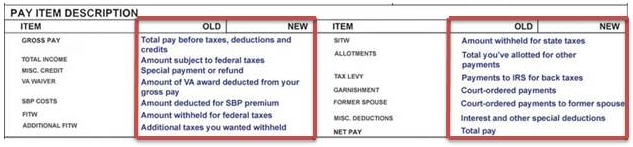

Va waiver deduction from retirement pay. In other words a 40 disability rating doesnt mean 40 of your retirement pay is tax free. Some retirees who receive VA disability compensation may also receive CRDP or CRSC payments that make up for part or all of the DoD retired pay that they waive to receive VA disability pay. The law requires that a military retiree waive a portion of their gross DoD retired pay dollar for dollar by the amount of their Department of Veterans Affairs VA disability compensation pay. VA Waiver and Retired Pay.

We will recoup the gross amount of 60000. Veteran Benefits Administration VBA overpayments are governed by the Department of Veterans Affairs under US Code Title 38 Veterans Benefits. Manage Your SBP Annuity. The VA disability offset requires military members to waive part of their military retirement pay in order to receive VA disability compensation benefits.

Check out our new helpful FAQs. For most members who retired under a non-disability law retired pay taxable income is simply reduced by the amount of any VA compensation received. Start an SBP Annuity. Since this compensation is not taxable but retired.

One gov site say this then another that. My retired pay on my RAS is 369500 which is 75 of High 3 Army rated at 80 when retired then DFAS makes a deduction calling it a VA waiver which brings me to 229307 which seems to be years of creditable service times 2½. It is still a good deal to do because VA disability is not taxed while military retirement is taxed. Below 50 the waived amount of retired pay is not restored by DFAS.

Veterans frequently waive only so much of their retired pay as is equal to the amount of VA disability compensation to which they are entitled. Unfortunately the cutoff was 50 or greater and veterans with a rating of 40 or lower are still subject to having their retirement pay offset. 2021 Cost of Living Adjustment and Pay Schedule There is a 13 percent Cost of Living Adjustment COLA for most retired pay and Survivor Benefit Plan annuities and the Special Survivor Indemnity Allowance SSIA effective Dec. This is known as the VA waiver or VA offset.

Info from DOD site on military compensation. A VA waiver is a situation where a person receives a certain percentage of disability from the VA and in order to get it they have to waive a portion of their military retirement in order to get it. If your VA disability rating is 40 or lower your military retirement pay is offset by the amount of your VA compensation. We recoup at the rate of 40 of gross income which would be 920.

CRDPCRSC Open Season The 2021 CRDPCRSC Open Season is January 1-31 2021. If a waiver is granted in full or part you will not be required to pay the amount that was waived. Provide for Loved Ones. When you request a waiver you are requesting that we terminate collection action on a debt.

Report SBP Annuitants Death. The CRDP laws allowed veterans with a VA disability rating of 50 or greater to receive both their retirement pay and their VA disability compensation concurrently with no offset or reduction in pay. Two Ways to Prepare. If you become eligible for 2500 per month from retired pay less a VA waiver of 200 you would have an adjusted gross taxable income of 2300.