Va Unemployment Tax Rate For Employers

If you're looking for picture and video information linked to the keyword you've come to visit the ideal blog. Our site provides you with suggestions for seeing the maximum quality video and picture content, search and locate more informative video content and graphics that fit your interests.

comprises one of thousands of movie collections from several sources, particularly Youtube, so we recommend this movie that you view. You can also bring about supporting this website by sharing videos and graphics that you like on this blog on your social media accounts like Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information you get on this website. This site is for them to visit this site.

October 2020 Local Unemployment Rates.

Va unemployment tax rate for employers. Any amount over 7000 for the year is excess wages and is not subject to tax. Here is a list of the non-construction new employer tax rates for each state and Washington DC. Established employers are subject to a lower or higher rate than new employers depending on an experience rating. The rates include social cost tax rates ranging from 049 to 146 and an employment administration fund EAF tax rate of 003.

In the face of federal inaction these changes will put more of our unemployment insurance funding into the hands of unemployed workers and small business owners who desperately need it UI Employer Tax Rates for 2021 are assigned by the previous calendar year from July 1 2019 to June 30 2020. Box 26441 Richmond VA 23261-6441. November 2020 Local Unemployment Rates. Use Employer Account Management Services EAMS or EAMS for Single Filers to file your tax reports or tax and wage reports online.

Ralph Northam announced. They also serve as a resource for unemployed workers seeking UI benefits. The wage base for SUI is 8000 of each employees taxable income. Effective January 1 2021 unemployment tax rates for experience-rated employers are to range from 052 to 602 compared with 013 to 572 in 2020.

Virginias unemployment trust fund is all but depleted and the state could have turned to businesses to replenish it with a tax rate spike in 2021. According to the release Unemployment Insurance Employer Tax Rates for 2021 are assigned by the previous calendar year from July 1 2019 to June 30 2020. This change is effective for calendar year 2020. Employers fund the UI program.

Rates are assigned by calendar year based on the individual situation of the employer. The taxable wage base remains 9000 for all other employers. Virginias Seasonally Adjusted Unemployment Rate Decreased to 49 Percent in November. The initial tax rate for new employers is 0270 27 which is applied to the first 7000 in wages paid to each employee during a calendar year.

UI benefits offer workers temporary income while theyre out of work or working reduced hours. Work Opportunity Tax Credit WOTC is a federal tax credit available to all private sector businessesIt was designed as an incentive to employers to hire individuals in certain targeted groups who consistently experience high rates of unemployment due to a variety of employment barriers. For 2020 the standard tax rate for new employers is 25 and the tax rate for new employers that are out-of-state contractors is 62. For filing tax reports or tax and wage reports online.

Unemployment Insurance Information for Employers The Virginia Employment Commission offers many programs and services for employers. Tax reports or tax and wage reports and unemployment tax payments can be filed and paid through our free and efficient online systems or by submitting our original paper forms. The Virginia unemployment rate rose to 49 percent in December while total nonfarm payroll employment increased by 800. Virginia employers get tax relief unemployment insurance tax rate wont increase next year Evan Watson 12232020 New Mexico fines two megachurches 10K each over packed Christmas Eve services.

That wont happen Gov. 2019 legislation LB 428 increases the SUI taxable wage base to 24000 for employers assigned the maximum rate 54 for calendar year 2019. The new employer rate usually applies for at least one year. Employers play an important role in providing unemployment insurance UI benefits to workers.

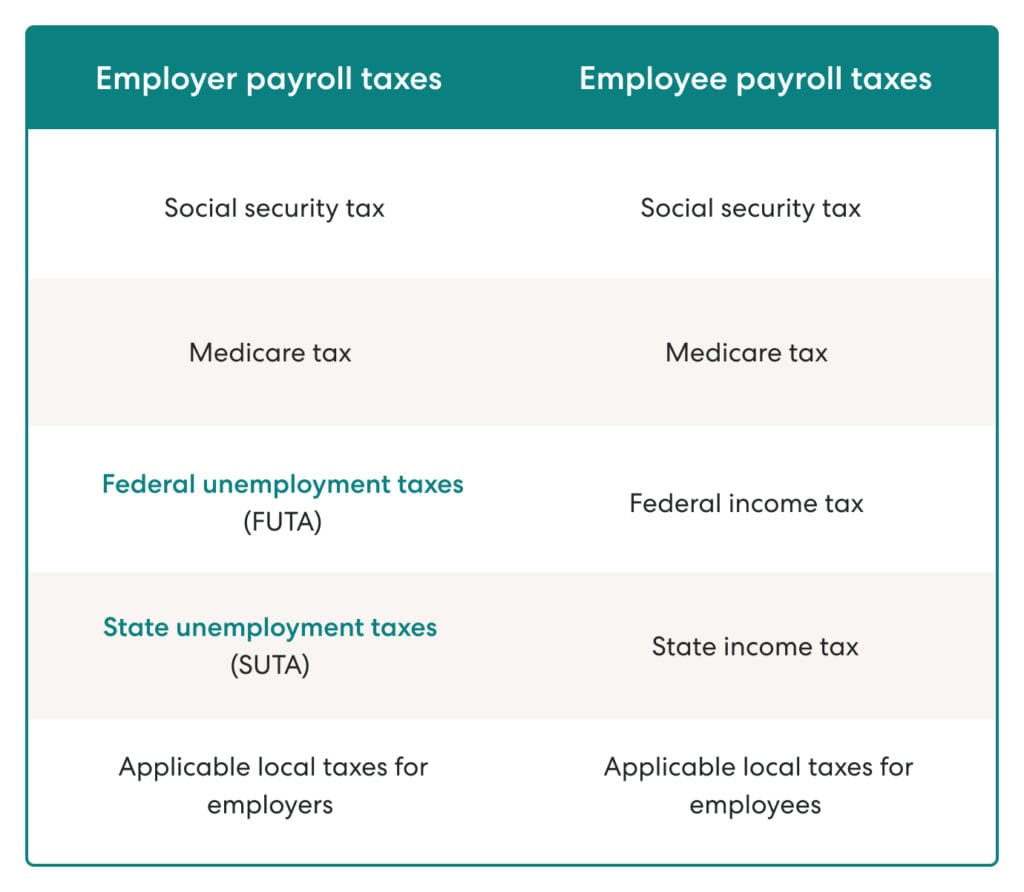

Note that some states require employees to contribute state unemployment tax. SUI tax rate by state. Our goal is to provide information and assistance to help you build a quality workforce and to help your business grow. Others may qualify for an experience base rate or receive an assigned base tax rate.

For more information about the tax rate review the Reemployment Tax Rate Information webpage. Virginias unemployment tax rates for experienced employers range from 01 to 62 in 2020 a spokeswoman for the state Employment Commission said Jan. If youre a new employer your rate will be between 251 and 621. Virginia Employment Commission Employer Accounts PO.

New Virginia employers receive the initial base tax rate of 25 plus add-ons until eligible for a calculated rate. Virginia has State Unemployment Insurance SUI which ranges from 011 to 621.