Va Unemployment Pay Rate 2020

If you're looking for video and picture information linked to the keyword you have come to visit the ideal blog. Our site provides you with suggestions for viewing the highest quality video and picture content, search and locate more enlightening video articles and images that match your interests.

includes one of thousands of video collections from several sources, especially Youtube, so we recommend this movie that you see. You can also contribute to supporting this site by sharing videos and images that you enjoy on this site on your social media accounts such as Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information you get on this site. This blog is for them to stop by this site.

UI Employer Tax Rates for 2021 are assigned by the previous calendar year from July 1 2019 to June 30 2020.

Va unemployment pay rate 2020. In 2020 regular unemployment benefit payments range from a minimum amount of 151 per week to a maximum amount of 648 per week This does not include the Federal pandemic benefit supplementary payment in effect during 2020. RICHMOND Virginias seasonally adjusted unemployment rate fell 03 percentage points in November to 49 percent which is 22 percentage points above the rate from a year agoAccording to household survey data in November the labor force expanded by 16323 or 04 percent to 4286658 as the number of unemployed residents fell by 12464. The Covid-19 relief legislation passed by Congress on December 21 2020 was signed into law by the President on December 27. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax.

To get the maximum a person must have earned during two quarters of their base period at least 1890001. Since your basic rate already provides payment for 1 child you would add the rate of 6100 for each additional child so 61 x 2. Virginia Relay call 711 or 800-828-1120. November 16 2020 by GS Pay Scale.

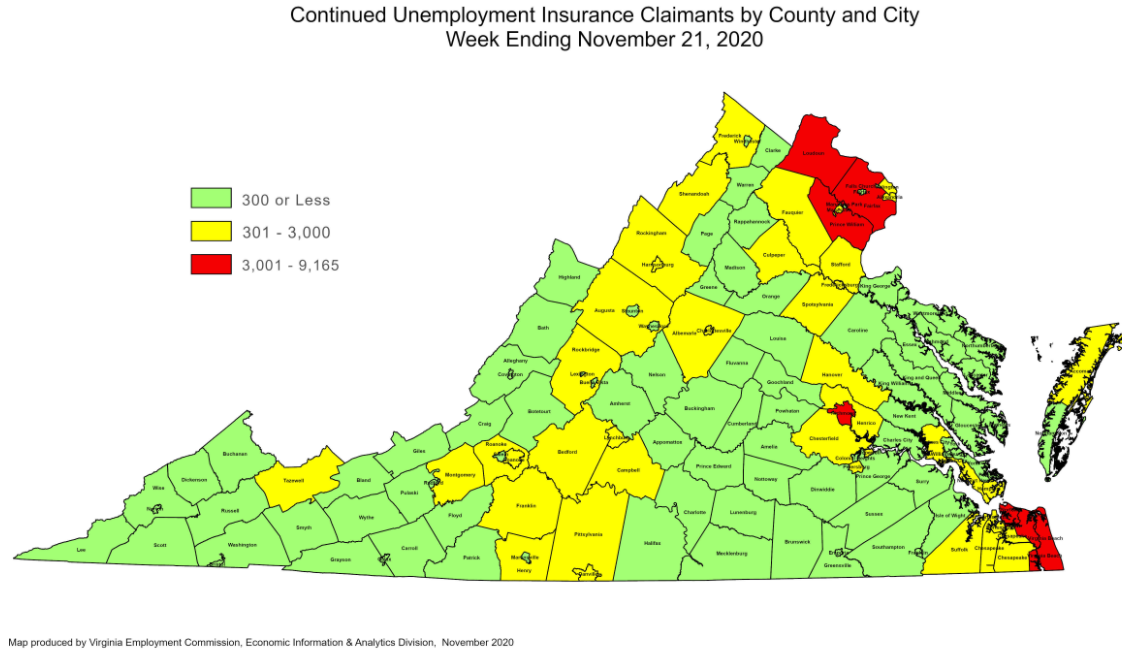

The most recent figures for Virginia show an unemployment rate of 49. Rates shown are a percentage of the labor force. Are unemployed through no fault of their own. Estimates for the current month are subject to revision the following month.

Have earned qualifying wages. Benefits are paid between 12 and 26 weeks depending on your situation. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. Va Pay Scale 2020 Read more.

You can collect benefits if you meet a series of legal eligibility requirements. Data refer to place of residence. Va unemployment pay rate 2020 Va Pay Scale 2020. Categories GS Pay Scale Tags new va disability pay scale 2020 richmond va gs pay scale 2020 va employee pay scale 2020 va gs pay scale 2020 va pay scale 2020 va pay scale 2020 nurse va payment scale 2020 va rating pay.

Weekly unemployment benefits in Virginia range from 60 to 378 per week and are based on your wages. Maximum unemployment pay varies state by state and the average unemployment benefit is 385 per week nationwide according to the Center on Budget and Policy Priorities. To apply for Virginia unemployment benefits click here. The unemployment provisions of this bill are known as the Continued Assistance to Unemployed Workers Act of 2020.

If your spouse receives Aid and Attendance you would also add 113 which is the added amount for a spouse receiving Aid and Attendance for a Veteran with a 70 disability rating. Jobless workers in every state get this extra 600 a week through July 31 2020 on top of what the unemployed receive from their regular state unemployment benefits. Seasonally adjusted nonfarm employment increased by 8100 jobs between October 2020 and November 2020 RICHMOND Virginias seasonally adjusted unemployment rate fell 03 percentage points in November to 49 percent which is 22 percentage points above the rate from a year ago. Continued Assistance to Unemployed Workers Act of 2020.

Employers receive a Base Tax Rate dependent on their particular account history and circumstances. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. The FPUC program provided an additional 600 per week in unemployment compensation per recipient through July 2020. General employers are liable if they have had a quarterly payroll of 1500 or more or have had an employee for 20 weeks or more during a calendar year.