Va Unemployment Compensation Rate

If you're looking for video and picture information linked to the keyword you've come to visit the ideal site. Our website gives you suggestions for viewing the highest quality video and picture content, hunt and find more enlightening video articles and images that fit your interests.

includes one of thousands of video collections from various sources, particularly Youtube, therefore we recommend this video that you see. This blog is for them to visit this website.

There was a 13 increase from 2020 following a 16 increase from 2019.

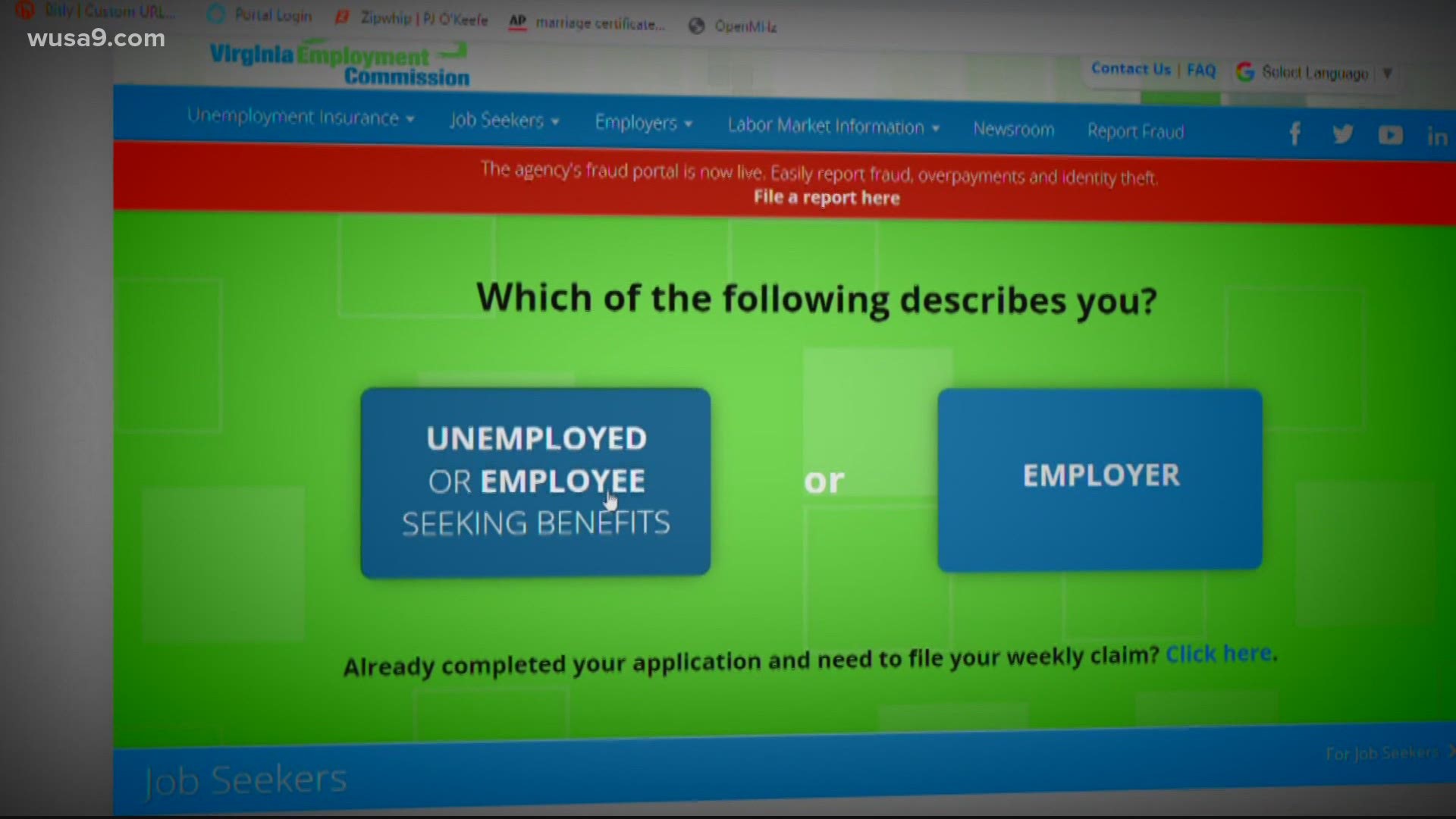

Va unemployment compensation rate. However you should continue to utilize VAWCvirginiagov to conduct an active search for employment. To find out if you qualify for unemployment compensation you should file a claim with the VEC office nearest to your home once your employment has ended. You will no longer access your UI weekly claim through the Virginia Workforce Connection site. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001.

Use your new Gov2Go account to file weekly unemployment insurance claims UI online as long as you remain unemployed or by calling 1-800-897-5630. That represents a lot of Americans who will find themselves grappling with taxation of their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns. Unemployment compensation generally provided by an unemployment check or a direct deposit provides partial income replacement for a defined length of time or until the worker finds employment. Unemployment insurance programs are governed by state governments and are funded by state federal and private companies that pay employment tax.

To get the maximum a person must have earned during two quarters of their base period at least 1890001. Ultimately the onus is on the state government to balance the checkbook so the state has to decide the benefits maximum amount duration and eligibility to receive the benefits. Virginia Relay call 711 or 800-828-1120. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO.

How VA Calculates Compensation Rates. SUI tax rate by state. VA makes a determination about the severity of your disability based on the evidence you submit as part of your claim or that VA obtains from your military records. Box 26441 Richmond VA 23261-6441.

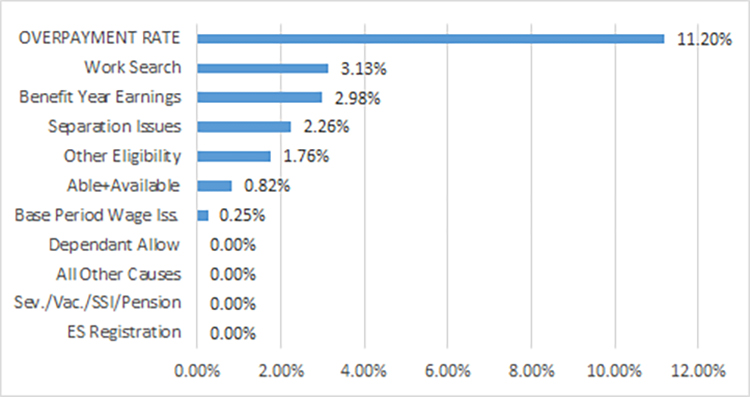

Here is a list of the non-construction new employer tax rates for each state and Washington DC. Note that some states require employees to contribute state unemployment tax. The Virginia Employment Commission VEC makes a determination as to whether or not any employee is eligible to receive unemployment compensation by looking at several factors including but not limited to the factors listed below. New Virginia employers receive the initial base tax rate of 25 plus add-ons until eligible for a calculated rate.

The taxable wage base is the amount of each employees annual wages that are taxable. The 2021 VA Disability Compensation Rates are effective as of Dec. The federal unemployment rate in the US. VA rates disability from 0 to 100 in 10 increments eg.

Table 2 compares the three states according to several tax measures. Basic Rates - 10-100 Combined Degree Only Effective 12119. Go to our How to Read Compensation Benefits Rate Tables to learn how to use the table. Benefits are paid through taxes on employers covered under the Virginia Unemployment Compensation Act.

Like its wages and benefits Connecticuts unemployment compensation tax rates are higher than those in the other two states. With Mixed Earner Unemployment Compensation a person who made more money from self-employment or a contracting job -- that requires a 1099 form -- could receive an extra 100 a week. The December 2018 seasonally adjusted unemployment rate for Virginia was down 08 percentage point from a year ago and continued to be the lowest rate since the April 2001 rate of 28 percent. And are therefore subject to the state unemployment insurance tax including for example those that.

The more you made the higher the payout. If you receive VA disability pay you will notice the increased amount in your first check which you should receive in January 2021. The Virginia Employment Commission VEC administers the unemployment compensation program that provides temporary financial assistance to individuals who become unemployed through no fault of their own. Others may qualify for an experience base rate or receive an assigned base tax rate.

You must be a Veteran. What you need to know Virtually all employers are covered by the Virginia Unemployment Compensation Act VA Code Sec. 463 208 45 170 37. Veterans Compensation Benefits Rate Tables - Effective 12119.

You may be entitled to partial unemployment benefits during this week if you earned less than what your weekly unemployment benefit amount would be plus 60. Was 102 in July 2020 according to the Bureau of Labor Statistics and that was actually down almost a percentage point from June. Weekly unemployment benefits in Virginia range from 60 to 378 per week and are based on your wages. Individual Unemployability is a part of VAs disability compensation program that allows VA to pay certain Veterans disability compensation at the 100 rate even though VA has not rated their service-connected disabilities at the total level.

The amount of basic benefit paid ranges depending on how disabled you are.