Va State Unemployment Tax Rate

If you're searching for video and picture information related to the key word you have come to visit the ideal blog. Our site gives you hints for viewing the maximum quality video and picture content, hunt and find more enlightening video articles and graphics that fit your interests.

includes one of tens of thousands of movie collections from several sources, particularly Youtube, so we recommend this movie for you to view. This blog is for them to visit this site.

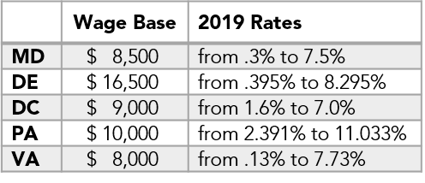

Here is a list of the non-construction new employer tax rates for each state and Washington DC.

Va state unemployment tax rate. In recent years it has been comprised of a Base Tax Rate thats been steady at 25 plus so-called add-ons consisting of a Pool Cost Charge and Fund Building Charge. Ralph Northam announced. Was 102 in July 2020 according to the Bureau of Labor Statistics and that was actually down almost a percentage point from June. When your application is entered in our database we will send you a new employer packet with any tax reports that need to be filed along with additional information about our reporting requirements.

In recalculating the tax rate for 2021 Executive Order Seventy-Four requires that the VEC not penalize businesses for lay-offs that occurred during the pandemic from April through June 2020. If an employer has no paid taxable payroll during the four-year period ending June 30th of the prior year they are assigned the maximum base tax rate of 62. Unlike the Federal Income Tax Virginias state income tax does not provide couples filing jointly with expanded income tax brackets. This will prevent Virginias struggling businesses from having to devote critical resources to higher state payroll taxes.

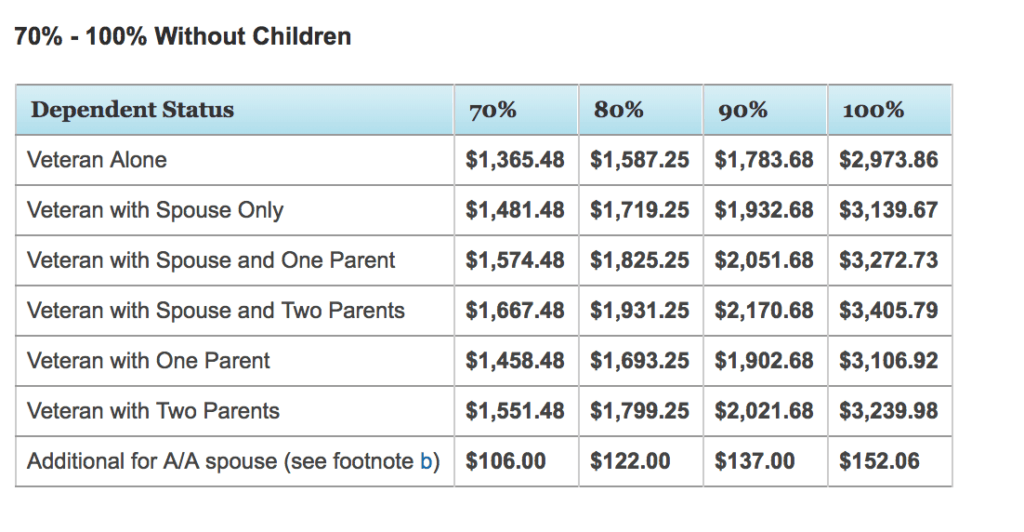

For 2020 the standard tax rate for new employers is 25 and the tax rate for new employers that are out-of-state contractors is 62. The tax rates are updated periodically and might increase for businesses in certain industries that have higher rates of turnover. 2 on up to 3000 of taxable income. Virginias unemployment tax rates for experienced employers range from 01 to 62 in 2020 a spokeswoman for the state Employment Commission said Jan.

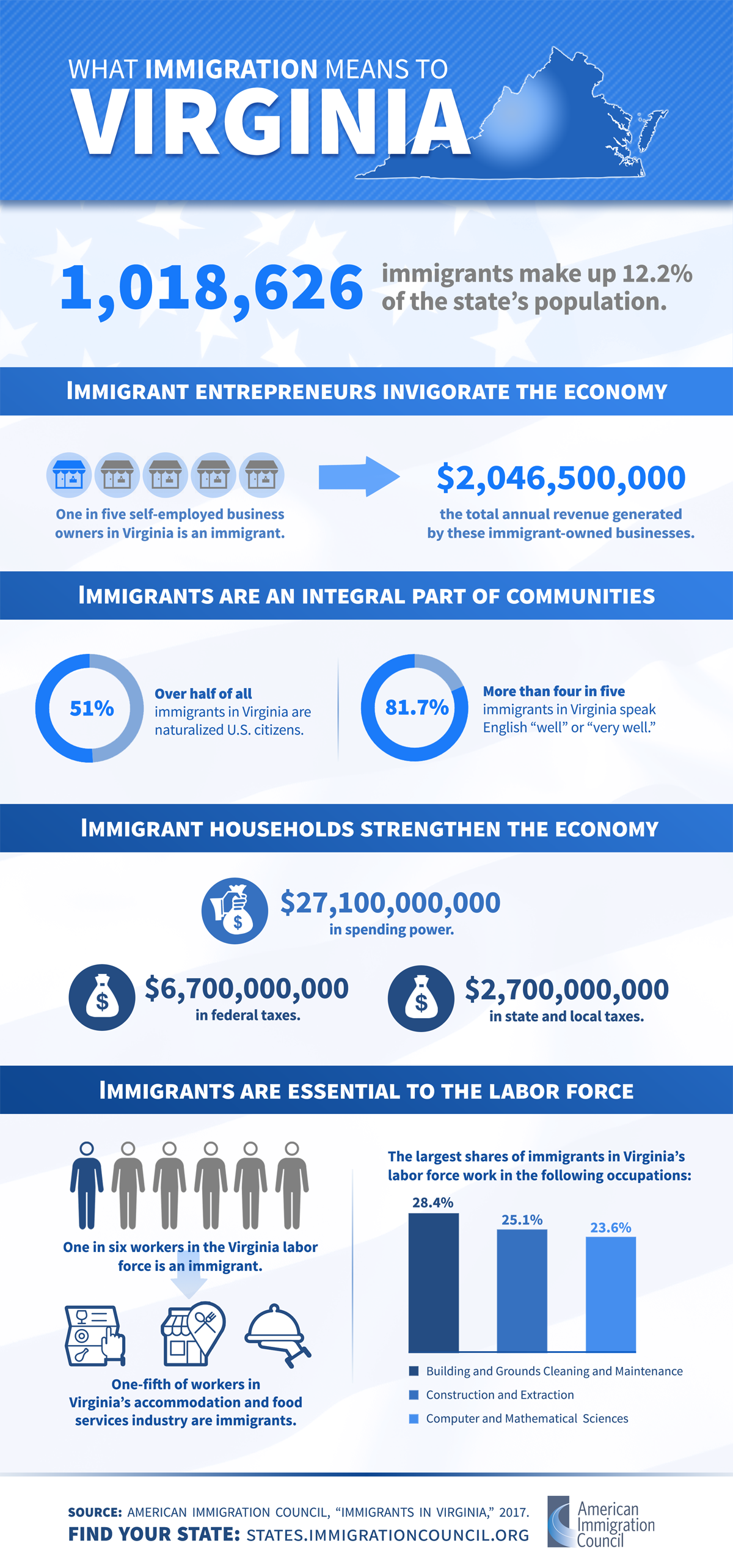

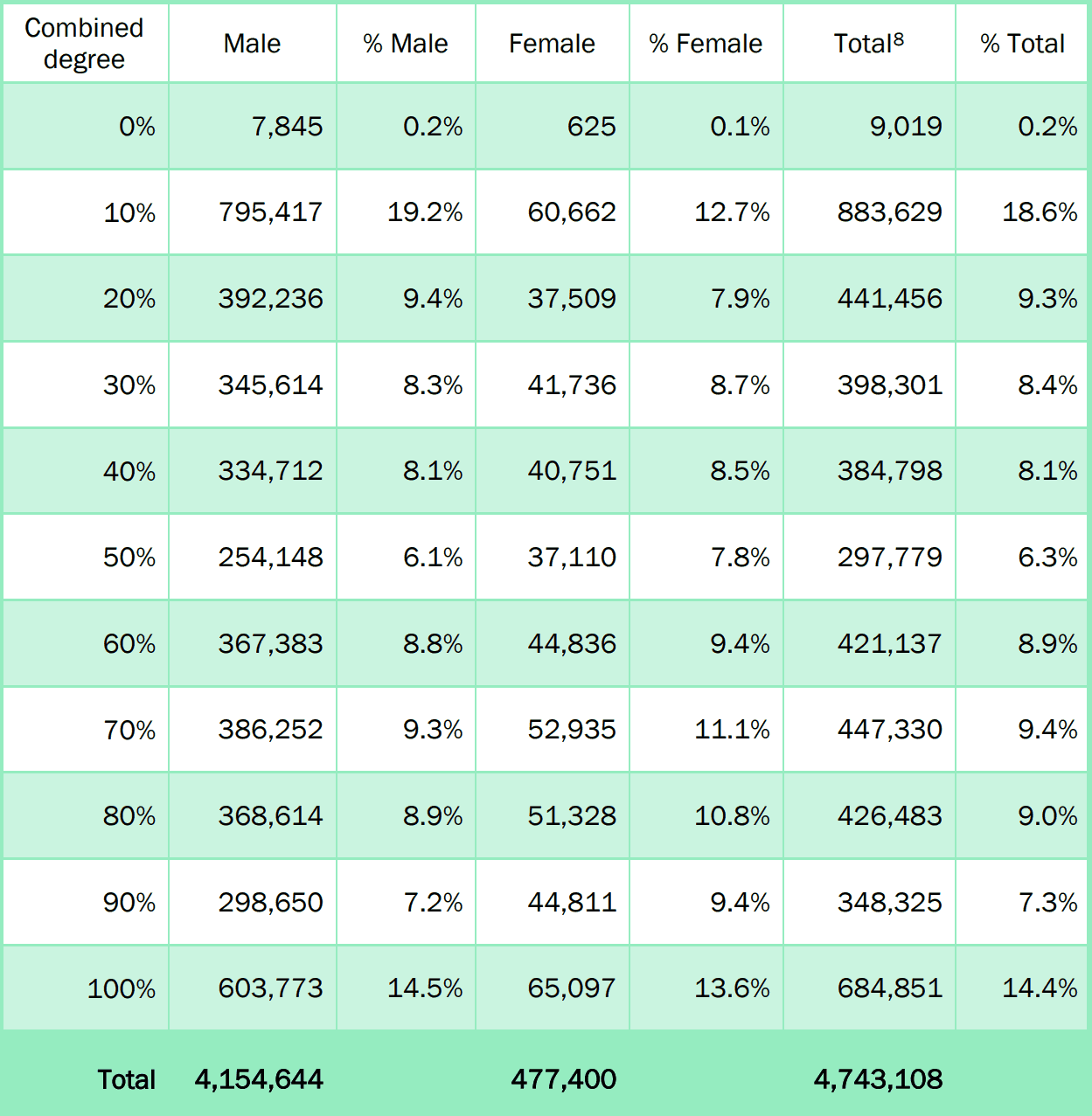

The Unemployment Insurance Employer Tax Rates for 2021 are assigned based on a businesss actions from the previous fiscal year. Estimates for the current month are subject to revision the following month. According to household survey data in November the labor force expanded by 16323 or 04 percent to 4286658 as the number of unemployed residents fell by 12464. Each state has a range of SUTA tax rates ranging from 065 to 68.

According to the release Unemployment Insurance Employer Tax Rates for 2021 are assigned by the previous calendar year from July 1 2019 to June 30 2020. Virginias maximum marginal income tax rate is the 1st highest in the United States ranking directly below Virginias. This means that the employer has not paid the tax due on the payroll on or before the September 30th prior to the computation year. In recent years the overall beginning rate has been roughly between 285 and 325.

This will prevent Virginias struggling businesses from having to devote critical resources to higher state payroll taxes. SUTA tax rates will vary for each state. State Income Tax Range. Rates shown are a percentage of the labor force.

July 1 2019 to June 30 2020. In recalculating the tax rate for 2021 Executive Order Seventy-Four requires that the VEC not penalize businesses for lay-offs that occurred during the pandemic from April through June 2020. SUTA Tax Rates and Wage Base Limit. Each state has its own SUTA tax rates and taxable wage base limit.

RICHMOND Virginias seasonally adjusted unemployment rate fell 03 percentage points in November to 49 percent which is 22 percentage points above the rate from a year ago. Box 26441 Richmond VA 23261-6441. Data refer to place of residence. The federal unemployment rate in the US.

Note that some states require employees to contribute state unemployment tax. Virginia Employment Commission Employer Accounts PO. Unemployment tax rates range from 01 to 62. That represents a lot of Americans who will find themselves grappling with taxation of their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns.

A pool-cost charge is not in effect for 2020. Virginia collects a state income tax at a maximum marginal tax rate of spread across tax brackets. There are no taxes on unemployment benefits in Virginia. Both of the latter charges which fluctuate each year are much less than 1.

That wont happen Gov. State Taxes on Unemployment Benefits. 575 on more than. Virginias unemployment trust fund is all but depleted and the state could have turned to businesses to replenish it with a tax rate spike in 2021.

The state UI tax rate for new employers also known as the standard beginning tax rate also changes from one year to the next. Through the State Unemployment Tax Act SUTA states levy a payroll tax on employers to fund the majority of their unemployment benefit programs.