Va Severance Pay Tax Refund

If you're looking for video and picture information related to the key word you have come to visit the ideal site. Our website provides you with suggestions for seeing the highest quality video and picture content, hunt and find more informative video content and graphics that fit your interests.

comprises one of tens of thousands of video collections from several sources, especially Youtube, therefore we recommend this video that you see. This blog is for them to visit this site.

Veterans can choose instead to claim a standard refund amount based on the calendar year an individuals tax year in which they received the severance payment.

Va severance pay tax refund. When weve finished processing your return the application will show you the date your refund was sent. Ive been doing searches for days now and cant seem to find anything concrete. 1750 for tax years 1991 2005. The IRS recently announced that over 130000 disabled veterans are due refunds from the IRS due to a computer glitch which caused the IRS to incorrectly withhold taxes on disability severance payments to combat-injured veterans.

104 a 4 generally provides that gross income does not include amounts received as a pension annuity or similar allowance for personal injuries or sickness resulting from active service in the armed forces. The Department of Defense sent a notice to the estate of a veteran whos now deceased indicating that the disability severance payment was originally reported as taxable income and that the estate may file a claim to exclude the payment as income because the decedent later became entitled to receive disability compensation from the Department of Veterans Affairs. General refund processing times during filing season. 1750 for tax years 1991 2005.

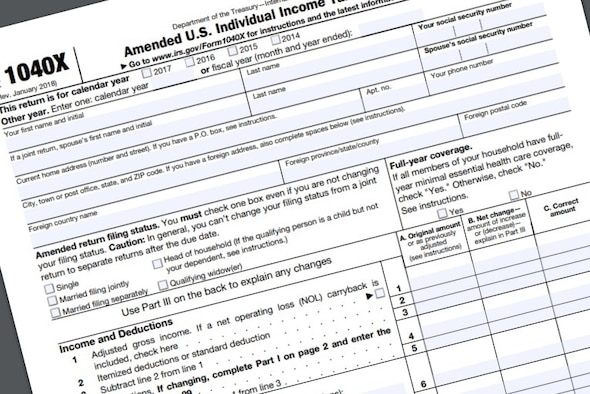

Severance payments are subject to social security and Medicare taxes income tax withholding and FUTA tax. Severance pay is compensation for the termination of an employment relationship or is deemed to be remuneration for past services. If you moved to a new state during 2020 youll normally file a part-year return for each state you lived in during 2020 assuming the states collect income tax. Simply write Disability Severance Pay on Form 1040X line 15 and enter the standard refund amount listed below on line 15 column B and on line 22 leaving the remaining lines blank.

These payments should be non-taxable payments just like disability compensation from the VA. Legislation passed in 2016 to address the Department of Defenses DoD errors in withholding taxes from pay that is supposed to be tax-free. Lines 15 and 22 must include the standard refund amount that applies to them. How long will it take to get your refund.

Public Document PD 97-123 31097 states that severance pay is considered Virginia source income to a nonresident individual when paid by a Virginia employer. The IRS also has approved a simplified method for obtaining the refund in which veterans can claim the standard refund amount on Form 1040X based on when they received the disability severance. Veterans who received disability severance pay from an injury sustained in combat since 1991 may have been taxed improperly and could be eligible for a refund. Allow an additional 3 weeks The Wheres my Refund application shows where in the process your refund is.

In an Information Release IRS has reminded veterans who received disability severance payments after 1991 and claimed them as income that the time limit to claim a refund is approaching. 1 year from the date of the DoD notice letter or 3 years after the due date for filing the original return for the year the DSP was made or 2 years after tax was paid for the year in which the DSP was made. 1750 for tax years 1991-2005 2400 for tax years 2006-2010 3200 for tax years 2011-2016. Because severance pay is considered wages for Virginia income tax purposes severance pay for nonresidents residing in states which have a reciprocal agreement with Virginia is exempt from Virginia withholding and income tax provided the individual provides the Taxpayer with a Withholding Tax Exemption Certificate Form VA-4 claiming this exemption.

Severance payments are wages subject to social security and Medicare taxes. Up to 8 weeks. Below are some common scenarios and how they would be handled. If you receive a lump-sum disability severance payment and are later awarded VA disability benefits you can exclude 100 of the severance benefit from your income under the provisions of 26 USC 104 see also Publication 17 2015 Your Federal Income Tax.

The Combat-Injured Veterans Tax Fairness Act of 2016 enacted December 2016 allows certain veterans who received lump sum disability severance payments additional time to file a claim for credit or refund of an overpayment attributable to the disability severance payment. Use these as a guide for your particular situation. You must mail the refund claim to the IRS generally by the later of. Veterans can choose instead to claim a standard refund amount based on the calendar year an individuals tax year in which they received the severance payment.

A standard refund amount based on the calendar year an individuals tax year in which they received the severance payment. Write Disability Severance Payment on line 15 of Form 1040X and enter on lines 15 and 22 the standard refund amount listed below that applies. 12 years E-6 AF. As noted in section 15 of Pub.

I was medicaly seperated in Jun 06 for chronic back. The law directed the Secretary of Defense to identify disability severance payments paid after January 17 1991 that were included as taxable income on Form W-2 Wage and Tax Statement but were later determined to be. On July 11 2018 the Internal Revenue Service IRS released information about these refunds and how veterans can go about claiming them. The information release provides two options for claiming the refund.

Up to 4 weeks. Write Disability Severance Payment on line 15 of Form 1040X and enter on lines 15 and 22 the standard refund amount listed below that applies.