Va Service Connected Disability Taxable

If you're searching for picture and video information related to the key word you've come to pay a visit to the right blog. Our website provides you with suggestions for seeing the maximum quality video and image content, search and find more informative video articles and images that fit your interests.

includes one of tens of thousands of movie collections from various sources, particularly Youtube, so we recommend this video for you to view. This site is for them to stop by this website.

If that is your only disability then your final VA Service-Connected Disability Rating is 30.

Va service connected disability taxable. Military retirement pay based on age or length of service is considered taxable income for Federal income taxes. The Department of Veterans Affairs just sent me a determination letter that increased my disability percentage from 30 to 50 retroactive to a prior tax year. Disability Compensation is a tax free monetary benefit paid to Veterans with disabilities that are the result of a disease or injury incurred or aggravated during active military service. However military disability retirement pay and veterans benefits including service-connected disability pension payments are almost always fully excluded from taxable income.

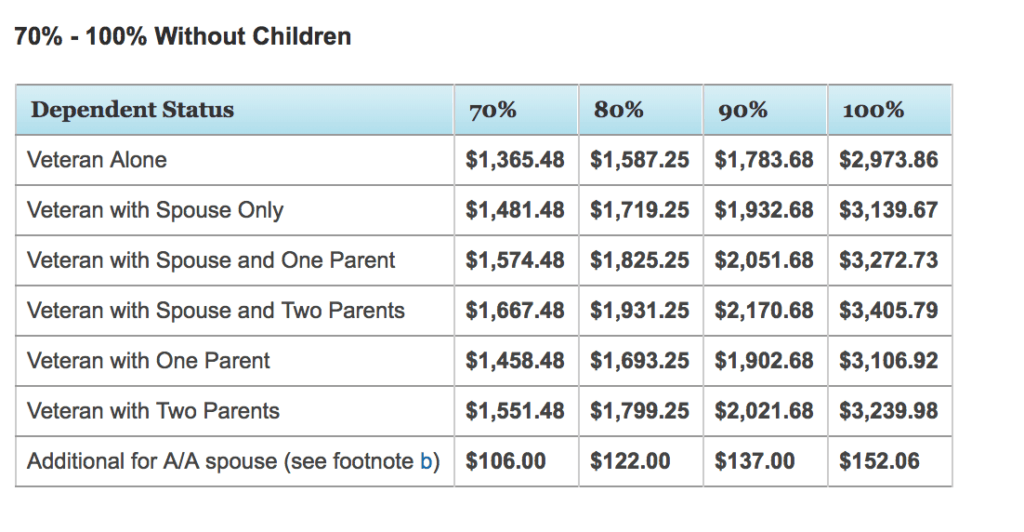

An increase in the veterans percentage of disability from the Department of Veterans Affairs which may include a retroactive determination or. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child. Its a tax-free monthly benefit. Which conditions qualify you for benefits.

Find the amount for children under age 18 6100. A program called Montana Disabled Veterans Assistance offers property tax reductions for those who are VA-rated at 100 service-connected disability. Disabled veterans may be eligible to claim a federal tax refund based on. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse.

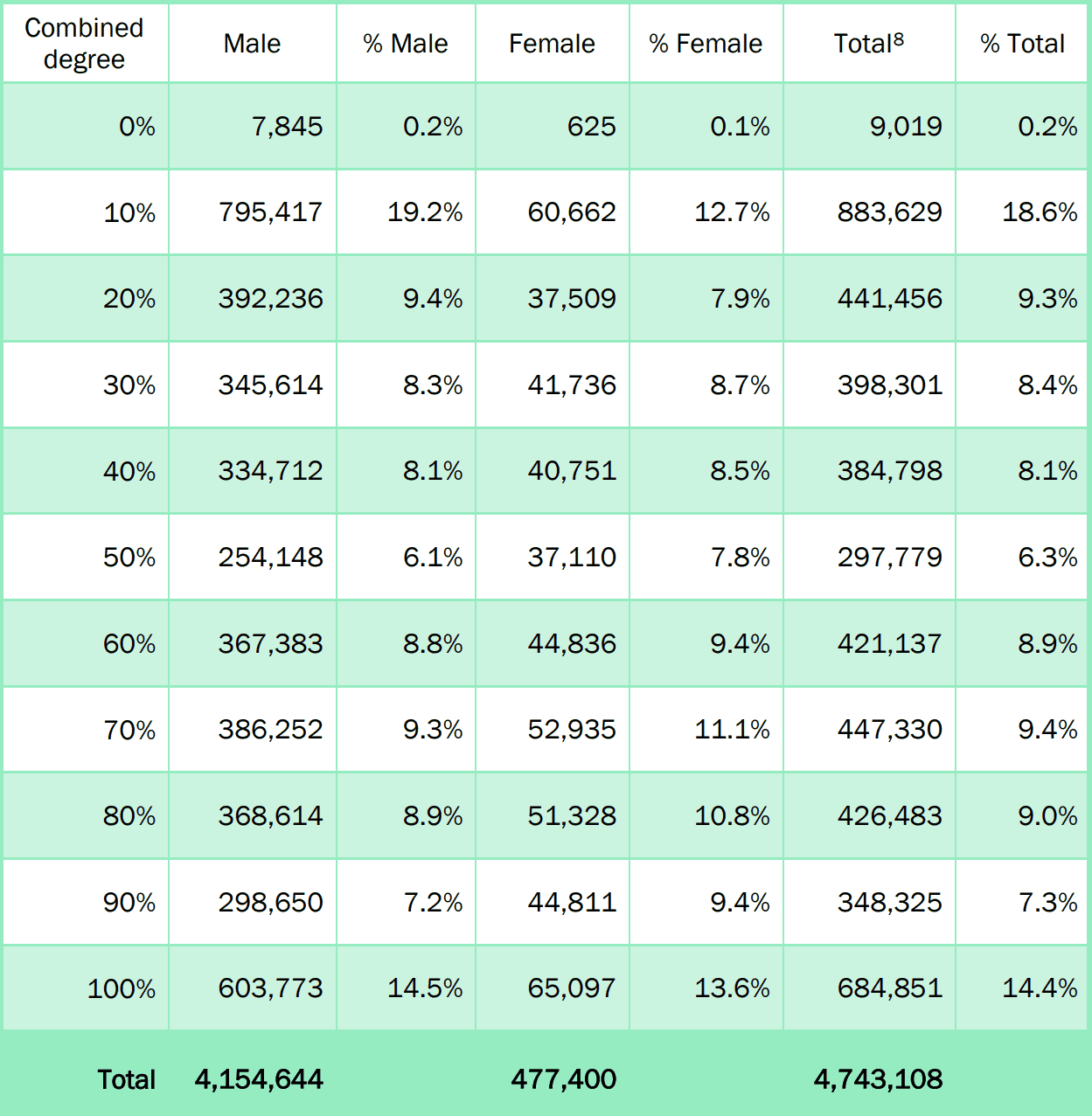

This benefit is income-based and the tax break ranges for 50 to 100 exempt depending on factors including marital status and income level. Special Tax Considerations for Veterans. Continuing with our example if your next rating is 10 you would multiply 10 against 70 which is 7. See all Montana Veterans Benefits.

How the claims process works. Veterans who have a service-related injury or illness may be entitled to VA disability compensation. According to the IRS you should not include in your income any veterans benefits paid under any law regulation or administrative practice administered by the Department of Veterans Affairs VA. However military disability retirement pay and Veterans benefits.

VA Disability Compensation Benefits. You may qualify for VA disability benefits for physical conditions like a chronic illness or injury and mental health conditions like PTSD that developed before during or after service. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Under normal circumstances the Form 1099-R issued to the veteran by the Defense Finance and Accounting Services correctly reflects the taxable portion of compensation received.

Next look at the Added amounts table. If you have multiple ratings you continue with the process using your final number each time as your starting point. The combat-disabled veteran applying for and being granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability. Disability pensions calculated on a basis of years of service in an organization are taxable but only the amount that exceeds the amount of disability benefits a taxpayer would receive from the VA based upon the level of disability.

Visit VAgov to learn.