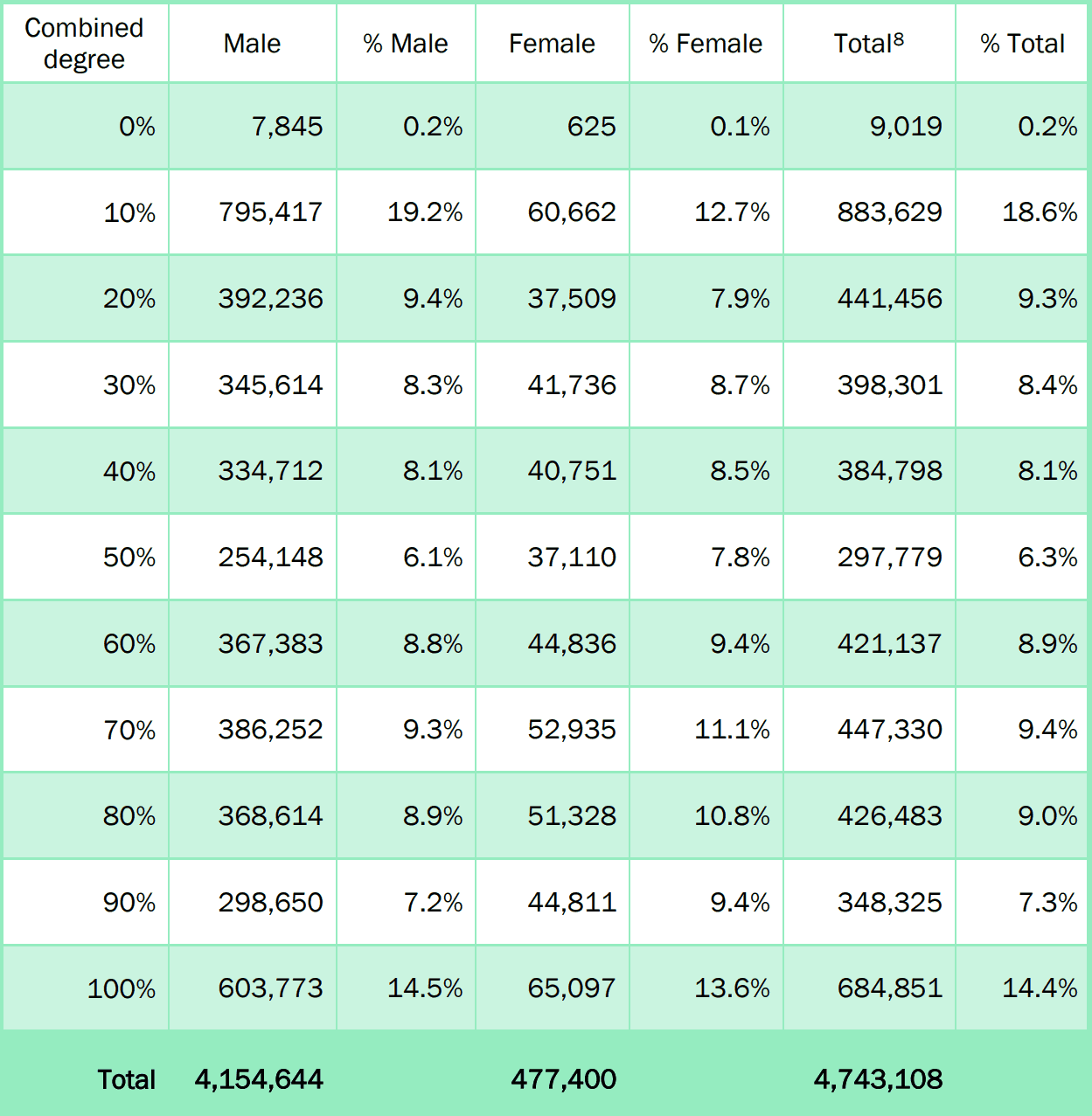

Va Rating Payment Table

If you're looking for picture and video information related to the key word you have come to pay a visit to the right site. Our site provides you with suggestions for viewing the maximum quality video and image content, hunt and find more informative video articles and graphics that fit your interests.

includes one of tens of thousands of video collections from several sources, especially Youtube, so we recommend this movie for you to view. This site is for them to visit this site.

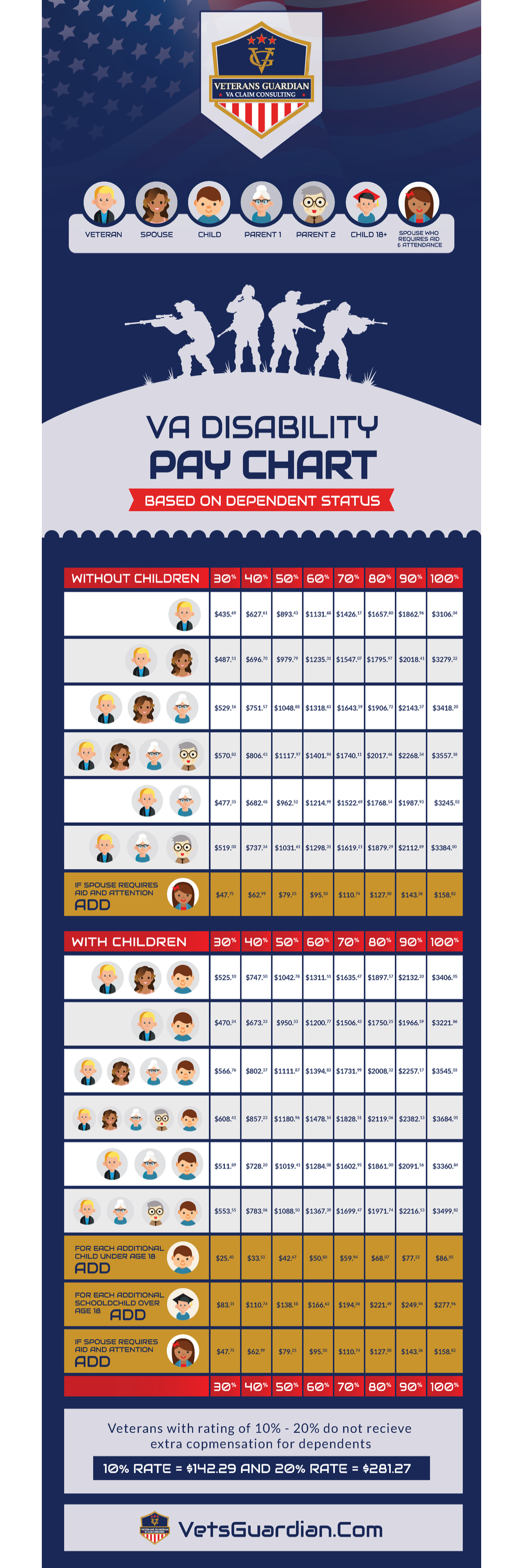

30 60 Without Children.

Va rating payment table. 10 20 No Dependents VA Disability Rating. The table is lengthy and requires each disability to be listed in order of severity with the greatest disability at the top of the list and the VA rater follows a procedure using the ratings matched with the table to arrive at the accurate combined disability percentage. The amount of basic benefit paid ranges depending on how disabled you are. The rate is slightly lower this year due to less inflation as a side effect of the pandemic.

If your spouse receives Aid and Attendance you would also add 113 which is the added amount for a spouse receiving Aid and Attendance for a Veteran with a 70 disability rating. In our example of a Veteran with 70 disability rating your total monthly payment amount would be. Next look at the Added amounts table. VA Disability Compensation COLA Raises.

VA rates disability from 0 to 100 in 10 increments eg. This is your monthly basic rate. Find the amount for children under age 18 6100. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child.

Adding a non school child child is under 18 adding a school child child is over 18 30 to 60. 10 20 30 etc. 160971 basic rate 1 spouse 1 child 59 second child under 18. 165671 basic rate 1 spouse 1 child 61 second child under 18.

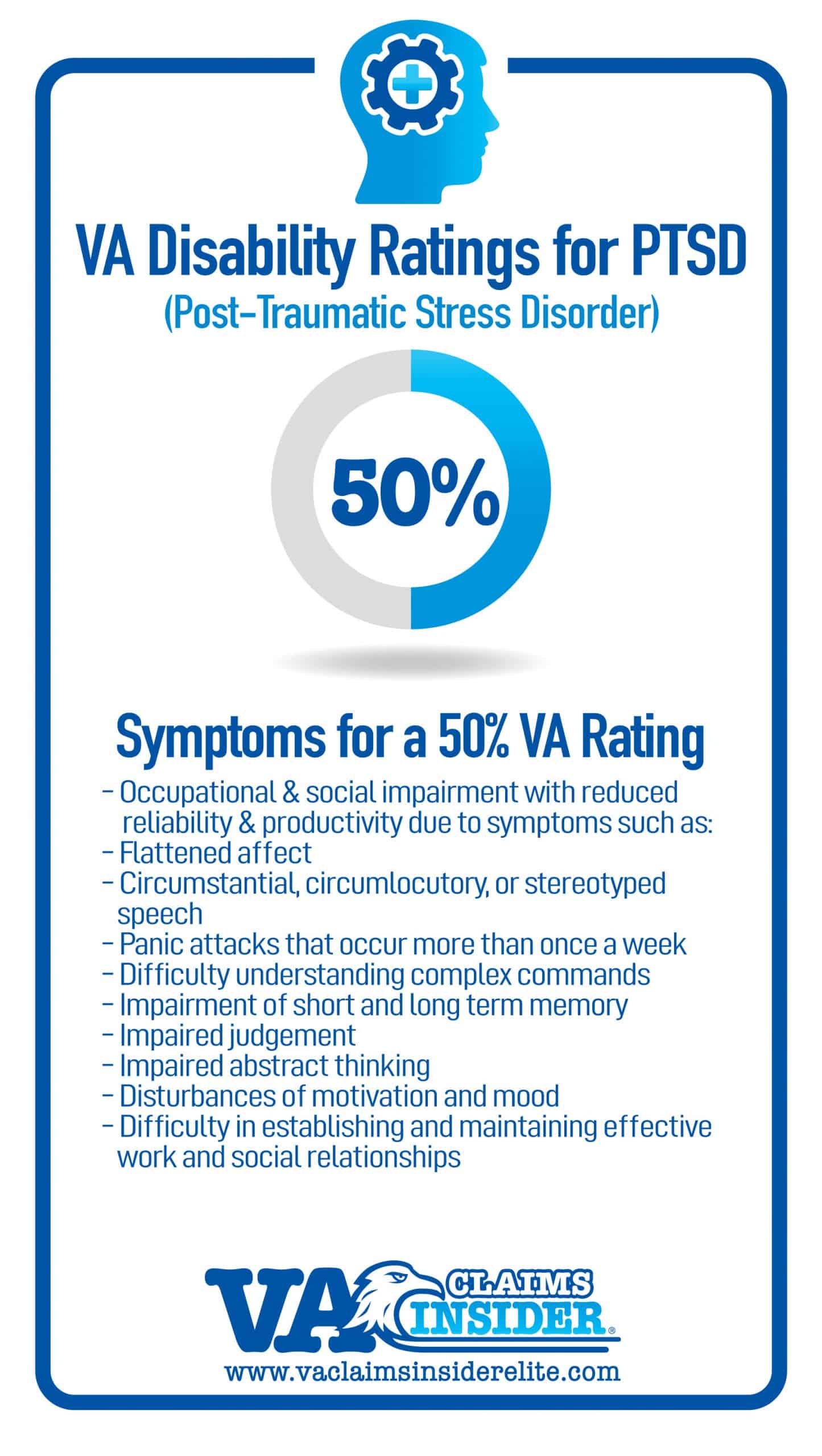

How to Determine Your Disability Compensation To rate your disability the VA reviews every piece of evidence in your claim and assigns a percentage based on the severity of the disability. 421904 basic rate 1 spouse 1 child 8717 second child under 18 8717 third child under 18 28157 1 child over 18 in a qualifying school program. Combined ratings tablexlsx Author. On the Basic SMC rates table find the amount for your disability rating and SMC letter designation.

The following tables show the 2021 VA disability rates for veterans with a rating 10 or higher. About VA Disability Ratings and VA Disability Compensation. 1 2020 Dependents Allowance. VA makes a determination about the severity of your disability based on the evidence you submit as part of your claim or that VA obtains from your military records.

2021 VA disability pay rates which are effective beginning December 1 2020 have increased by 13 based on the latest cost-of-living adjustment COLA. These tables cover the combined degree evaluations of these percentages. In our example of a Veteran with 70 disability rating your total monthly payment amount would be. In our example of a Veteran with a SMC-L designation your total monthly payment amount would be.

419 - 421 - Age in Service-Connected ClaimsAnalogous RatingsApplication of Rating Schedule 422 - 423 - Rating of Disabilities Aggravated by Active ServiceAttitude of Rating Officers 424 - Correspondence 425 - Combined Ratings Table 426 - Bilateral Factor 427 - Use of Diagnostic Code Numbers. Add these amounts to your basic rate to get your total monthly payment amount. 30 60 With Children. Table I-Combined Ratings Table 10 combined with 10 is 19 10 20 30 40 50 60 70 80 90.

For veterans with more than one disability the VA uses the combined ratings table to calculate your disability percentage. 70 100 With Children. These tables add a child to each of the first four categories found in the description for Without Children above and have the rates for. If you were a Veteran with a dependent spouse no dependent parents or children and you had an SMC-M designation your monthly basic rate would be 449619 each month.